United Healthcare 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

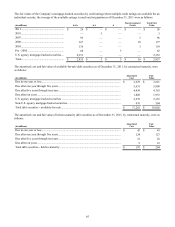

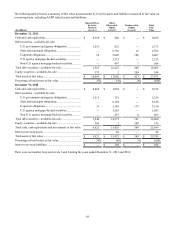

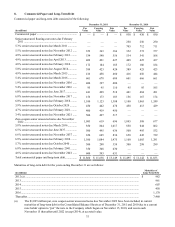

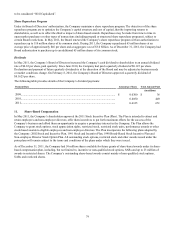

The table below includes fair values for certain financial instruments for which it is practicable to estimate fair value. The

carrying values and fair values of these financial instruments were as follows:

(in millions)

Assets

Debt securities - available-for-sale ....................................

Equity securities - available-for-sale .................................

Debt securities - held-to-maturity......................................

AARP Program-related investments..................................

Interest rate swap assets.....................................................

Liabilities

Senior unsecured notes ......................................................

Interest rate swap liabilities ...............................................

AARP Program-related other liabilities.............................

December 31, 2011

Carrying Value

$ 18,002

544

197

2,441

—

11,638

—

76

Fair Value

$ 18,002

544

204

2,441

—

13,149

—

76

December 31, 2010

Carrying Value

$ 16,060

516

203

2,435

46

10,212

104

59

Fair Value

$ 16,060

516

208

2,435

46

10,903

104

59

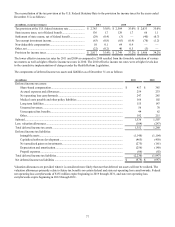

The carrying amounts reported in the Consolidated Balance Sheets for cash and cash equivalents, accounts and other current

receivables, unearned revenues, commercial paper, accounts payable and accrued liabilities approximate fair value because of

their short-term nature. These assets and liabilities are not listed in the table above.

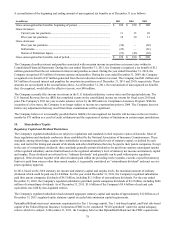

The following methods and assumptions were used to estimate the fair value and determine the fair value hierarchy

classification of each class of financial instrument:

Cash and Cash Equivalents. The carrying value of cash and cash equivalents approximates fair value as maturities are less

than three months. Fair values of cash equivalent instruments that do not trade on a regular basis in active markets are classified

as Level 2.

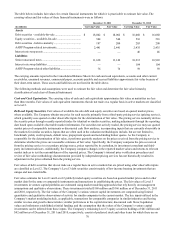

Debt and Equity Securities. Fair values of available-for-sale debt and equity securities are based on quoted market prices,

where available. The Company obtains one price for each security primarily from a third-party pricing service (pricing service),

which generally uses quoted or other observable inputs for the determination of fair value. The pricing service normally derives

the security prices through recently reported trades for identical or similar securities, making adjustments through the reporting

date based upon available observable market information. For securities not actively traded, the pricing service may use quoted

market prices of comparable instruments or discounted cash flow analyses, incorporating inputs that are currently observable in

the markets for similar securities. Inputs that are often used in the valuation methodologies include, but are not limited to,

benchmark yields, credit spreads, default rates, prepayment speeds and non-binding broker quotes. As the Company is

responsible for the determination of fair value, it performs quarterly analyses on the prices received from the pricing service to

determine whether the prices are reasonable estimates of fair value. Specifically, the Company compares the prices received

from the pricing service to a secondary pricing source, prices reported by its custodian, its investment consultant and third-

party investment advisors. Additionally, the Company compares changes in the reported market values and returns to relevant

market indices to test the reasonableness of the reported prices. The Company’s internal price verification procedures and

review of fair value methodology documentation provided by independent pricing services has not historically resulted in

adjustment in the prices obtained from the pricing service.

Fair values of debt securities that do not trade on a regular basis in active markets but are priced using other observable inputs

are classified as Level 2. The Company’s Level 3 debt securities consist mainly of low income housing investments that are

unique and non-transferable.

Fair value estimates for Level 1 and Level 2 publicly traded equity securities are based on quoted market prices and/or other

market data for the same or comparable instruments and transactions in establishing the prices. The fair values of Level 3

investments in venture capital portfolios are estimated using market modeling approaches that rely heavily on management

assumptions and qualitative observations. These investments totaled $168 million and $166 million as of December 31, 2011

and 2010, respectively. The fair values of the Company’s various venture capital investments are computed using limited

quantitative and qualitative observations of activity for similar companies in the current market. The key inputs utilized in the

Company’s market modeling include, as applicable, transactions for comparable companies in similar industries and having

similar revenue and growth characteristics; similar preferences in the capital structure; discounted cash flows; liquidation

values and milestones established at initial funding; and the assumption that the values of the Company’s venture capital

investments can be inferred from these inputs. The Company’s remaining Level 3 equity securities holdings of $41 million and

$42 million as of December 31, 2011 and 2010, respectively, consist of preferred stock and other items for which there are no