Vonage 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

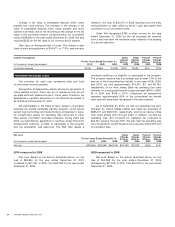

mar

k

et

i

ng expen

di

tures an

d

overa

ll

t

i

g

h

ter contro

l

s on costs

p

artiall

y

offset b

y

lower revenues as our overall customer bas

e

decreased in 2009 and hi

g

her interest expense associated wit

h

our November 2008 financin

g.

C

ash used for workin

g

capital requirements increased by

$

22,260 durin

g

the year ended December 31, 2009 compared t

o

the year ended December 31, 2008, primarily due to prepay

-

ments to take advanta

g

eo

f

discounts ne

g

otiated with vendor

s

g

iven our concentration account requirements under our prio

r

c

r

ed

it

fac

iliti

es.

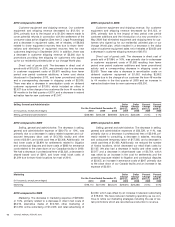

I

nvest

i

ng

A

ct

i

v

i

t

i

e

s

C

ash used in investing activities for 2010 of

$

4,686 wa

s

attributable to capital expenditures of

$

17,674 and development

of software assets of

$

22,712, partiall

y

offset b

y

a decrease in

r

estricted cash of

$

35,700 due primaril

y

to the reduction of

$

32,830 of reserves held b

y

our credit card processors as

a

r

esult of improvements in credit qualit

y

and the elimination of

t

he concentration account under our prior credit facilities of

$

3,277 as a result of our new Credit Facilit

y

.

C

ash used in investing activities for 2009 of

$

50,565 wa

s

attributable to capital expenditures of

$

23,724,

$

1,250 for th

e

l

icensing of IBM patents, development of software assets of

$

21

,

654

,

and an increase in restricted cash of

$

3

,

937.

C

ash provided by investin

g

activities for 2008 of

$

40,48

6

was attributable to net

p

urchases and sales of marketable secu

-

r

ities of $79,942, offset by the purchase of capital expenditure

s

of $38,476, of which $26,530 was for software ac

q

uisition an

d

develo

p

ment and an increase in restricted cash of $980 relate

d

t

o reserves required by our credit card processors.

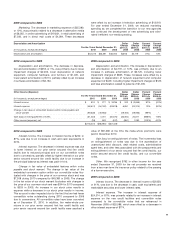

Fi

nanc

i

ng

A

ct

i

v

i

t

i

es

C

ash used in financing activities for 2010 of $143,762 was

attributable to

$

28,664 in First Lien Senior Facilit

y

principa

l

p

a

y

ments,

$

13,128 in Second Lien Senior Facilit

y

principa

l

p

ayments, including

$

3,668 representing paid-in-kind (“PIK”

)

i

nterest payments, payments of

$

290,660 to extinguish Firs

t

Lien

S

enior Facilit

y

,

S

econd Lien

S

enior Facilit

y

and

C

onvertibl

e

Notes including

$

28,652 representing PIK interest payments

,

and

$

1,500 in capital lease pa

y

ments partiall

y

offset b

y

pro-

ceeds of the Credit Facilit

y

of

$

200,000 offset b

y

note discoun

t

of

$

6,000 and debt related costs of

$

5,430, and proceeds o

f

$

1,620 from stock options exercised.

C

ash used in financing activities for 2009 of

$

3,253 wa

s

attributable to

$

1,251 in capital lease pa

y

ments,

$

1,809 in Firs

t

Lien Senior Facilit

y

principal pa

y

ments and

$

252 in additiona

l

d

e

b

tre

l

ate

d

costs.

C

ash used in financin

g

activities for 2008 of

$

68,370 wa

s

p

rimarily attributable to the repurchase of our previous con

-

v

ertible notes of

$

253,460 in a tender offer in November 2008.

We also had a new debt financin

g

for

$

220,300 offset by ori

g

inal

i

ssue discount of

$

7,167, debt related costs of

$

26,799, and th

e

p

rincipal payments on capital lease obli

g

ations of

$

1,036.

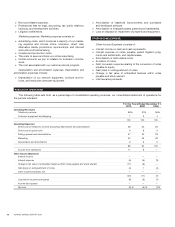

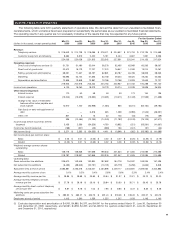

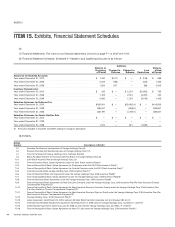

CONTRACTUAL OBLIGATIONS AND OTHER COMMERCIAL COMMITMENTS

T

he table below summarizes our contractual obli

g

ations at December 31, 2010, and the e

ff

ect such obli

g

ations are expected to

have on our liquidity and cash

f

low in

f

uture periods.

P

a

y

ments

D

ue

by P

er

i

o

d

(dollars in thousands

)

T

ota

l

L

es

s

tha

n

1

yea

r

2

-

3

years

4-

5

years

Af

t

e

r

5

y

ears

(unaudited)

C

ontractual

O

bli

g

ations:

S

enior secured term loa

n

$

200,000

$

20,000

$

40,000

$

140,000

$

–

Interest related to senior secured term loan 76,891 19,359 32,799 24,733

–

C

apital lease obli

g

ation

s

29

,

044 4

,

118 8

,

484 8

,

826

7,

616

O

peratin

g

lease obli

g

ation

s

7,7

48 3

,77

03

,55

8 420

–

Purchase obli

g

ation

s

55,

130 1

7,5

23 23

,

98

7

13

,

620

–

O

ther obli

g

ations

13

,

000

7,

800

5,

200

–

–

Total contractual obli

g

ations

$

381,813

$

72,570

$

114,028

$

187,599

$

7,616

O

ther

C

ommercial

C

ommitments

:

Standb

y

letters of credi

t

$

7

,

885 $ 7

,

885 $ – $ – $

–

T

otal contractual obligations and other commercial commitments $389,698 $80,455 $114,028 $187,599 $7,616

S

enior debt facilit

y.

O

n December 14, 2010, we entered int

o

t

he Credit Facility which consists of a

$

200,000 senior secured

t

erm loan.

S

ee Note 6 in the notes to the consolidated financial

s

t

a

t

e

m

e

nt

s.

C

apital lease obli

g

ations

.

A

t December 31, 2010, we ha

d

c

apital lease obli

g

ations of $29,044 related to our corporate

headquarters in Holmdel, New Jersey that expire in 2017.

O

peratin

g

lease obli

g

ations. At December 31, 2010,

f

uture

c

ommitments for operatin

g

leases included $6,274 fo

r

c

o-location facilities in the United States that accommodate

a

p

ortion of our network equipment throu

g

h 2013, $224 for kiosks

leased in various locations throu

g

hout the United States throu

gh

2

011, $525 for office space leased for our London, United Kin

g-

d

om office throu

g

h 2015, $35 for office space leased in Atlanta,

G

eor

g

ia for product development throu

g

h 2011, $652 for offic

e

sp

ace leased in Tel Aviv, Israel

f

or a

pp

lication develo

p

ment

38

VO

NA

G

E ANN

U

AL REP

O

RT 2010