United Healthcare 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

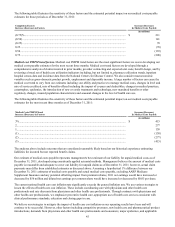

related to reimbursement for out-of-network medical services.

Cash flows used for investing activities increased $4.4 billion, primarily due to acquisitions completed in 2010, decreases in

sales of investments due to a more stable market environment and the use of operating cash to purchase investments.

Cash flows used for financing activities decreased $664 million, or 29%, primarily due to proceeds from the issuance of

commercial paper and long-term debt, partially offset by increases in common stock repurchases and cash dividends paid on

our common stock.

Financial Condition

As of December 31, 2011, our cash, cash equivalent and available-for-sale investment balances of $28.0 billion included

$9.4 billion of cash and cash equivalents (of which $1.6 billion was held by non-regulated entities), $18.0 billion of debt

securities and $544 million of investments in equity securities and venture capital funds. Given the significant portion of our

portfolio held in cash equivalents, we do not anticipate fluctuations in the aggregate fair value of our financial assets to have a

material impact on our liquidity or capital position. The use of different market assumptions or valuation methodologies,

primarily used in valuing our Level 3 securities (those securities priced using significant unobservable inputs), may have an

effect on the estimated fair value amounts of our investments. Due to the subjective nature of these assumptions, the estimates

may not be indicative of the actual exit price if we had sold the investment at the measurement date. We had $417 million of

Level 3 securities as of December 31, 2011. Other sources of liquidity, primarily from operating cash flows and our commercial

paper program, which is supported by our $3.0 billion bank credit facility, reduce the need to sell investments during adverse

market conditions. See Note 4 of Notes to the Consolidated Financial Statements for further detail of our fair value

measurements.

Our cash equivalent and investment portfolio has a weighted-average duration of 2.1 years and a weighted-average credit rating

of “AA” as of December 31, 2011. Included in the debt securities balance are $2.4 billion of state and municipal obligations

that are guaranteed by a number of third parties. Due to the high underlying credit ratings of the issuers, the weighted-average

credit rating of these securities both with and without the guarantee is “AA” as of December 31, 2011. We do not have any

significant exposure to any single guarantor (neither indirect through the guarantees, nor direct through investment in the

guarantor). When multiple credit ratings are available for an individual security, the average of the available ratings is used to

determine the weighted-average credit rating.

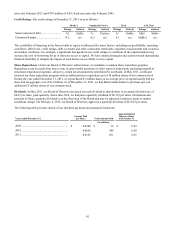

Capital Resources and Uses of Liquidity

In addition to cash flow from operations and cash and cash equivalent balances available for general corporate use, our capital

resources and uses of liquidity are as follows:

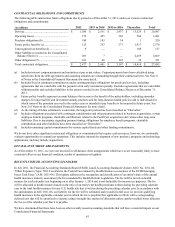

Commercial Paper. We maintain a commercial paper borrowing program, which facilitates the private placement of unsecured

debt through third-party broker-dealers. The commercial paper program is supported by the $3.0 billion bank credit facility

described below. As of December 31, 2011, we had no commercial paper outstanding.

Bank Credit Facility. In December 2011, we amended and renewed our five-year revolving bank credit facility with 21 banks,

which will mature in December 2016. The amendment included increasing the borrowing capacity to $3.0 billion. This facility

supports our commercial paper program and is available for general corporate purposes. There were no amounts outstanding

under this facility as of December 31, 2011. The interest rate on borrowings is variable based on term and amount and is

calculated based on the LIBOR plus a credit spread based on our senior unsecured credit ratings. As of December 31, 2011, the

annual interest rate on this facility, had it been drawn, would have ranged from 1.2% to 1.7%.

Our bank credit facility contains various covenants, including requiring us to maintain a debt to debt-plus-equity ratio below

50%. Our debt to debt-plus-equity ratio, calculated as the sum of debt divided by the sum of debt and shareholders’ equity, was

29.1% and 30.1% as of December 31, 2011 and December 31, 2010, respectively. We were in compliance with our debt

covenants as of December 31, 2011.

Long-term debt. Periodically, we access capital markets and issue long-term debt for general corporate purposes and the funds

may be used, for example, to meet our working capital requirements, to refinance debt, to finance acquisitions, for share

repurchases or for other general corporate purposes.

In November 2011, we issued $1.5 billion in senior unsecured notes. The issuance included $400 million of 1.9% fixed-rate

notes due November 2016, $500 million of 3.4% fixed-rate notes due November 2021 and $600 million of 4.6% notes due

November 2041.

In February 2011, we issued $750 million in senior unsecured notes. The issuance included $400 million of 4.7% fixed-rate