XM Radio 2013 Annual Report Download - page 103

Download and view the complete annual report

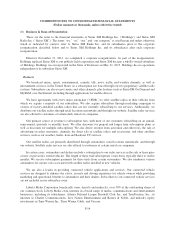

Please find page 103 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

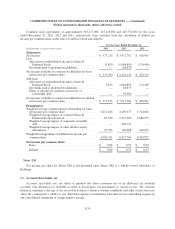

(Dollar amounts in thousands, unless otherwise stated)

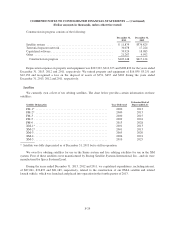

the fair value of awards granted using the hybrid approach for volatility, which weights observable historical

volatility and implied volatility of qualifying actively traded options on our common stock. The expected life

assumption represents the weighted-average period stock-based awards are expected to remain outstanding.

These expected life assumptions are established through a review of historical exercise behavior of stock-based

award grants with similar vesting periods. Where historical patterns do not exist, contractual terms are used. The

risk-free interest rate represents the daily treasury yield curve rate at the grant date based on the closing market

bid yields on actively traded U.S. treasury securities in the over-the-counter market for the expected term. Our

assumptions may change in future periods.

Stock-based awards granted to employees, non-employees and members of our board of directors include

warrants, stock options, restricted stock awards and restricted stock units.

Income Taxes

Deferred income taxes are recognized for the tax consequences related to temporary differences between the

carrying amount of assets and liabilities for financial reporting purposes and the amounts used for tax purposes at

each year-end, based on enacted tax laws and statutory tax rates applicable to the periods in which the differences

are expected to affect taxable income. In determining the period in which related tax benefits are realized for

book purposes, excess share-based compensation deductions included in net operating losses are realized after

regular net operating losses are exhausted; excess tax compensation benefits are recorded off balance-sheet as a

memo entry until the period the excess tax benefit is realized through a reduction of taxes payable. A valuation

allowance is recognized when, based on the weight of all available evidence, it is considered more likely than not

that all, or some portion, of the deferred tax assets will not be realized. Income tax expense is the sum of current

income tax plus the change in deferred tax assets and liabilities.

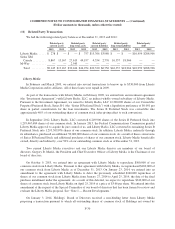

As of December 31, 2013 and 2012, we maintained a valuation allowance of $7,831 and $9,835,

respectively, relating to deferred tax assets that are not likely to be realized due to certain state net operating loss

limitations and acquired net operating losses that we are not more likely than not going to be able to utilize.

ASC 740 requires a company to first determine whether it is more likely than not that a tax position will be

sustained based on its technical merits as of the reporting date, assuming that taxing authorities will examine the

position and have full knowledge of all relevant information. A tax position that meets this more likely than not

threshold is then measured and recognized at the largest amount of benefit that is greater than fifty percent likely

to be realized upon effective settlement with a taxing authority. Changes in recognition or measurement are

reflected in the period in which the change in judgment occurs. We record interest and penalties related to

uncertain tax positions in Income tax (expense) benefit in our consolidated statements of comprehensive income.

We report revenues net of any tax assessed by a governmental authority that is both imposed on, and

concurrent with, a specific revenue-producing transaction between a seller and a customer in our consolidated

statements of comprehensive income.

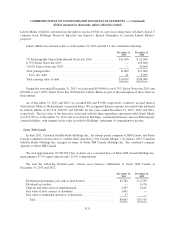

Fair Value of Financial Instruments

The fair value of a financial instrument is the amount at which the instrument could be exchanged in an

orderly transaction between market participants. As of December 31, 2013 and 2012, the carrying amounts of

cash and cash equivalents, accounts and other receivables, and accounts payable approximated fair value due to

the short-term nature of these instruments. ASC 820, Fair Value Measurements and Disclosures, establishes a

fair value hierarchy for input into valuation techniques as follows:

i. Level 1 input — unadjusted quoted prices in active markets for identical instrument;

F-21