United Healthcare 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

For debt securities, if we intend to either sell or determine that we will be more likely than not be required to sell a debt

security before recovery of the entire amortized cost basis or maturity of the debt security, we recognize the entire impairment

in earnings. If we do not intend to sell the debt security and we determine that we will not be more likely than not be required

to sell the debt security but we do not expect to recover the entire amortized cost basis, the impairment is bifurcated into the

amount attributed to the credit loss, which is recognized in earnings, and all other causes, which are recognized in other

comprehensive income.

For equity securities, we recognize impairments in other comprehensive income if we expect to hold the equity security until

fair value increases to at least the equity security's cost basis and we expect that increase in fair value to occur in a reasonably

forecasted period. If we intend to sell the equity security or if we believe that recovery of fair value to cost will not occur in the

near term, we recognize the impairment in through our income statement.

Inherently, there is uncertainty included in the impairment assessment of investments. Our analysis includes significant

judgments and estimates including: the fair value of the investment, the underlying credit quality of the issuers and the credit

ratings of the issuer other forms of credit enhancements, the financial condition and near term prospects of the issuer, and

general industry and sector economic conditions.

Fair values. We perform an analysis around the fair values of the securities held including obtaining an understanding of the

pricing method and procedures over the valuation of securities. Fair values of available-for-sale debt and equity securities are

based on quoted market prices, where available. We obtain one price for each security primarily from a third-party pricing

service (pricing service), which generally uses quoted or other observable inputs for the determination of fair value. The pricing

service normally derives the security prices through recently reported trades for identical or similar securities, making

adjustments through the reporting date based upon available observable market information. For securities not actively traded,

the pricing service may use quoted market prices of comparable instruments or discounted cash flow analyses, incorporating

inputs that are currently observable in the markets for similar securities. Inputs that are often used in the valuation

methodologies include, but are not limited to, benchmark yields, credit spreads, default rates and prepayment speeds, and non-

binding broker quotes. As we are responsible for the determination of fair value, we perform quarterly analyses on the prices

received from the pricing service to determine whether the prices are reasonable estimates of fair value. Specifically, we

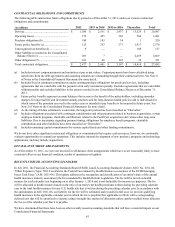

compare:

• the prices received from the pricing service to prices reported by a secondary pricing service, its custodian, its

investment consultant and/or third-party investment advisors; and

• changes in the reported market values and returns to relevant market indices and our expectations to test the

reasonableness of the reported prices.

Based on our internal price verification procedures and our review of the fair value methodology documentation provided by

independent pricing service, we have not historically adjusted the prices obtained from the pricing service.

Other-than-temporary impairment assessment. Individual securities with fair values lower than costs are reviewed for

impairment considering the factors above including: the length of time of impairment, credit standing, financial condition, near

term-prospects and other factors specific to the issuer. Other factors included in the assessment include the type and nature of

the securities and liquidity. Given the nature of our portfolio, primarily investment grade securities, the primary causes of

historical impairments were market related (e.g., interest rate fluctuations, etc) as opposed to credit related. We do not expect

that trend to change in the near term. Generally, we do not assume that we will be required to sell a security because our large

cash holdings reduce this risk. However, our intent to sell a security may change from period to period if facts and

circumstances change.

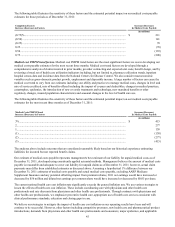

We believe we will collect the principal and interest due on our debt securities with an amortized cost in excess of fair value.

The unrealized losses at December 31, 2011 and 2010 were primarily caused by market interest rate increases and not by

unfavorable changes in the credit standing. We manage our investment portfolio to limit our exposure to any one issuer or

market sector, and largely limit our investments to U.S. government and agency securities; state and municipal securities;

mortgage-backed securities; and corporate debt obligations, substantially all of investment-grade quality. Securities

downgraded below policy minimums after purchase will be disposed of in accordance with our investment policy. Total other-

than-temporary impairments during 2011, 2010 and 2009 were $12 million, $23 million and $64 million, respectively. Our cash

equivalent and investment portfolio has a weighted-average duration of 2.1 years and a weighted-average credit rating of “AA”

as of December 31, 2011. We have minimal securities collateralized by sub-prime or Alt-A securities, and a minimal amount of

commercial mortgage loans in default.

The judgments and estimates related to fair value and other-than-temporary impairment may ultimately prove to be inaccurate

due to many factors including: circumstances may change over time, industry sector and market factors may differ from

expectations and estimates or we may ultimately sell a security we previously intended to hold. Our assessment of the financial