XM Radio 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.program is structured to meet the requirements of the intensely competitive and rapidly changing environment in

which we operate, while ensuring that we maintain continuity in our senior management, and that the named

executive officers are compensated in a manner that advances both the short- and long-term interests of our

stockholders and avoids unnecessary or excessive risk-taking.

A high proportion of the compensation for our named executives officers also involves pay that is “at

risk” — namely, the annual bonus and equity-based awards. The Compensation Committee uses “at risk”

compensation to motivate the named executive officers to achieve goals and objectives that support our business

plan and align our executives’ interests with those of our stockholders. The Compensation Committee further

believes that delivering compensation in the form of, or based on the value of, our common stock promotes

alignment between executive performance and stockholder interests. Accordingly, the value of equity-based

compensation represents a large portion of our executives’ total compensation, including through grants of

equity-based awards.

Processes and Compensation Decisions

The Compensation Committee regularly reviews our practices to assess whether our existing compensation

structure properly enhances stockholder value. In 2013, the Compensation Committee received advice from an

independent compensation consultant regarding trends in general compensation practices, including trends in

equity-based awards. The members of the Compensation Committee also relied on their significant experience,

general industry knowledge and informed judgment in making compensation decisions as to our named executive

officers’ base salaries, annual bonuses and equity-based awards.

The Compensation Committee does not attempt to set compensation levels for each named executive officer

within a particular range related to levels provided by peers. The Compensation Committee relies on the general

business and industry knowledge and experience of its members and occasionally uses informal market

comparisons as one of many factors in making compensation decisions. Other factors considered when making

individual executive compensation decisions include individual contribution and performance, reporting

structure, historical compensation, internal pay equity, complexity and importance of roles and responsibilities,

expected future contributions, leadership and growth potential and our performance. The Compensation

Committee also believes that it is in our stockholders’ interests, and consistent with industry practice, to enter

into arrangements with our named executive officers in order to provide stability for our senior executives.

Further, any compensation or equity awards provided to the named executive officers are subject to clawback as

may be required pursuant to any law or regulation.

In determining compensation element levels, including the annual grants of equity-based awards, if any, for

each named executive officer (other than the Chief Executive Officer), the Compensation Committee also

consults with and considers the recommendations and input of our Chief Executive Officer.

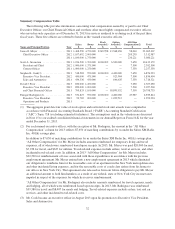

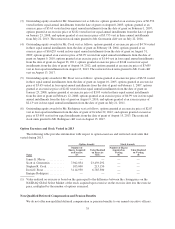

Total Compensation for Named Executive Officers

The Compensation Committee’s goal is to award compensation that incentivizes our named executive

officers to enhance value for our stockholders without encouraging the taking of inappropriate business risks, and

is not considered excessive when all elements of potential compensation are considered. In making decisions

with respect to any single element of a named executive officer’s compensation, the Compensation Committee

considers the officer’s level of responsibility, experience and contributions, internal pay equity and the total

compensation that may be awarded to the officer, including salary, annual bonus, long-term incentives,

perquisites and other benefits. In addition, the Compensation Committee considers the other benefits to which the

officer is entitled under his employment agreement, including compensation payable upon termination of

employment. (Each named executive officers is employed pursuant to agreements described under “Potential

Payments upon Termination or Change-in-Control — Employment Agreements” below.)

25