United Healthcare 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

notes due February 2021 and $350 million of 6.0% fixed-rate notes due February 2041.

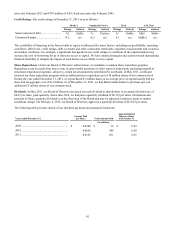

Credit Ratings. Our credit ratings at December 31, 2011 were as follows:

Senior unsecured debt............................

Commercial paper..................................

Moody’s

Ratings

A3

P-2

Outlook

Stable

n/a

Standard & Poor’s

Ratings

A-

A-2

Outlook

Positive

n/a

Fitch

Ratings

A-

F1

Outlook

Stable

n/a

A.M. Best

Ratings

bbb+

AMB-2

Outlook

Stable

n/a

The availability of financing in the form of debt or equity is influenced by many factors, including our profitability, operating

cash flows, debt levels, credit ratings, debt covenants and other contractual restrictions, regulatory requirements and economic

and market conditions. For example, a significant downgrade in our credit ratings or conditions in the capital markets may

increase the cost of borrowing for us or limit our access to capital. We have adopted strategies and actions toward maintaining

financial flexibility to mitigate the impact of such factors on our ability to raise capital.

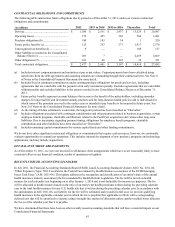

Share Repurchases. Under our Board of Directors’ authorization, we maintain a common share repurchase program.

Repurchases may be made from time to time in open market purchases or other types of transactions (including prepaid or

structured repurchase programs), subject to certain preset parameters established by our Board. In May 2011, our Board

renewed our share repurchase program with an authorization to repurchase up to 110 million shares of our common stock.

During the year ended December 31, 2011, we repurchased 65 million shares at an average price of approximately $46 per

share and an aggregate cost of $3.0 billion. As of December 31, 2011, we had Board authorization to purchase up to an

additional 65 million shares of our common stock.

Dividends. In May 2011, our Board of Directors increased our cash dividend to shareholders to an annual dividend rate of

$0.65 per share, paid quarterly. Since June 2010, we had paid a quarterly dividend of $0.125 per share. Declaration and

payment of future quarterly dividends is at the discretion of the Board and may be adjusted as business needs or market

conditions change. On February 8, 2012, our Board of Directors approved a quarterly dividend of $0.1625 per share.

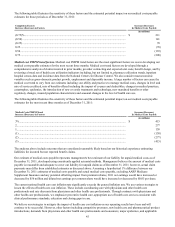

The following table provides details of our dividend payments and annual dividend rate:

Years ended December 31,

2009.................................................................

2010.................................................................

2011.................................................................

Amount Paid

per Share

$ 0.0300

0.4050

0.6125

Total Amount Paid

(in millions)

$ 36

449

651

Annual Dividend

Rate per Share

at December 31,

$ 0.03

0.50

0.65