XM Radio 2010 Annual Report Download - page 23

Download and view the complete annual report

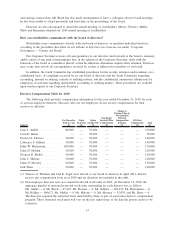

Please find page 23 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.including strength of character, mature judgment, familiarity with our business and related industries,

independence of thought and an ability to work collegially. The Nominating and Corporate Governance

Committee also may consider the extent to which a candidate would fill a present need on the board of

directors. After conducting an initial evaluation of a candidate, the Nominating and Corporate Governance

Committee will interview that candidate if it believes the candidate might be qualified to be a Common Stock

Director and may ask the candidate to meet with other directors and management. If the Nominating and

Corporate Governance Committee believes a candidate would be a valuable addition to the board of directors,

it will recommend to the board that candidate’s nomination as a Common Stock Director.

Who is the board’s chairman?

In November 2009, Eddy W. Hartenstein was elected the Chairman of the Board of Directors. The

chairman of our board organizes the work of the board and ensures that the board has access to sufficient

information to enable the board to carry out its functions, including monitoring our performance and the

performance of management. The chairman, among other things, presides over meetings of the board of

directors, establishes the agenda for each meeting of the board in consultation with our Chief Executive

Officer, oversees the distribution of information to directors, and performs other duties or assignments as

agreed with either the board of directors or our Chief Executive Officer. The board of directors has determined

that it is currently in our best interests to separate the chairman of the board position and the Chief Executive

Officer position because it allows the Chief Executive Officer to focus on our day-to-day business, including

risk management, while allowing the chairman of the board to lead the board and assist the board in its

fundamental role of providing advice to and independent oversight of management. Further, the board

recognizes that the Chief Executive Officer position requires a significant dedication of time, effort, and

energy in the current business environment. Our Corporate Governance Guidelines (the “Guidelines”) do not

establish this approach as a policy, but as a matter that is considered from time-to-time.

How does the board determine which directors are considered independent?

Our board reviews the independence of our directors annually. The provisions of our Guidelines regarding

director independence meet, and in some areas exceed, the listing standards of The NASDAQ Global Select

Market (“NASDAQ”). A copy of the Guidelines is available on our website at http://investor.siriusxm.com.

The Nominating and Corporate Governance Committee undertook a review of director independence in

April 2011. As part of this review, the committee reviewed written questionnaires submitted by directors. The

questionnaires disclose transactions and relationships between each director or members of his immediate

family, on one hand, and SIRIUS XM, other directors, members of our senior management and our affiliates,

on the other hand.

As a result of this review, the Nominating and Corporate Governance Committee determined that all of

our directors and nominees are independent under the standards set forth in our Guidelines and applicable

NASDAQ listing standards, with the exception of Mel Karmazin, our Chief Executive Officer, and John C.

Malone, Gregory B. Maffei and David J.A. Flowers, each of whom is an employee of Liberty Media

Corporation. With respect to Joan L. Amble, the board evaluated ordinary course transactions during the last

three fiscal years between us and the American Express Company, for which she serves as an executive

officer, and found that the amount paid by us to American Express was less than 5% of American Express’

consolidated gross revenues during its last three fiscal years. Similarly, with respect to Vanessa A. Wittman,

the board evaluated an ordinary course transaction that occurred during 2010 and 2011 between us and an

indirect wholly owned subsidiary of Marsh & McLennan Companies, Inc. (“MMC”). Ms. Wittman serves as

an executive officer of MMC. The board found that the amount we paid to this MMC subsidiary was less than

one tenth of one percent of MMC’s reported consolidated revenues in each of these years.

The board has also determined that all of the members of the Audit Committee are financially literate and

meet the independence requirements mandated by the applicable NASDAQ listing standards, Section 10A(m)(3)

of the of the Exchange Act and our Guidelines. The board has determined that all of the members of the

Compensation Committee meet the independence requirements mandated by the applicable NASDAQ listing

standards and our Guidelines and qualify as “non-employee directors” for purposes of Rule 16b-3 of the

Exchange Act and as “outside directors” for purposes of Section 162(m) of the Internal Revenue Code of

13