Texas Instruments 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2008 ANNUAL REPORT [ 13 ]

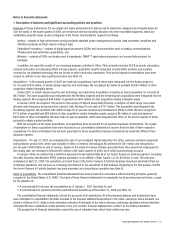

We determine expected volatility on all options granted after July 1, 2005, using available implied volatility rates rather than on an

analysis of historical volatility. We believe that market-based measures of implied volatility are currently the best available indicators of

the expected volatility used in these estimates.

We determine expected lives of options based on the historical share option exercise experience of our optionees using a rolling

10-year average. We believe the historical experience method is the best estimate of future exercise patterns currently available.

Risk-free interest rates are determined using the implied yield currently available for zero-coupon U.S. government issues with a

remaining term equal to the expected life of the options.

Expected dividend yields are based on the approved annual dividend rate in effect and the current market price of our common

stock at the time of grant. No assumption for a future dividend rate change has been included unless there is an approved plan to

change the dividend in the near term.

The fair value per share of RSUs that we grant is determined based on the market price of our common stock on the date of grant.

The TI Employees 2005 Stock Purchase Plan is a discount-purchase plan and consequently, the Black-Scholes option pricing model is

not used to determine the fair value per share of these awards. The fair value per share under this plan equals the amount of the discount.

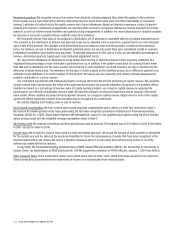

Long-term incentive and director compensation plans

We have stock options outstanding to participants under the Texas Instruments 2000 Long-Term Incentive Plan, the Texas Instruments

2003 Long-Term Incentive Plan and the Texas Instruments 1996 Long-Term Incentive Plan. No further options may be granted under the

1996 plan. We also assumed stock options granted under the Burr-Brown 1993 Stock Incentive Plan and the Radia Communications,

Inc. 2000 Stock Option/Stock Issuance Plan. Unless the options are acquisition-related replacement options, the option price per share

may not be less than 100 percent of the fair market value of our common stock on the date of the grant. Substantially all the options

have a 10-year term and vest ratably over four years. Our options generally continue to vest after the option recipient retires.

We have RSUs outstanding under the 2000 Long-Term Incentive Plan and the 2003 Long-Term Incentive Plan. Each RSU represents

the right to receive one share of TI common stock on the vesting date, which is generally four years after the date of grant. Upon vesting,

the shares are issued without payment by the grantee. RSUs generally do not continue to vest after the recipient’s retirement date.

Under the 2000 Long-Term Incentive Plan, we may grant stock options, including incentive stock options, restricted stock and RSUs,

performance units and other stock-based awards. The plan provides for the issuance of 120,000,000 shares of TI common stock. In

addition, if any stock-based award under the 1996 Long-Term Incentive Plan terminates, any unissued shares subject to the terminated

award become available for grant under the 2000 Long-Term Incentive Plan. No more than 13,400,000 shares of common stock may be

awarded as restricted stock, RSUs or other stock-based awards (other than stock options) under the plan.

Under the 2003 Long-Term Incentive Plan, we may grant stock options (other than incentive stock options), restricted stock

and RSUs, performance units and other stock-based awards to non-management employees. The plan provides for the issuance of

240,000,000 shares of TI common stock. Executive officers and approximately 200 managers are ineligible to receive awards under

this plan.

Under our 2003 Director Compensation Plan, we may grant stock options, RSUs and other stock-based awards to non-employee

directors, as well as issue TI common stock upon the distribution of stock units credited to deferred-compensation accounts established

for such directors. The plan provides for the annual grant of a stock option to each non-employee director from January 2004 through

2010. For the years 2001 through 2006, each grant was an option to purchase 15,000 shares with an option price equal to fair market

value on the date of grant. Effective in 2007, the plan reduced the annual stock option grant to 7,000 shares and included an annual

grant of 2,500 RSUs to each non-employee director. Under the plan, we also make a one-time grant of 2,000 RSUs to each new non-

employee director of TI. The plan provides for the issuance of 2,000,000 shares of TI common stock.

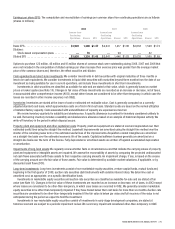

Stock option and RSU transactions under the above-mentioned long-term incentive and director compensation plans (including

assumed stock options granted under the Burr-Brown and Radia Communications, Inc. plans) during 2008 were as follows:

Stock Options Restricted Stock Units

Shares

Weighted

Average Exercise

Price per Share Shares

Weighted

Average Grant-Date

Fair Value per Share

Outstanding grants, December 31, 2007 ............. 185,967,331 $ 30.78 7,711,407 $28.75

Granted ..................................... 8,490,032 29.72 3,609,689 29.09

Vested (RSUs) ................................ — — (628,500)32.05

Forfeited .................................... (3,286,978)35.35 (341,872)30.05

Exercised .................................... (8,705,307)17.25 — —

Outstanding grants, December 31, 2008 ........... 182,465,078 $31.29 10,350,724 $ 28.63