Vonage 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(

In thousands, except per share amounts

)

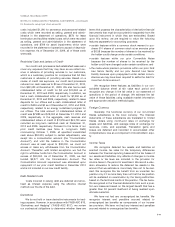

costs included

$

1,090 for severance and personnel-relate

d

costs which were recorded as selling, general and admin

-

istrative in the statement of o

p

erations,

$

670 for leas

e

t

e

rmin

a

ti

o

n

a

n

d

f

ac

iliti

es

-r

e

l

a

t

ed cos

t

s

whi

c

hw

e

r

e

r

eco

r

ded

as sellin

g

,

g

eneral and administrative in the statement of

o

p

erations, and

$

769 for asset im

p

airments which were

r

ecorded in the statement of o

p

erations as

p

art of de

p

recia

-

tion ex

p

ense. As o

f

December 31, 2009, all o

f

these cost

s

were

p

aid.

Restricted

C

ash and Letters of

C

redi

t

O

ur credit card

p

rocessors had established reserves to

cover an

y

exposure that the

y

ma

y

have as we collect rev-

enue in advance of providin

g

services to our customers

,

which is a customary practice for companies that bill thei

r

customers in advance of providin

g

services. Based on

a

r

eview of credit risk ex

p

osure, our credit card

p

rocessors

r

educed our cash reserves to

$

0 as of December 31, 2010

,

from

$

22,423 at December 31, 2009. We also had a cash

collateralized letter of credit for

$

0 and

$

10,500 as o

f

December 31, 2010 and 2009, respectively. In addition, w

e

had a cash collateralized letter of credit for $7,350 as o

f

December 31, 2010 and 2009, respectively, related to leas

e

de

p

osits

f

or our o

ff

ices and a cash collateralized letter o

f

credit for $535 and $0 as of December 31, 2010 and 2009

,

r

espectively, related to an ener

g

y curtailment pro

g

ram

f

o

r

ou

r

off

i

ces

.Th

e

t

o

t

a

l

a

m

ou

nt

of co

ll

a

t

e

r

a

liz

ed

l

e

tt

e

r

sof

credit was $7,885 and $18,000 at December 31, 2010 and

2009, respectively. In the a

gg

re

g

ate, cash reserves and

collateralized letters of credit of $7,978 and $43,700 wer

e

r

ecorded as lon

g

-term restricted cash at December 31

,

2010 and 2009, respectively. Pursuant to the terms o

f

ou

r

p

rior credit facilities (see Note 6. Lon

g

-term Debt

)

commencin

g

October 1, 2009, all specified unrestricte

d

cash above $30,000, sub

j

ect to certain ad

j

ustments, was

s

we

p

t into a concentration account

(

the “Concentratio

n

Account”), and until the balance in the Concentratio

n

Account was at least equal to $30,000, we could not

access or make an

y

withdrawals from the Concentratio

n

Account. Therea

f

ter, with limited exceptions, we had th

e

r

ight to withdraw funds from the Concentration Account i

n

excess of $30

,

000. As of December 31

,

2009

,

we had

funded $3

,

277 into the Concentration Account. Th

e

C

oncentration Account requirement was eliminated upo

n

r

epa

y

ment o

f

our prior credit

f

acilities in December 2010

and is not included in our new credit facilit

y.

Debt Related

C

osts

C

osts incurred in raisin

g

debt are deferred and amor

-

t

ized as interest expense usin

g

the effective interes

t

m

e

th

od o

v

e

rth

e

lif

eo

fth

e deb

t.

D

e

riv

a

tiv

es

W

e do not hold or issue derivative instruments for trad

-

in

g

purposes. However, in accordance with FA

S

BA

SC

815,

“

D

erivatives and Hed

g

in

g

”(

“FA

S

BA

SC

815”

)

, we review

our contractual obli

g

ations to determine whether there are

terms that possess the characteristics of derivative financial

instruments that must be accounted for separatel

y

from the

financial instrument in which they are embedded. Base

d

upon this review, we are required to value the followin

g

features separately for accountin

g

purposes

:

>

certain features within a common stock warrant to pur

-

chase 514 shares of common stock at an exercise price

of

$

0.58 because the number of shares to be received b

y

th

e

h

o

ld

er cou

ld

c

h

ange un

d

er certa

i

n con

di

t

i

ons;

>

certain features within our prior

C

onvertible Note

s

because the number of shares to be received b

y

th

e

h

o

ld

er cou

ld h

ave c

h

ange

d

un

d

er certa

i

n con

di

t

i

ons; an

d

>

t

he make-whole

p

remium

p

rovisions within our

p

rior Firs

t

Lien Senior Facility and our prior Second Lien Senio

r

F

ac

ili

ty

b

ecause upon prepayment un

d

er certa

i

nc

i

rcum-

stances we ma

y

have been required to settle the debt

f

o

r

m

ore than its

f

ace amount.

W

e recognize these features as liabilities in our con-

s

olidated balance sheet at fair value each period and

r

ecognize any change in the fair value in our statement o

f

operations in the period of change. We estimate the fai

r

v

alue of these liabilities using available market informatio

n

and appropriate valuation methodologies.

Foreign

C

urrenc

y

G

enerally, the functional currency of our non-Unite

d

S

tates subsidiaries is the local currency. The financia

l

s

tatements o

f

these subsidiaries are translated to United

S

tates dollars usin

g

month-end rates of exchan

g

e for

assets and liabilities, and avera

g

e rates o

f

exchan

g

e

f

o

r

r

evenues, costs, and expenses. Translation

g

ains and

losses a

r

e defe

rr

ed a

n

d

r

eco

r

ded

in

accu

m

u

l

a

t

ed o

th

er

com

p

rehensive loss as a com

p

onent o

f

stockholders’ e

q

ui

-

t

y.

I

ncome

T

axe

s

We reco

g

nize de

f

erred tax assets and liabilities a

t

enacted income tax rates

f

or the temporary di

ff

erences

b

etween the

f

inancial reportin

g

bases and the tax bases o

f

our assets and liabilities. Any e

ff

ects o

f

chan

g

es in incom

e

t

ax rates or tax laws are included in the

p

rovision

f

o

r

i

ncome taxes in the

p

eriod o

f

enactment. We record a valu-

a

ti

o

n

a

ll

o

w

a

n

ce

t

o

r

educe

th

e defe

rr

ed

t

a

x

asse

t

s

t

o

th

e

amount that we estimate is more likely than not to be real-

i

zed. We reco

g

nize the tax bene

f

it

f

rom an uncertain ta

x

p

osition only i

f

it is more likely than not that the tax positio

n

w

ill b

e susta

i

ne

d

on exam

i

nat

i

on

b

yt

h

e tax

i

n

g

aut

h

or

i

t

i

es

,

b

ased on the technical merits o

f

the position. The tax bene-

f

its recognized in the

f

inancial statements

f

rom such a posi

-

t

ion are measured based on the largest bene

f

it that has

a

greater than 50 percent likelihood o

f

being realized upon

u

l

t

i

mate reso

l

ut

i

on

.

We have not had any unreco

g

nized tax benefits. W

e

r

eco

g

nize interest and penalties accrued related t

o

unreco

g

nized tax bene

f

its as components o

f

our incom

e

t

ax provision. We have not had any interest and penaltie

s

accrued related to unreco

g

nized tax bene

f

its.

F

-

11