XM Radio 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

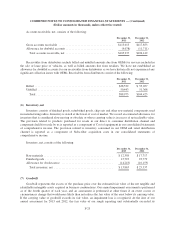

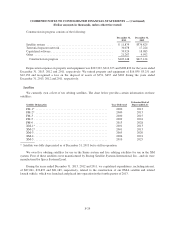

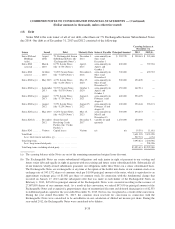

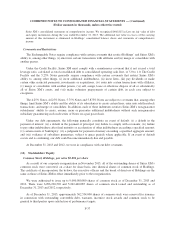

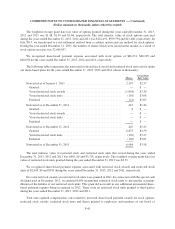

(13) Debt

Sirius XM is the sole issuer of all of our debt, other than our 7% Exchangeable Senior Subordinated Notes

due 2014. Our debt as of December 31, 2013 and 2012 consisted of the following:

Carrying balance at

December 31,

Issuer Issued Debt Maturity Date Interest Payable Principal Amount 2013 2012(h)

Sirius XM and

Holdings

(a)(b) .........

August

2008

7% Exchangeable Senior

Subordinated Notes (the

“Exchangeable Notes”)

December 1,

2014

semi-annually on

June 1 and

December 1

$ 502,370 $ 500,481 $ 545,888

Sirius XM

(a)(c)(d) .......

March

2010

8.75% Senior Notes

(the “8.75% Notes”)

April 1,

2015

semi-annually on

April 1 and

October 1

800,000 — 792,944

Sirius XM

(a)(c)(e) .......

October

2010

7.625% Senior Notes

(the “7.625% Notes”)

November 1,

2018

semi-annually on

May 1 and

November 1

700,000 — 690,353

Sirius XM (a)(c) . . May 2013 4.25% Senior Notes

(the “4.25% Notes”)

May 15,

2020

semi-annually on

May 15 and

November 15

500,000 494,809 —

Sirius XM (a)(c) . . September

2013

5.875% Senior Notes

(the “5.875% Notes”)

October 1,

2020

semi-annually on

April 1 and

October 1

650,000 642,914 —

Sirius XM (a)(c) . . August

2013

5.75% Senior Notes

(the “5.75% Notes”)

August 1,

2021

semi-annually on

February 1 and

August 1

600,000 594,499 —

Sirius XM (a)(c) . . August

2012

5.25% Senior Notes

(the “5.25% Notes”)

August 15,

2022

semi-annually on

February 15 and

August 15

400,000 394,648 394,174

Sirius XM (a)(c) . . May 2013 4.625% Senior Notes

(the “4.625% Notes”)

May 15,

2023

semi-annually on

May15 and

November 15

500,000 494,653 —

Sirius XM (f) .... December

2012

Senior Secured

Revolving Credit

Facility (the “Credit

Facility”)

December 5,

2017

variable fee paid

quarterly

1,250,000 460,000 —

Sirius XM ....... Various Capital leases Various n/a n/a 19,591 11,861

Total Debt ....... 3,601,595 2,435,220

Less: total current maturities (g) ................... 507,774 4,234

Total long-term . . . 3,093,821 2,430,986

Less: long-term related party ..................... — 208,906

Total long-term, excluding related party .............. $3,093,821 $2,222,080

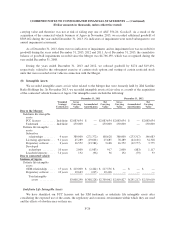

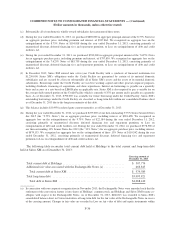

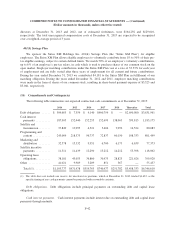

(a) The carrying balance of the Notes are net of the remaining unamortized original issue discount.

(b) The Exchangeable Notes are senior subordinated obligations and rank junior in right of payment to our existing and

future senior debt and equally in right of payment with our existing and future senior subordinated debt. Substantially all

of our domestic wholly-owned subsidiaries guarantee our obligations under these Notes on a senior subordinated basis.

The Exchangeable Notes are exchangeable at any time at the option of the holder into shares of our common stock at an

exchange rate of 543.1372 shares of common stock per $1,000 principal amount of the notes, which is equivalent to an

approximate exchange price of $1.841 per share of common stock. In connection with the fundamental change that

occurred on January 17, 2013 and the subsequent offer that was made to each holder of the Exchangeable Notes on

February 1, 2013, $47,630 in principal amount of the Exchangeable Notes were converted resulting in the issuance of

27,687,850 shares of our common stock. As a result of this conversion, we retired $47,630 in principal amount of the

Exchangeable Notes and recognized a proportionate share of unamortized discount and deferred financing fees of $2,533

to Additional paid-in capital for the year ended December 31, 2013. No loss was recognized as a result of the conversion.

During the year ended December 31, 2013, the common stock reserved for conversion in connection with the

Exchangeable Notes were considered to be anti-dilutive in our calculation of diluted net income per share. During the

year ended 2012, the Exchangeable Notes were considered to be dilutive.

F-35