XM Radio 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

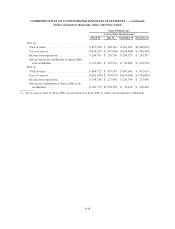

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

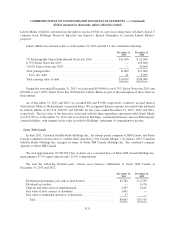

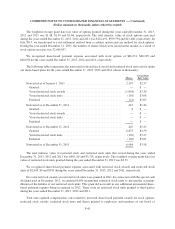

The weighted average grant date fair value of options granted during the years ended December 31, 2013,

2012 and 2011 was $1.48, $1.09 and $1.04, respectively. The total intrinsic value of stock options exercised

during the years ended December 31, 2013, 2012 and 2011 was $142,491, $399,794 and $13,408, respectively. In

July 2013, we transitioned to a net-settlement method from a cashless option exercise method for stock options.

During the year ended December 31, 2013, the number of shares which were issued in the market as a result of

stock option exercises was 32,649,857.

We recognized share-based payment expense associated with stock options of $66,231, $60,299 and

$48,038 for the years ended December 31, 2013, 2012 and 2011, respectively.

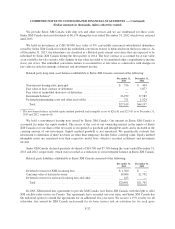

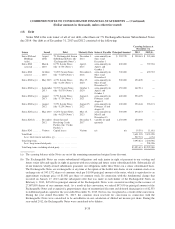

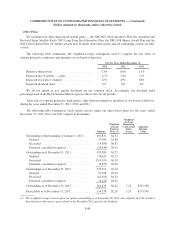

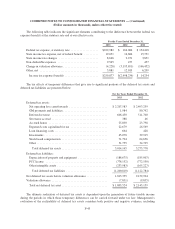

The following table summarizes the nonvested restricted stock award and restricted stock unit activity under

our share-based plans for the years ended December 31, 2013, 2012 and 2011 (shares in thousands):

Shares

Grant Date

Fair Value

Nonvested as of January 1, 2011 ...................................... 2,397 $2.57

Granted ....................................................... — $ —

Vested restricted stock awards ..................................... (1,854) $3.30

Vested restricted stock units ....................................... (101) $3.08

Forfeited ...................................................... (21) $3.05

Nonvested as of December 31, 2011 ................................... 421 $1.46

Granted ....................................................... 8 $ —

Vested restricted stock awards ..................................... — $ —

Vested restricted stock units ....................................... — $ —

Forfeited ...................................................... — $ —

Nonvested as of December 31, 2012 ................................... 429 $3.25

Granted ....................................................... 6,873 $3.59

Vested restricted stock units ....................................... (192) $3.27

Forfeited ...................................................... (126) $3.61

Nonvested as of December 31, 2013 ................................... 6,984 $3.58

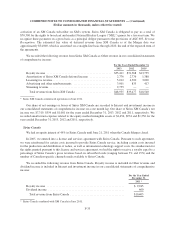

The total intrinsic value of restricted stock and restricted stock units that vested during the years ended

December 31, 2013, 2012 and 2011 was $605, $0 and $3,178, respectively. The weighted average grant date fair

value of restricted stock units granted during the year ended December 31, 2013 was $3.59.

We recognized share-based payment expense associated with restricted stock awards and restricted stock

units of $2,645, $0 and $543 during the years ended December 31, 2013, 2012 and 2011, respectively.

No restricted stock awards or restricted stock units were granted in 2011. In connection with the special cash

dividend paid in December 2012, we granted 8,000 incremental restricted stock units to prevent the economic

dilution of the holders of our restricted stock units. This grant did not result in any additional incremental share-

based payment expense being recognized in 2012. There were no restricted stock units granted to third parties

during the years ended December 31, 2013, 2012 and 2011.

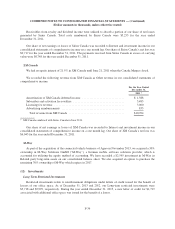

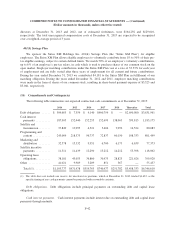

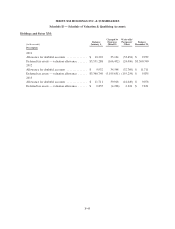

Total unrecognized compensation costs related to unvested share-based payment awards for stock options,

restricted stock awards, restricted stock units and shares granted to employees and members of our board of

F-41