United Healthcare 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

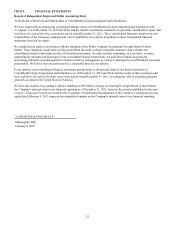

56

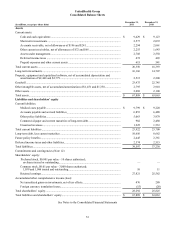

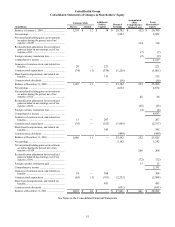

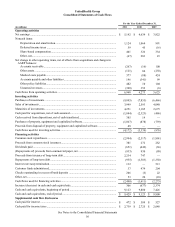

UnitedHealth Group

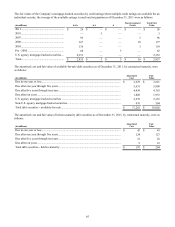

Consolidated Statements of Cash Flows

(in millions)

Operating activities

Net earnings ........................................................................................................................

Noncash items:

Depreciation and amortization.....................................................................................

Deferred income taxes .................................................................................................

Share-based compensation...........................................................................................

Other, net......................................................................................................................

Net change in other operating items, net of effects from acquisitions and changes in

AARP balances:

Accounts receivable.....................................................................................................

Other assets..................................................................................................................

Medical costs payable..................................................................................................

Accounts payable and other liabilities.........................................................................

Other policy liabilities..................................................................................................

Unearned revenues.......................................................................................................

Cash flows from operating activities ..................................................................................

Investing activities

Purchases of investments ....................................................................................................

Sales of investments............................................................................................................

Maturities of investments....................................................................................................

Cash paid for acquisitions, net of cash assumed.................................................................

Cash received from dispositions, net of cash transferred....................................................

Purchases of property, equipment and capitalized software...............................................

Proceeds from disposal of property, equipment and capitalized software..........................

Cash flows used for investing activities..............................................................................

Financing activities

Common stock repurchases ................................................................................................

Proceeds from common stock issuances.............................................................................

Dividends paid ....................................................................................................................

(Repayments of) proceeds from commercial paper, net .....................................................

Proceeds from issuance of long-term debt..........................................................................

Repayments of long-term debt............................................................................................

Interest rate swap termination.............................................................................................

Customer funds administered..............................................................................................

Checks outstanding in excess of bank deposits ..................................................................

Other, net.............................................................................................................................

Cash flows used for financing activities .............................................................................

Increase (decrease) in cash and cash equivalents................................................................

Cash and cash equivalents, beginning of period.................................................................

Cash and cash equivalents, end of period ...........................................................................

Supplemental cash flow disclosures

Cash paid for interest ..........................................................................................................

Cash paid for income taxes.................................................................................................

For the Year Ended December 31,

2011

$ 5,142

1,124

59

401

(67)

(267)

(121)

377

146

482

(308)

6,968

(9,895)

3,949

4,251

(1,844)

385

(1,067)

49

(4,172)

(2,994)

381

(651)

(933)

2,234

(955)

132

37

206

53

(2,490)

306

9,123

$ 9,429

$ 472

$ 2,739

2010

$ 4,634

1,064

45

326

203

(16)

84

(88)

(341)

10

352

6,273

(7,855)

2,593

3,105

(2,323)

19

(878)

—

(5,339)

(2,517)

272

(449)

930

747

(1,583)

—

974

(5)

20

(1,611)

(677)

9,800

$ 9,123

$ 509

$ 2,725

2009

$ 3,822

991

(16)

334

23

100

(250)

424

99

104

(6)

5,625

(6,466)

4,040

2,675

(486)

—

(739)

—

(976)

(1,801)

282

(36)

(99)

—

(1,350)

513

204

22

(10)

(2,275)

2,374

7,426

$ 9,800

$ 527

$ 2,048

See Notes to the Consolidated Financial Statements