Texas Instruments 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[ 10 ] TEXAS INSTRUMENTS 2008 ANNUAL REPORT

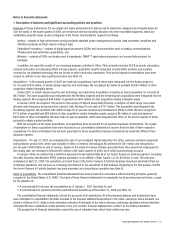

Investments in venture capital funds, consisting of limited partnership interests, are accounted for under the equity method of

accounting where we have more than a 3 percent limited partnership interest, and under the cost method of accounting where our

limited partnership interest is less than 3 percent. For our investments accounted for under the equity method, our proportionate share

of the net income or loss of the limited partnerships is recorded in OI&E. Investments in venture capital funds are subject to a periodic

impairment review. We record any impairment considered other-than-temporary in OI&E.

Investments in mutual funds are classified as trading securities and stated at fair value. These mutual funds hold a variety of debt

and equity investments and are intended to generate returns that offset changes in certain liabilities related to deferred compensation

arrangements. We record adjustments to fair value of both the mutual funds and the related deferred compensation liabilities in selling,

general and administrative (SG&A) expense (see Note 12 for a discussion of deferred compensation arrangements).

Goodwill and intangible assets: Goodwill is not amortized but is reviewed for impairment annually or more frequently if certain

impairment indicators arise. We complete our annual goodwill impairment tests as of October 1 for our reporting units. The test

compares the fair value for each reporting unit to its associated book value including goodwill. With the change in our segment reporting

structure, existing goodwill included in our former Semiconductor segment was allocated to the applicable reporting units and tested for

impairment (see Note 11).

We amortize intangible assets on a straight-line basis over their estimated lives, and write off fully amortized intangible assets

against accumulated amortization.

Foreign currency: The functional currency for our non-U.S. subsidiaries is the U.S. dollar. Accounts recorded in currencies other than

the U.S. dollar are remeasured into the functional currency. Current assets (except inventories), deferred income taxes, other assets,

current liabilities and long-term liabilities are remeasured at exchange rates in effect at the end of each reporting period. Inventories,

and property, plant and equipment and depreciation thereon, are remeasured at historic exchange rates. Revenue and expense accounts

other than depreciation for each month are remeasured at the appropriate daily rate of exchange. Net currency exchange gains and

losses from remeasurement are credited or charged to OI&E.

Derivatives: We use derivative financial instruments to manage exposure to foreign exchange risk. We do not apply hedge accounting to

our foreign currency derivative instruments. These instruments are primarily forward foreign currency exchange contracts that are used

as economic hedges to reduce the adverse earnings impact exchange rate fluctuations may have on our non-U.S. dollar net balance

sheet exposures or for specified non-U.S. dollar forecasted transactions. Gains and losses from changes in the fair value of these

forward foreign currency exchange contracts are credited or charged to OI&E.

We do not use derivatives for speculative or trading purposes.

Changes in accounting standards: In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements, which provides

guidance on how to measure assets and liabilities recorded at fair value. SFAS 157 does not expand the use of fair value to any

new circumstances, but does require additional disclosure in annual and quarterly reports. We adopted SFAS 157 and its related

amendments for financial assets and liabilities as of January 1, 2008 (see Note 10). SFAS 157 is effective for non-financial assets and

liabilities for us beginning January 1, 2009. We have evaluated the non-financial assets and liabilities portion of the standard and expect

it will have no significant impact on our financial condition or results of operations.

In October 2008, the FASB issued FASB Staff Position (FSP) FAS 157-3, Determining the Fair Value of a Financial Asset When the

Market for That Asset Is Not Active, which clarifies how companies should apply the fair value measurement methodologies of SFAS 157

to financial assets whose markets are illiquid or inactive. Under this FSP, companies may use their own assumptions about future cash

flows and risk-adjusted discount rates when relevant observable inputs are either unavailable or based solely on transaction prices that

reflect forced liquidations or distressed sales. This FSP was effective as of September 30, 2008. There was no impact to our financial

condition or results of operations from the adoption of this FSP.

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and Hedging Activities – An Amendment of

FASB Statement No. 133. This standard applies to derivative instruments, nonderivative instruments that are designated and qualify as

hedging instruments and related hedged items accounted for under SFAS 133. SFAS 161 does not change the accounting for derivatives

and hedging activities, but requires enhanced disclosure concerning the effect on the financial statements from their use. SFAS 161

is effective for us beginning January 1, 2009. Given our limited use of derivatives, we do not expect our disclosures about the use of

derivatives to be significantly impacted by this standard.

In June 2008, the FASB issued FSP EITF 03-6-1, Determining Whether Instruments Granted in Share-Based Payment Transactions

Are Participating Securities. Under this standard, unvested awards of share-based payments with rights to receive dividends or dividend

equivalents, such as our restricted stock units (RSUs), are considered participating securities for purposes of calculating EPS as disclosed

in the income statement. This FSP is effective for us beginning January 1, 2009. All prior period EPS data presented in financial reports

after the effective date shall be adjusted retrospectively to conform with this FSP. Early application is not permitted. We have evaluated the

potential impact of this standard and determined it will result in insignificant adjustments to previously reported EPS amounts.