XM Radio 2013 Annual Report Download - page 57

Download and view the complete annual report

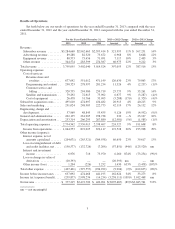

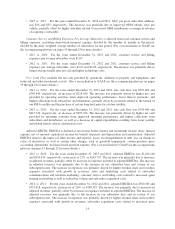

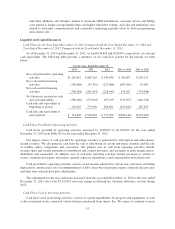

Please find page 57 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•2012 vs. 2011: For the years ended December 31, 2012 and 2011, equipment revenue was $73,456 and

$71,051, respectively, an increase of 3%, or $2,405. The increase was driven by royalties from higher

OEM production, offset by lower direct to consumer sales.

We expect equipment revenue to fluctuate based on OEM production for which we receive royalty

payments for our technology and, to a lesser extent, on the volume and mix of equipment sales in our aftermarket

and direct to consumer business.

Other Revenue includes amounts earned from subscribers for the U.S. Music Royalty Fee, revenue from our

Canadian affiliate and ancillary revenues.

•2013 vs. 2012: For the years ended December 31, 2013 and 2012, other revenue was $344,574 and

$283,599, respectively, an increase of 22%, or $60,975. The increase was driven by revenues from the

U.S. Music Royalty Fee as the number of subscribers increased and subscribers on the 12.5% rate

increased, and higher royalty revenue from Sirius XM Canada.

•2012 vs. 2011: For the years ended December 31, 2012 and 2011, other revenue was $283,599 and

$274,387, respectively, an increase of 3%, or $9,212. The increase was driven by revenues from the U.S.

Music Royalty Fee as the number of subscribers increased, and higher royalty revenue from Sirius XM

Canada.

We expect other revenue to increase as our subscriber base drives higher U.S. Music Royalty Fees and as

the revenue of our Canadian affiliate grows.

Operating Expenses

Revenue Share and Royalties include distribution and content provider revenue share, advertising revenue

share, and broadcast and web streaming royalties. Advertising revenue share is recognized in revenue share and

royalties in the period in which the advertising is broadcast.

•2013 vs. 2012: For the years ended December 31, 2013 and 2012, revenue share and royalties were

$677,642 and $551,012, respectively, an increase of 23%, or $126,630, and increased as a percentage of

total revenue. The increase was primarily attributable to greater revenues subject to royalty and/or

revenue sharing arrangements and a 12.5% increase in the statutory royalty rate for the performance of

sound recordings as well as a decrease in the benefit to earnings from the amortization of deferred credits

on executory contracts initially recognized in purchase price accounting associated with the Merger.

•2012 vs. 2011: For the years ended December 31, 2012 and 2011, revenue share and royalties were

$551,012 and $471,149, respectively, an increase of 17%, or $79,863, and increased as a percentage of

total revenue. The increase was primarily attributable to greater revenues subject to royalty and/or

revenue sharing arrangements and a 7% increase in the statutory royalty rate for the performance of sound

recordings, partially offset by an increase in the benefit to earnings from the amortization of deferred

credits on executory contracts initially recognized in purchase price accounting associated with the

Merger.

We expect our revenue share and royalty costs to increase as our revenues grow, our royalty rates increase

and as a result of the above noted discontinued deferred credits on executory contracts associated with the

Merger. As determined by the Copyright Royalty Board’s decision, we paid royalties of 9.0%, 8.0% and 7.5% of

gross revenues, subject to certain exclusions, for the years ended December 31, 2013, 2012 and 2011,

respectively, and will pay 9.5% in 2014.

Programming and Content includes costs to acquire, create, promote and produce content. We have entered

into various agreements with third parties for music and non-music programming that require us to pay license

fees and other amounts.

•2013 vs. 2012: For the years ended December 31, 2013 and 2012, programming and content expenses

were $290,323 and $278,997, respectively, an increase of 4%, or $11,326, but decreased as a percentage

5