XM Radio 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(3) Summary of Significant Accounting Policies

Use of Estimates

In presenting consolidated financial statements, management makes estimates and assumptions that affect the

reported amounts and accompanying notes. Additionally, estimates were used when recording the fair values of

assets acquired and liabilities assumed in the Merger. Estimates, by their nature, are based on judgment and

available information. Actual results could differ materially from those estimates.

Significant estimates inherent in the preparation of the accompanying consolidated financial statements

include revenue recognition, asset impairment, useful lives of our satellites, share-based payment expense, and

valuation allowances against deferred tax assets. Economic conditions in the United States could have a material

impact on our accounting estimates.

Recent Accounting Pronouncements

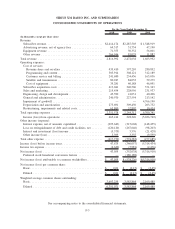

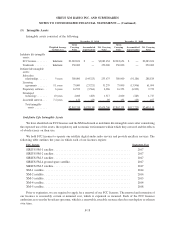

The Financial Accounting Standards Board (“FASB”) updated Accounting Standards Codification (“ASC”)

470 to incorporate ASU 2009-15, Accounting for Own-Share Lending Arrangements in Contemplation of Con-

vertible Debt Issuance or Other Financing, into the ASC. This standard requires share-lending arrangements in an

entity’s own shares to be initially measured at fair value and treated as an issuance cost, excluded from basic and

diluted earnings per share, and requires an entity to recognize a charge to earnings if it becomes probable the

counterparty will default on the arrangement. This guidance was adopted as of January 1, 2010 on a retrospective

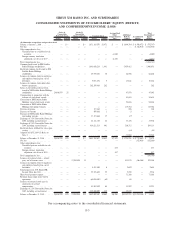

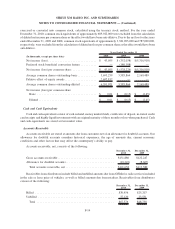

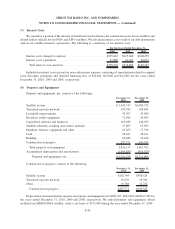

basis, as required, for all arrangements outstanding as of that date. The following table reflects the retrospective

adoption of ASU 2009-15 on our December 31, 2009 consolidated balance sheet:

As Originally

Reported

Retrospective

Adjustments

As Currently

Reported

Balance Sheet Line Item:

Deferred financing fees, net .................... $ 8,902 $ 57,505 $ 66,407

Related party long-term assets, net of current

portion ................................. 110,594 1,173 111,767

Long-term debt, net of current portion ............ 2,799,127 575 2,799,702

Long-term related party debt, net of current portion . . 263,566 13 263,579

Additional paid-in capital ..................... 10,281,331 70,960 10,352,291

Accumulated deficit ......................... (10,241,238) (12,870) (10,254,108)

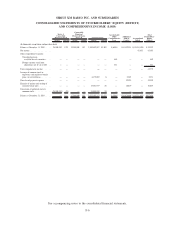

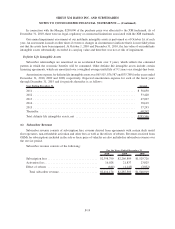

The following table reflects the adoption of ASU 2009-15 on our statement of operations for the years ended

December 31, 2009 and 2008:

As Originally

Reported

Retrospective

Adjustments

As Currently

Reported

As Originally

Reported

Retrospective

Adjustments

As Currently

Reported

For the Year Ended

December 31, 2009

For the Year Ended

December 31, 2008

Statement of Operations Line

Item:

Interest expense, net of amounts

capitalized ............. $(306,420) $(9,248) $(315,668) $ (144,833) $(3,622) $ (148,455)

Net loss attributable to common

stockholders ............ (528,978) (9,248) (538,226) (5,313,288) (3,622) (5,316,910)

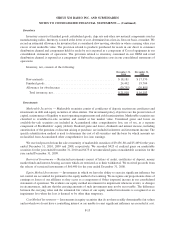

For the year ended December 31, 2010, we recorded $10,095, in interest expense related to the amortization of

the costs associated with the share-lending arrangement and other issuance costs. As of December 31, 2010, the

unamortized balance of the debt issuance costs was $51,243, with $50,218 recorded in deferred financing fees, net,

F-10

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)