Vonage 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(

In thousands, except per share amounts

)

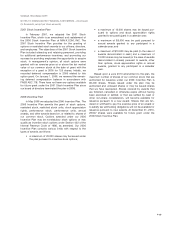

2001

S

tock Incentive Pla

n

In Februar

y

2001, we adopted the 2001

S

tock

Incentive Plan

,

which is an amendment and restatement of

t

he 2000

S

tock Incentive Plan of MIN-X.

CO

M

,

IN

C

.Th

e

2001

S

tock Incentive Plan provides for the granting o

f

options or restricted stock awards to our officers, directors

,

and emplo

y

ees. The objectives of the 2001

S

tock Incentive

Pl

an

i

nc

l

u

d

e

d

attract

i

ng an

d

reta

i

n

i

ng personne

l

, prov

idi

n

g

for additional performance incentives, and promoting ou

r

s

uccess

b

y prov

idi

ng emp

l

oyees t

h

e opportun

i

ty to acqu

i

re

s

toc

k

.

I

n management

’

sop

i

n

i

on, a

ll

stoc

k

opt

i

ons were

granted with an exercise price at or above the fair marke

t

v

alue of our common stock at the date of grant with th

e

exception of a grant in 2005 for 125 shares. Initially, w

e

r

ecorded deferred compensation in 2005 related to thi

s

option grant.

O

n January 1, 2006, we reversed the remain-

i

ng deferred compensation balance in accordance wit

h

FA

S

BA

SC

718. There have not been an

y

options available

for future grant under the 2001

S

tock Incentive Plan since

our board of directors terminated the

p

lan in 2008

.

2

006

In

ce

ntiv

e

Pl

a

n

In May 2006 we adopted the 2006 Incentive Plan. The

2006 Incentive Plan permits the

g

rant o

f

stock options

,

r

estricted stock, restricted stock units, stock a

pp

reciation

r

i

g

hts, per

f

ormance stock, per

f

ormance units, annual

awards, and other awards based on, or related to, shares o

f

our common stock. O

p

tions awarded under our 2006

Incentive Plan may be nonstatutory stock options or ma

y

qualify as incentive stock options under Section 422 of th

e

Internal Revenue Code of 1986, as amended. Our 200

6

I

ncent

i

ve

Pl

an conta

i

ns var

i

ous

li

m

i

ts w

i

t

h

respect to t

he

ty

pes o

f

awards, as

f

ollows

:

• a maximum o

f

20,000 shares ma

y

be issued unde

r

th

ep

l

an pursuant to

i

ncent

i

ve stoc

k

opt

i

ons;

• a maximum o

f

10,000 shares may be issued pur-

suant to options and stock appreciation ri

g

ht

s

g

ranted to any participant in a calendar year;

• a maximum of $5,000 may be paid pursuant to

annual awards

g

ranted to any participant in

a

calendar year; and

• a maximum of $10,000 may be paid (in the case o

f

awards denominated in cash

)

and a maximum o

f

1

0,000 shares may be issued (in the case of awards

denominated in shares

)p

ursuant to awards, other

t

han options, stock appreciation ri

g

hts or annua

l

awards,

g

ranted to any participant in a calenda

r

y

ear

.

B

ase

d

upon a

J

une 2010 amen

d

ment to t

h

ep

l

an, t

he

maximum number o

f

shares o

f

our common stock that are

authorized

f

or issuance under our 2006 Incentive Plan i

s

6

6,400 shares. Shares issued under the plan ma

y

b

e

aut

h

or

i

ze

d

an

d

un

i

ssue

d

s

h

ares or ma

yb

e

i

ssue

d

s

h

are

s

t

hat we have reacquired. Shares covered b

y

awards that

are

f

or

f

eited, cancelled or otherwise expire without havin

g

b

een exerc

i

se

d

or sett

l

e

d

,ort

h

at are sett

l

e

dby

cas

h

o

r

other non-share consideration

,

will become available for

i

ssuance pursuant to a new award.

S

hares that are ten

-

dered or withheld to pa

y

the exercise price of an award o

r

t

o satisfy tax withholding obligations will not be available fo

r

i

ssuance pursuant to new awar

d

s.

A

t

D

ecem

b

er 31, 2010,

23,947 shares were available for future grant under th

e

2006

S

tock Incentive Plan

.

F

-25