Vonage 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(

In thousands, except per share amounts

)

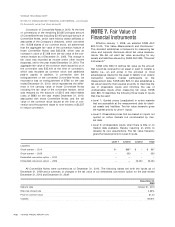

Fair Value of

O

ther Financial Instrument

s

T

he carrying amounts of our financial instruments

,

i

nc

l

u

di

ng cas

h

an

d

cas

h

equ

i

va

l

ents, accounts rece

i

va

bl

e

,

and accounts pa

y

able, approximate fair value because of

t

heir short maturities. The carrying amounts of our capita

l

l

eases approximate fair value of these obligations base

d

upon management’s best estimates of interest rates that

would be available for similar debt obligations at

December 31

,

2010 and 2009. We believe the fair value o

f

our debt at December 31, 2010 was approximately th

e

same as its carryin

g

amount as market conditions, includ

-

i

n

g

available interest rates, credit spread relative to our

credit ratin

g

, and illiquidity, remain relatively unchan

g

e

d

f

rom the issuance date o

f

our debt on December 14

,

2

0

1

0.

N

ote 8.

Co

mm

o

n

S

t

oc

k

C

ommon

S

tock Warrant

O

n April 17, 2002, Vonage’s principal stockholder

and

C

hairman received a warrant to purchase 514 share

s

of Common Stock at an exercise price of

$

0.70 per shar

e

t

hat expires on June 20, 2012. As a result of the issuanc

e

of our

C

onvertible Notes, the exercise price was reduce

d

t

o

$

0.58.

No

t

e9

.

E

mployee Benefit

P

lans

S

hare-Based

C

ompensatio

n

O

ur stock option program is a long-term retentio

n

p

ro

g

ram that is intended to attract, retain and provide

i

ncentives for talented emplo

y

ees, officers and directors

,

and to ali

g

n stockholder and employee interests.

C

ur-

r

ently, we

g

rant options from our 2006 Incentive Plan.

O

u

r

2001

S

tock Incentive Plan was terminated b

y

our board o

f

di

rectors

i

n 2008.

A

s suc

h,

s

h

are-

b

ase

d

awar

d

s are no

l

onger granted under the 2001

S

tock Incentive Plan.

U

n

d

er t

h

e 2006

I

ncent

i

ve

Pl

an

,

s

h

are-

b

ase

d

awar

d

s can

be granted to all employees, including executive officers

,

outs

id

e consu

l

tants, an

d

non-emp

l

oyee

di

rectors.

V

est

i

n

g

periods for share-based awards are generally four years

for both plans. Awards granted under each plan expire i

n

five or 10 years from the effective date of grant. As of April

2010, the

C

ompany began routinely granting awards wit

h

a10

y

ear exp

i

rat

i

on per

i

o

d.

T

he fair value for these options was estimated at the date of

g

rant usin

g

a Black-

S

choles option-pricin

g

model. The

assum

p

tions used to value o

p

tions are as follows

:

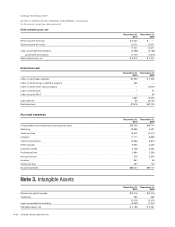

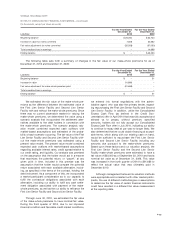

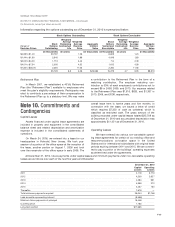

20

1

0 2009 2008

Risk-

f

ree interest rate 0.99-2.89

%

1.50-3.12

%

1.24-3.23

%

Expected stock price volatilit

y

100.05-106.55

%

87.70-109.31

%

66.29-86.83

%

Di

v

id

en

dyi

e

ld

0

.00

%

0.00

%

0.00

%

Expected life (in

y

ears) 3.75-6.25 3.75-6.25 3.75-6.2

5

Beginning January 1, 2006, we estimated the vola-

t

ility of our stock usin

g

historical volatility of comparable

p

ublic companies in accordance with

g

uidance in FA

SB

A

SC

718, “

C

om

p

ensation-

S

tock

C

om

p

ensation”. Be

g

in-

nin

g

in the first quarter of 2008, we used the historica

l

v

olatility of our common stock to measure expected vola-

t

ility for future option

g

rants

.

T

he risk-free interest rate assum

p

tion is based u

p

on

observed interest rates a

pp

ro

p

riate for the term of ou

r

emplo

y

ee stock options. The expected term of emplo

y

e

e

stock options represents the wei

g

hted-avera

g

e period

t

hat the stock o

p

tions are ex

p

ected to remain out-

standin

g

, which we derive based on our historical settle

-

m

ent ex

p

erience.

O

ur

S

tock Incentive Plans as of December 31, 2010 are summarized as follows

(

in thousands

)

:

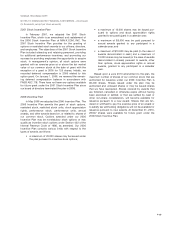

S

hares

A

uthorize

d

S

hare

s

Available

f

or

G

rant

S

tock

O

ption

s

O

utstandin

g

R

estr

i

cte

d

S

tock and

R

estricte

d

S

toc

k

U

nit

s

2001 Incentive Plan

–

5

,

315

–

2006 Incentive Plan 66

,

400 23

,

947 30

,

414 2

,

33

2

Total as of December 31

,

2010 66

,

400 23

,

947 35

,

729 2

,

332

F

-

24

VO

NA

G

E ANN

U

AL REP

O

RT 2010