Texas Instruments 2008 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2008 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2008 ANNUAL REPORT [ 11 ]

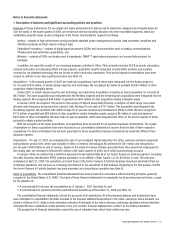

In December 2007, the FASB concurrently issued SFAS No. 141(R), Business Combinations, and SFAS No. 160, Noncontrolling

Interests in Consolidated Financial Statements - an Amendment of ARB No. 51. SFAS 141(R) provides new guidance on the recognition,

measurement and subsequent accounting for assets acquired and liabilities assumed in business combination transactions. In addition,

SFAS 141(R) changes the accounting treatment for certain items in business combinations, including, for example, expensing acquisition-

related costs, recording acquired contingent liabilities/assets at their acquisition-date fair value and capitalization of in-process R&D

costs. If an entity owns less than a 100 percent ownership interest, SFAS 160 provides for the recognition, measurement and subsequent

accounting for non-controlling (i.e., minority) interests included in an entity’s consolidated financial statements. Both of these standards

require measurements based on fair value as determined under the provisions of SFAS 157. In addition, both of these standards include

expanded disclosure requirements. They are effective prospectively for us for transactions occurring on or after January 1, 2009. The

impact that adoption of SFAS 141(R) and SFAS 160 will have on our financial condition and results of operations will depend on the

specific terms of any applicable future transactions.

In November 2008, the FASB ratified EITF Issue No. 08-6, Equity Method Investment Accounting Considerations. EITF 08-6 resolves

several accounting issues that have arisen with the issuance of SFAS 141(R) in applying the equity method of accounting, such as how

to determine the initial carrying value after an acquisition and how to assess an impairment in value of the underlying assets of an equity

method investment. This EITF will be effective for us beginning January 1, 2009, consistent with the effective date of SFAS 141(R) and

SFAS 160. We are currently evaluating the potential impact this standard will have on our financial condition and results of operations.

In November 2008, the FASB ratified EITF Issue No. 08-7, Accounting for Defensive Intangible Assets. EITF 08-7 provides guidance

on how to account for intangible assets acquired in a business combination, in situations when the acquirer does not intend to actively

use the assets but intends to hold (or lock up) the assets to prevent competitors from obtaining access to the assets. These are referred

to as “defensive intangible assets.” This EITF will be effective for defensive intangible assets acquired by us beginning January 1, 2009,

consistent with the effective date of SFAS 141(R). The impact that adoption of this EITF will have on our financial condition and results of

operations will depend on the specific terms of any applicable future business combinations.

In December 2008, the FASB issued FSP FAS 132(R)-1, Employers’ Disclosures about Postretirement Benefit Plan Assets. This FSP

provides guidance on an employer’s disclosures about plan assets of a defined benefit pension or other postretirement plan, including

disclosures about investment policies and strategies, categories of plan assets, fair value measurements of plan assets and significant

concentrations of risk. These disclosures will be required for fiscal years ending after December 15, 2009. There will be no impact to

our financial condition or results of operations from the adoption of this FSP.

2. Restructuring activities

We record severance-related expenses in accordance with the provisions of SFAS No. 112, Employer’s Accounting for Post-Employment

Benefits; SFAS No. 146, Accounting for Costs Associated with Exit or Disposal Activities and SFAS No. 88, Employers’ Accounting for

Settlements and Curtailments of Defined Benefit Pension Plans and for Termination Benefits. The determination of when we accrue for

involuntary severance costs and which standard applies depends on whether the termination benefits are provided under an ongoing

benefit arrangement as described in SFAS 112 or under a one-time benefit arrangement as defined by SFAS 146. We record involuntary

severance-related expenses related to an ongoing benefit arrangement in accordance with the provisions of SFAS No. 112 once they are

probable and the amounts are estimable. One-time, involuntary termination benefits are recorded under the provisions of SFAS No. 146

when the benefits have been communicated to employees. Voluntary termination benefits are accounted for under the provisions of

SFAS No. 88 and are recorded when the employee accepts the offered benefit arrangement.

When the decision to commit to a restructuring plan requires an asset impairment review, we evaluate such impairment issues

under the provisions of SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets. Because the impairment is a

direct result of the restructuring, the impairment amount is included in the restructuring expense line item in the income statement and

is recorded as an adjustment of the basis of the asset, not as a liability relating to a restructuring charge. When we commit to a plan to

abandon a long-lived asset before the end of its previously estimated useful life, we accelerate the recognition of depreciation to reflect

the use of the asset over its shortened useful life. When an asset is to be sold, we write the carrying value down to its net realizable

value and cease depreciation.

2008 and 2009 actions

In October 2008, we announced actions that, when complete, will reduce annualized expenses by more than $200 million in our

Wireless segment, especially our cellular baseband operation. About 650 jobs are expected to be eliminated. The total restructuring

charges related to this action will be approximately $110 million and are expected to be complete by June 2009.

In January 2009 we announced actions that include employment reductions to align our spending with demand that has weakened

in the slowing economy. Our employment will be reduced 12 percent through 1,800 layoffs and 1,600 voluntary retirements and

departures. The total restructuring charges for this action will be about $300 million and will continue through the third quarter of 2009.

Combined with the Wireless actions described above, our annualized costs will be reduced by more than $700 million.