Vonage 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

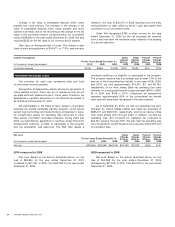

C

hange in fair value of embedded features within notes

pa

y

able and stock warran

t

.

The increase in the chan

g

e in fair

v

alue of embedded features within notes pa

y

able and stock

warrant is primarily due to the recordin

g

of the chan

g

e in the fair

va

l

ue o

fth

eco

nv

e

r

s

i

o

nf

ea

t

u

r

eco

nt

a

in

ed

within

ou

r

co

nv

e

rti

b

l

e

notes of

$

49,380 for the year ended December 31, 2009. We also

r

ecorded

$

553 for the fair value of our common stock warrant.

G

ain (loss) on extin

g

uishment of notes. The chan

g

ein

g

ai

n

(loss) of early extin

g

uishment of $34,611, or 113%, was primarily

r

elated to the loss of $30,570 in 2008 resultin

g

from the early

extin

g

uishment of debt offset by $4,041

g

ain associated with

co

nv

e

r

s

i

o

n

of ou

r

co

nv

e

rti

b

l

e

n

o

t

es

.

O

ther

.

W

e reco

g

nized $792 in other income for the year

e

nded December 31, 2009

f

or the net

p

roceeds we receive

d

f

rom a key-man term li

f

e insurance policy related to the passin

g

of a fo

rm

e

r

e

x

ecu

tiv

e

.

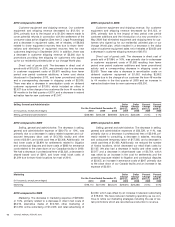

Income Tax Expens

e

F

or the Years Ended December 31

,

D

o

ll

a

r

C

han

ge

2

0

1

0

v

s

.

2

009

Do

ll

a

r

C

han

ge

2009

v

s

.

2008

Pe

r

ce

nt

C

han

g

e

2

0

1

0

v

s.

2

009

P

e

r

ce

nt

C

han

ge

2

009

v

s

.

2

008

(

in thousands, except percentages

)

2

0

1

0

2

009

2

008

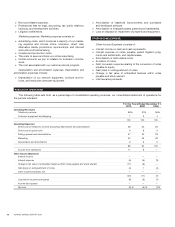

Income tax expense

$

(318)

$

(836)

$

(678)

$

518

$

(158) 62% (23%

)

PROVISION FOR INCOME TAXES

T

he provision

f

or each

y

ear represents state and local

i

ncome taxes current

ly

pa

y

a

bl

e.

Recognition of deferred tax assets will require generation o

f

future taxable income. There can be no assurance that we wil

l

generate sufficient taxable income in future years. Therefore, w

e

established a valuation allowance on net deferred tax assets o

f

$

415

,

903 as of December 31

,

2010.

We participated in the

S

tate of New Jerse

y

’s corporatio

n

b

usiness tax benefit certificate transfer program, which allows

certa

i

n

hi

g

h

tec

h

no

l

ogy an

dbi

otec

h

no

l

ogy compan

i

es to trans

-

fer unused New Jersey net operating loss carryovers to other

N

ew

J

ersey corporat

i

on

b

us

i

ness taxpayers.

D

ur

i

ng 2003 an

d

2004, we submitted an application to the New Jerse

y

Economi

c

Development Authority, or EDA, to participate in the pro

g

ram

and the a

pp

lication was a

pp

roved. The EDA then issued

a

certi

f

icate certi

f

yin

g

our eli

g

ibility to participate in the pro

g

ram

.

T

he pro

g

ram requires that a purchaser pay at least 75

%

o

f

the

amount o

f

the surrendered tax bene

f

it. In tax years 2008, 2009,

and 2010, we sold approximately, $10,051, $0, and $2,194

,

r

espectively, of our New Jersey State net operatin

g

loss carr

y

forwards for a reco

g

nized benefit of approximately $605 in 2008,

$

0 in 2009, and $168 in 2010. Collectively, all transactions

r

epresent approximatel

y

85

%

o

f

the surrendered tax bene

f

i

t

eac

h

year an

dh

ave

b

een recogn

i

ze

di

nt

h

e year rece

i

ve

d.

As o

f

December 31, 2010, we had net operating loss carry

forwards for United

S

tates federal and state tax purposes of

$

885,431 and

$

849,567, respectively, expiring at various time

s

from years ending 2012 through 2030. In addition, we had ne

t

operating loss carry forwards for

C

anadian tax purposes o

f

$

42,457 expiring through 2027. We also had net operating loss

carry forwards for United Kingdom tax purposes of

$

40,335 wit

h

no exp

i

rat

i

on

d

ate

.

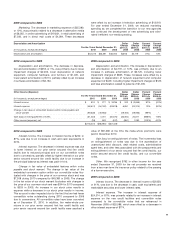

N

et

L

os

s

F

or t

h

e

Y

ears

E

n

d

e

dD

ecem

b

er

3

1

,

D

o

ll

a

r

C

hange

20

1

0

vs

.

2009

D

o

ll

a

r

Chang

e

2009

vs.

2008

P

ercen

t

C

hange

20

1

0

vs

.

2009

P

ercent

Chang

e

2009

vs

2008

(in thousands, except percentages

)

20

1

0 2009 2008

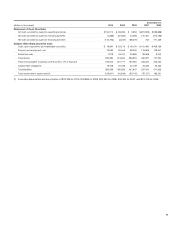

Net loss $(83,665) $(42,598) $(64,576) $(41,067) $21,978 (96%) 34

%

2010 com

p

ared to 2009

Ne

tL

oss

.

B

ased on the activity described above, our ne

t

l

oss of $83,665 for the year ended December 31, 2010

i

ncreased by $41,067, or 96%, from $42,598 for the year ended

December 31, 2009

.

2009 com

p

ared to 2008

Ne

tL

oss

.

B

ased on the activity described above, our net

l

oss of $42,598 for the year ended December 31, 200

9

decreased by $21,978, or 34%, from $64,576 for the year ende

d

December 31, 2008

.

3

4

VO

NA

G

E ANN

U

AL REP

O

RT 2010