Texas Instruments 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2008 ANNUAL REPORT [ 3 ]

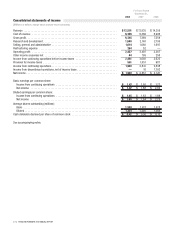

Consolidated statements of comprehensive income

[Millions of dollars]

For Years Ended

December 31,

2008 2007 2006

Income from continuing operations ............................................. $1,920 $2,641 $2,638

Other comprehensive income (loss):

Available-for-sale investments:

Unrealized gains (losses), net of tax benefit (expense) of $20, ($3) and ($2) ......... (38)8 5

Reclassification of recognized transactions, net of tax benefit (expense)

of $0, $0 and $0 ..................................................... — (1) (1)

Net actuarial loss of defined benefit plans:

Annual adjustment, net of tax benefit (expense) of $282 and ($19) ................ (476)5 —

Reclassification of recognized transactions, net of tax benefit (expense)

of ($17) and ($12) .................................................... 32 28 —

Prior service cost of defined benefit plans:

Annual adjustment, net of tax benefit (expense) of $1 and $2 .................... 14 (2) —

Reclassification of recognized transactions, net of tax benefit (expense)

of ($1) and $1 ....................................................... 2 1 —

Minimum pension liability adjustment:

Annual adjustment, net of tax benefit (expense) of $0, $0 and ($33) ............... — —48

Total .................................................................. (466)39 52

Total comprehensive income from continuing operations ............................ 1,454 2,680 2,690

Income from discontinued operations, net of income taxes ........................... — 16 1,703

Total comprehensive income .................................................. $1,454 $2,696 $4,393

See accompanying notes.