United Healthcare 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

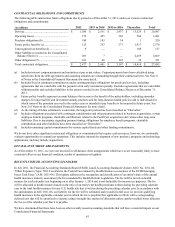

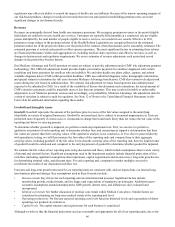

The following table illustrates the sensitivity of these factors and the estimated potential impact on our medical costs payable

estimates for those periods as of December 31, 2011:

Completion Factors

Increase (Decrease) in Factors

(0.75)%.............................................................................................................................................

(0.50) ................................................................................................................................................

(0.25) ................................................................................................................................................

0.25...................................................................................................................................................

0.50...................................................................................................................................................

0.75...................................................................................................................................................

Increase (Decrease)

In Medical Costs Payable

(in millions)

$ 211

141

70

(70)

(139)

(208)

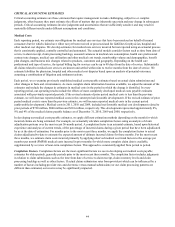

Medical cost PMPM trend factors. Medical cost PMPM trend factors are the most significant factors we use in developing our

medical costs payable estimates for the most recent three months. Medical cost trend factors are developed through a

comprehensive analysis of claims incurred in prior months, provider contracting and expected unit costs, benefit design, and by

reviewing a broad set of health care utilization indicators including, but not limited to, pharmacy utilization trends, inpatient

hospital census data and incidence data from the National Centers for Disease Control. We also consider macroeconomic

variables such as gross-domestic product growth, employment and disposable income. A large number of factors can cause the

medical cost trend to vary from our estimates including: our ability and practices to manage medical costs, changes in level and

mix of services utilized, mix of benefits offered including the impact of co-pays and deductibles, changes in medical practices,

catastrophes, epidemics, the introduction of new or costly treatments and technology, new mandated benefits or other

regulatory changes, insured population characteristics and seasonal changes in the level of health care use.

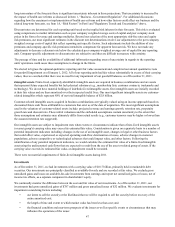

The following table illustrates the sensitivity of these factors and the estimated potential impact on our medical costs payable

estimates for the most recent three months as of December 31, 2011:

Medical Costs PMPM Trend

Increase (Decrease) in Factors

3%.....................................................................................................................................................

2........................................................................................................................................................

1........................................................................................................................................................

(1) .....................................................................................................................................................

(2) .....................................................................................................................................................

(3) .....................................................................................................................................................

Increase (Decrease)

In Medical Costs Payable

(in millions)

$ 415

277

138

(138)

(277)

(415)

The analyses above include outcomes that are considered reasonably likely based on our historical experience estimating

liabilities for incurred but not reported benefit claims.

Our estimate of medical costs payable represents management's best estimate of our liability for unpaid medical costs as of

December 31, 2011, developed using consistently applied actuarial methods. Management believes the amount of medical costs

payable is reasonable and adequate to cover our liability for unpaid claims as of December 31, 2011; however, actual claim

payments may differ from established estimates as discussed above. Assuming a hypothetical 1% difference between our

December 31, 2011 estimates of medical costs payable and actual medical costs payable, excluding AARP Medicare

Supplement Insurance and any potential offsetting impact from premium rebates, 2011 net earnings would have increased or

decreased by $56 million and diluted net earnings per common share would have increased or decreased by $0.05 per share.

The current national health care cost inflation rate significantly exceeds the general inflation rate. We use various strategies to

lessen the effects of health care cost inflation. These include coordinating care with physicians and other health care

professionals and rate discounts from physicians and other health care professionals. Through contracts with physicians and

other health care professionals, we emphasize preventive health care, appropriate use of health care services consistent with

clinical performance standards, education and closing gaps in care.

We believe our strategies to mitigate the impact of health care cost inflation on our operating results have been and will

continue to be successful. However, other factors including competitive pressures, new health care and pharmaceutical product

introductions, demands from physicians and other health care professionals and consumers, major epidemics, and applicable