Vonage 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(

In thousands, except per share amounts

)

D

eprec

i

at

i

on an

d

amort

i

zat

i

on expense

D

ecem

b

er

3

1

,

20

1

0

D

ecem

b

er

3

1

,

2009

D

ecem

b

er

3

1

,

2008

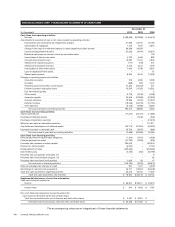

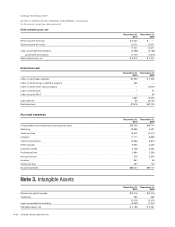

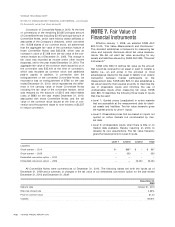

Network equipment and computer hardware $20,887 $21,698 $21,64

7

S

oftware 22

,

602 19

,

418 11

,

85

8

Capital lease

s

2,

199 2

,

199 2

,

199

O

ther leasehold improvements 3,679 3,685 3,760

F

urn

i

ture 1

,

827 2

,

061 2

,

409

V

e

hi

c

l

es

1

5997

Di

sp

l

a

y

s

—

48 161

P

atents 1

,

145 1

,

319 2

,

81

5

52

,

3

5

4

5

0

,

43

7

44

,

946

Property and equipment impairments 584 1,886 1,762

S

oftware im

p

airments

13

5

1

,

068 1

,

904

Depreciation and amortization expense $53,073 $53,391 $48,61

2

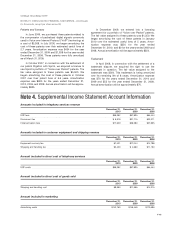

A

mount

i

nc

l

u

d

e

di

n

i

nterest expens

e

D

ecem

b

er

3

1

,

20

1

0

D

ecem

b

er

3

1

,

2009

D

ecem

b

er

3

1

,

2008

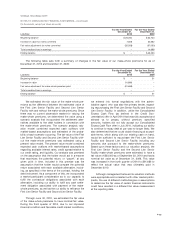

D

ebt related costs amortization $1

,

402 $2

,

708 $3

,

237

Amount included in other income

(

expense

)

, net

D

ecem

b

er

3

1

,

20

1

0

D

ecem

b

er

3

1

,

2009

D

ecem

b

er

3

1

,

2008

Net gains (losses) resulting from foreign exchange transactions $(19) $46 $(315

)

Note 5.

I

n

co

m

e

T

a

x

es

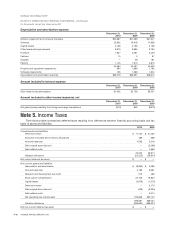

T

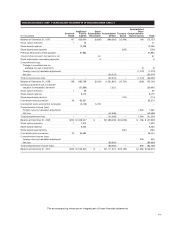

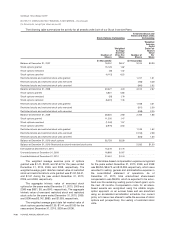

he following table summarizes deferred taxes resulting from differences between financial accounting basis and ta

x

bas

i

so

f

asse

t

sa

n

d

li

ab

iliti

es.

20

1

0 2009

C

urrent assets and liabilities:

De

f

erred revenue

$

17

,

150 $ 21

,

45

0

A

ccounts rece

i

va

bl

ean

di

nventor

y

a

ll

owance

s

489 688

A

ccrue

d

expenses 4

,

583 5

,

218

D

e

b

tor

i

g

i

na

li

ssue

di

scoun

t

— (2,098

)

D

e

b

tre

l

ate

d

cost

s

—1

,

65

6

22

,

222 26

,

914

V

a

l

ua

ti

o

n

a

ll

o

w

a

n

ce

(

22,222

)(

26,914

)

Net current de

f

erred tax asse

t

$

—

$

—

N

on-current assets an

dli

a

bili

t

i

es

:

De

p

reciation and amortizatio

n

$(

8,332

)$

2,089

A

ccrued ex

p

enses

4

,7

89

5,5

67

Research and develo

p

ment tax credit

519 469

S

tock o

p

tion com

p

ensatio

n

22

,

1

5

319

,

820

C

a

p

ital lease

s

(

1,878

)(

1,275

)

D

e

f

e

rr

ed

r

e

v

e

n

ue

—

3

,

1

7

3

Debt ori

g

inal issue discoun

t

(

426

)(

6,934

)

D

eb

tr

e

l

a

t

ed cos

t

s

—

6

,

014

N

et operatin

g

loss carryforwar

d

3

7

6

,

8

5

6 330

,

104

393

,

681 3

5

9

,

027

V

a

l

uat

i

on a

ll

owance

(

393,681) (359,027

)

N

et non-current de

f

erred tax asse

t

$

—

$

—

F-16

VO

NA

G

E ANN

U

AL REP

O

RT 2010