XM Radio 2013 Annual Report Download - page 56

Download and view the complete annual report

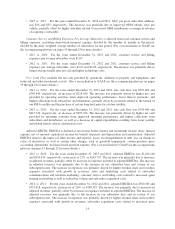

Please find page 56 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our results of operations discussed below include Sirius XM Connected Vehicle Services Inc. activity from the

acquisition date, November 4, 2013, as well as the impact of purchase price accounting adjustments associated with

the acquisition and the Merger. The purchase price accounting adjustments include: (i) the elimination of deferred

revenue associated with the investment in XM Canada, (ii) recognition of deferred subscriber revenues not

recognized in purchase price accounting, and (iii) elimination of the benefit of deferred credits on executory

contracts, which are primarily attributable to third party arrangements with an OEM and programming providers.

The deferred credits on executory contracts attributable to third party arrangements with an OEM included in

revenue share and royalties, subscriber acquisition costs, and sales and marketing concluded with the expiration of

the acquired contract during 2013. The impact of these purchase price accounting adjustments is detailed in our

Adjusted Revenues and Operating Expenses tables on pages 19 through 25 of our glossary.

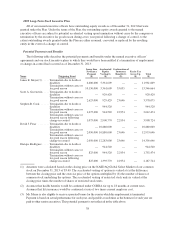

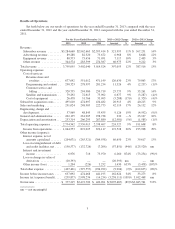

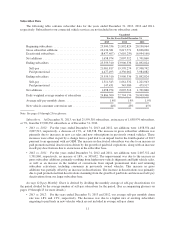

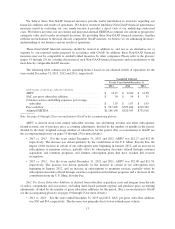

Total Revenue

Subscriber Revenue includes subscription, activation and other fees.

•2013 vs. 2012: For the years ended December 31, 2013 and 2012, subscriber revenue was $3,284,660

and $2,962,665, respectively, an increase of 11%, or $321,995. The increase was primarily attributable to

a 9% increase in the daily weighted average number of subscribers, the impact of the increase in certain

of our subscription rates beginning in January 2012 as more subscribers migrated to the higher rates, and

an increase in subscriptions to premium services, premier channels and Internet streaming, as well as the

inclusion of connected vehicle subscription revenue in 2013. These increases were partially offset by

subscription discounts offered through customer acquisition and retention programs, and an increasing

number of lifetime subscription plans that have reached full revenue recognition.

•2012 vs. 2011: For the years ended December 31, 2012 and 2011, subscriber revenue was $2,962,665

and $2,595,414, respectively, an increase of 14%, or $367,251. The increase was primarily attributable to

a 9% increase in daily weighted average number of subscribers, the increase in certain of our subscription

rates beginning in January 2012, and an increase in subscriptions to premium services, including premier

channels, data services and Internet streaming. The increase was partially offset by subscription discounts

offered through customer acquisition and retention programs.

We expect subscriber revenues to increase based on the growth of our subscriber base, including connected

vehicle subscribers, promotions, subscription plan mix, and identification of additional revenue streams from

subscribers. We increased certain of our subscription rates beginning January 2014.

Advertising Revenue includes the sale of advertising on certain non-music channels, net of agency fees.

Agency fees are based on a contractual percentage of the gross advertising revenue.

•2013 vs. 2012: For the years ended December 31, 2013 and 2012, advertising revenue was $89,288 and

$82,320, respectively, an increase of 8%, or $6,968. The increase was primarily due to a greater number

of advertising spots sold and broadcast, as well as increases in rates charged per spot.

•2012 vs. 2011: For the years ended December 31, 2012 and 2011, advertising revenue was $82,320 and

$73,672, respectively, an increase of 12%, or $8,648. The increase was primarily due to a greater number

of advertising spots sold and broadcast, as well as increases in rates charged per spot.

We expect our advertising revenue to grow as more advertisers are attracted to our national platform and

growing subscriber base and as we launch additional non-music channels.

Equipment Revenue includes revenue and royalties from the sale of satellite radios, components and

accessories.

•2013 vs. 2012: For the years ended December 31, 2013 and 2012, equipment revenue was $80,573 and

$73,456, respectively, an increase of 10%, or $7,117. The increase was driven by royalties from higher

OEM production, the mix of royalty eligible radios and, to a lesser extent, improved aftermarket

subsidies.

4