Texas Instruments 2008 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2008 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[ 12 ] TEXAS INSTRUMENTS 2008 ANNUAL REPORT

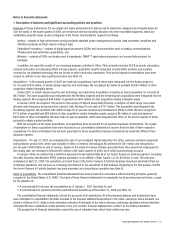

In the fourth quarter of 2008, we recognized $230 million in restructuring charges related to these actions, which included

$121 million for a portion of the actions announced in January 2009 and $109 million for the Wireless actions announced in October

2008. The restructuring costs consisted of $218 million for severance and benefits costs and $12 million related to impairments of

long-lived assets. We also fully impaired $24 million of assets that were held for sale related to a 2007 action discussed below.

As of December 31, 2008, $2 million has been paid for these actions to terminated employees for severance and benefits.

2007 actions

In January 2007, we announced plans to change how we develop advanced digital manufacturing process technology. Instead of

separately creating our own core process technology, we work collaboratively with our foundry partners to specify and drive the next

generations of digital process technology. Additionally, we stopped production at an older digital factory. These actions are complete and

as a result, about 300 jobs were eliminated by year-end 2007.

Operating profit for 2007 included a charge of $52 million related to these actions, which consisted of severance and benefits costs

of $31 million and acceleration of depreciation on the impacted facilities’ assets of $21 million. These amounts have been reclassified

from cost of revenue ($37 million), R&D ($14 million) and SG&A ($1 million) to the restructuring expense line on the income statement to

conform to the 2008 presentation.

As of December 31, 2008, $19 million has been paid for these actions to terminated employees for severance and benefits.

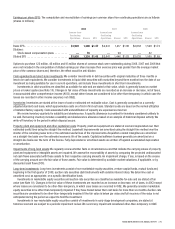

3. Stock-based compensation

2008 2007 2006

Stock-based compensation expense recognized:

Cost of revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $41 $53 $64

Research and development ......................................................... 62 83 101

Selling, general and administrative ................................................... 110 144 167

Total .......................................................................... $213 $280 $332

These amounts include expense related to non-qualified stock options, RSUs and to stock options offered under our employee stock

purchase plan.

We issue awards of non-qualified stock options generally with graded vesting provisions (e.g., 25 percent per year for four years). In

such cases, we recognize the related compensation cost on a straight-line basis over the minimum service period required for vesting

of the award. For awards to employees who are retirement eligible or nearing retirement eligibility, we recognize compensation cost

on a straight-line basis over the longer of the service period required to be performed by the employee in order to earn the award, or a

six-month period.

We also issue RSUs, which generally vest four years after the date of grant. In such cases, we recognize the related compensation

costs on a straight-line basis over the vesting period.

Fair value assumptions:

We estimated the fair values for non-qualified stock options using the Black-Scholes option-pricing model with the following weighted-

average assumptions:

Long-term plans (a) 2008 2007 2006

Weighted average grant date fair value, per share ................................. $ 8.86$ 9.72 $ 11.82

Weighted average assumptions used:

Expected volatility ...................................................... 31%28%34%

Expected lives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.7 yrs 5.6 yrs 5.0 yrs

Risk-free interest rates .................................................. 3.01%4.73%4.50%

Expected dividend yields ................................................. 1.34%0.57%0.37%

(a) Includes stock options under the long-term incentive plans and the director plans.