XM Radio 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

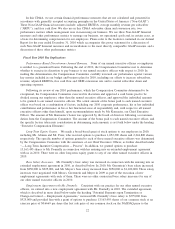

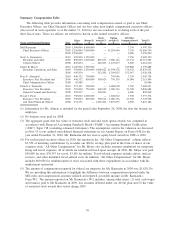

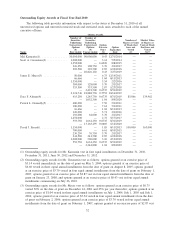

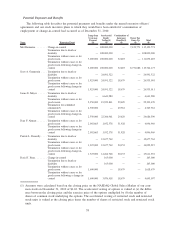

Outstanding Equity Awards at Fiscal Year-End 2010

The following table provides information with respect to the status at December 31, 2010 of all

unexercised options and unvested restricted stock and restricted stock units awarded to each of the named

executive officers.

Name

Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

Option

Exercise

Price

($)

Option

Expiration

Date

Number of

Shares or Units

of Stock that

have not

Vested

(#)

Market Value

of Shares or

Units of Stock

that have not

Vested

($)(7)

Option Awards

Mel Karmazin(1) ................. 30,000,000 90,000,000 0.43 12/31/2014 — —

Scott A. Greenstein(2) . . ........... 1,000,000 — 3.14 5/5/2014 — —

1,250,000 — 6.6020 8/8/2015 — —

326,250 108,750 3.70 2/1/2017 — —

303,500 303,500 2.87 1/23/2018 — —

— 20,826,102 0.43 7/27/2019 — —

James E. Meyer(3) ............... 50,000 — 6.75 12/14/2011 — —

66,666 — 1.04 8/11/2013 — —

1,350,000 — 5.54 2/2/2016 — —

384,000 128,000 3.70 2/1/2017 — —

353,500 353,500 2.87 1/23/2018 — —

— 2,491,500 0.6735 8/31/2019 — —

2,126,746 18,888,738 0.5752 10/14/2019 — —

Dara F. Altman(4) ................ 415,250 1,245,750 0.6735 8/31/2019 85,866 139,962

— 1,052,300 1.04 8/9/2020 — —

Patrick L. Donnelly(5) . . ........... 400,000 — 7.50 5/1/2011 — —

100,000 — 7.61 5/1/2011 — —

16,666 — 1.04 8/11/2013 — —

120,000 — 5.71 2/1/2016 — —

192,000 64,000 3.70 2/1/2017 — —

1,450,000 — 2.72 5/17/2017 — —

553,750 1,661,250 0.6735 8/31/2019 — —

— 13,163,495 0.6669 1/14/2020 — —

David J. Frear(6) ................. 1,150,000 — 1.85 8/11/2013 100,000 163,000

700,000 — 6.61 8/10/2015 — —

230,250 76,750 3.70 2/1/2017 — —

241,500 241,500 2.87 1/23/2018 — —

1,000,000 500,000 3.10 2/12/2018 — —

553,750 1,661,250 0.6735 8/31/2019 — —

— 2,244,800 1.04 8/9/2020 — —

(1) Outstanding equity awards for Mr. Karmazin vest in four equal installments on December 31, 2010,

December 31, 2011, June 30, 2012 and December 31, 2012.

(2) Outstanding equity awards for Mr. Greenstein vest as follows: options granted at an exercise price of

$3.14 vested immediately on the date of grant on May 5, 2004; options granted at an exercise price of

$6.60 vested in three equal annual installments from the date of grant on August 8, 2005; options granted

at an exercise price of $3.70 vested in four equal annual installments from the date of grant on February 1,

2007; options granted at an exercise price of $2.87 vest in four equal annual installments from the date of

grant on January 23, 2008; and options granted at an exercise price of $0.43 vest in four equal annual

installments commencing on July 26, 2010.

(3) Outstanding equity awards for Mr. Meyer vest as follows: options granted at an exercise price of $6.75

vested 50% on the date of grant on December 14, 2001 and 25% per year thereafter; options granted at an

exercise price of $1.04 vested in three equal annual installments on July 1, 2004, July 1, 2005 and July 1,

2006; options granted at an exercise price of $5.54 vested in four equal annual installments from the date

of grant on February 2, 2006; options granted at an exercise price of $3.70 vested in four equal annual

installments from the date of grant on February 1, 2007; options granted at an exercise price of $2.87 vest

32