XM Radio 2013 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

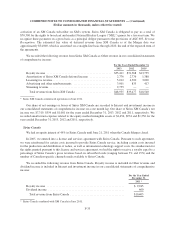

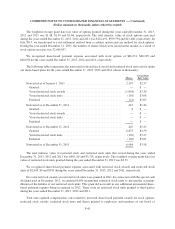

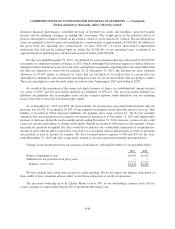

directors at December 31, 2013 and 2012, net of estimated forfeitures, were $164,292 and $129,010,

respectively. The total unrecognized compensation costs at December 31, 2013 are expected to be recognized

over a weighted-average period of 3 years.

401(k) Savings Plan

We sponsor the Sirius XM Holdings Inc. 401(k) Savings Plan (the “Sirius XM Plan”) for eligible

employees. The Sirius XM Plan allows eligible employees to voluntarily contribute from 1% to 50% of their pre-

tax eligible earnings, subject to certain defined limits. We match 50% of an employee’s voluntary contributions,

up to 6% of an employee’s pre-tax salary, in cash which is used to purchase shares of our common stock on the

open market. Employer matching contributions under the Sirius XM Plan vest at a rate of 33.33% for each year

of employment and are fully vested after three years of employment for all current and future contributions.

During the year ended December 31, 2013 we contributed $4,181 to the Sirius XM Plan in fulfillment of our

matching obligation. During the years ended December 31, 2012 and 2011, employer matching contributions

were made in the form of shares of our common stock, resulting in share-based payment expense of $3,523 and

$3,041, respectively.

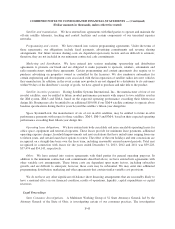

(16) Commitments and Contingencies

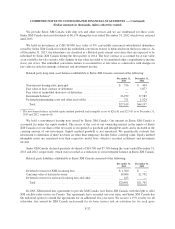

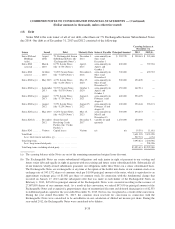

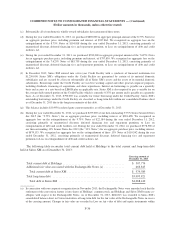

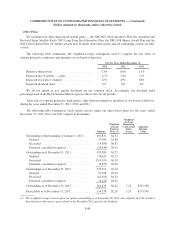

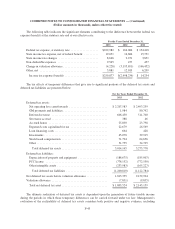

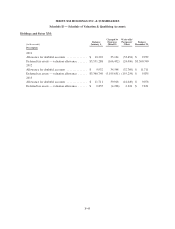

The following table summarizes our expected contractual cash commitments as of December 31, 2013:

2014 2015 2016 2017 2018 Thereafter Total

Debt obligations ...... $ 509,663 $ 7,359 $ 4,140 $460,799 $ — $2,650,000 $3,631,961

Cash interest

payments .......... 187,905 152,440 152,255 152,699 138,063 399,813 1,183,175

Satellite and

transmission ........ 37,849 13,993 4,321 3,404 3,992 16,524 80,083

Programming and

content ............ 245,069 218,373 96,737 72,837 60,150 108,333 801,499

Marketing and

distribution ........ 32,578 15,332 9,951 6,700 6,173 6,639 77,373

Satellite incentive

payments .......... 11,511 11,439 12,290 13,212 14,212 55,398 118,062

Operating lease

obligations ......... 38,181 43,053 36,860 30,475 28,825 221,626 399,020

Other ............... 41,021 9,989 3,209 851 367 — 55,437

Total (1) ........... $1,103,777 $471,978 $319,763 $740,977 $251,782 $3,458,333 $6,346,610

(1) The table does not include our reserve for uncertain tax positions, which at December 31, 2013 totaled $1,432, as the

specific timing of any cash payments cannot be projected with reasonable certainty.

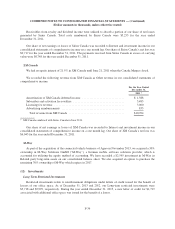

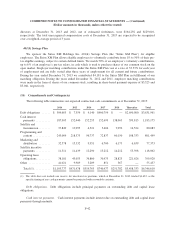

Debt obligations. Debt obligations include principal payments on outstanding debt and capital lease

obligations.

Cash interest payments. Cash interest payments include interest due on outstanding debt and capital lease

payments through maturity.

F-42