Texas Instruments 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2008 ANNUAL REPORT [ 9 ]

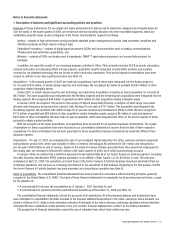

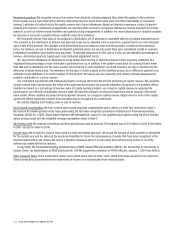

Earnings per share (EPS): The computation and reconciliation of earnings per common share from continuing operations are as follows

(shares in millions):

2008 2007 2006

Income from

Continuing

Operations Shares EPS

Income from

Continuing

Operations Shares EPS

Income from

Continuing

Operations Shares EPS

Basic EPS .............................. $1,920 1,308 $1.47 $2,641 1,417 $1.86 $2,638 1,528 $1.73

Dilutives:

Stock-based compensation plans ......... — 16 — 29 — 32

Diluted EPS ............................. $1,920 1,324 $1.45 $2,641 1,446 $1.83 $2,638 1,560 $1.69

Options to purchase 123 million, 46 million and 93 million shares of common stock were outstanding during 2008, 2007 and 2006 that

were not included in the computation of diluted earnings per share because their exercise price was greater than the average market

price of the common shares and, therefore, the effect would be anti-dilutive.

Cash equivalents and short-term investments: We consider investments in debt securities with original maturities of three months or

less to be cash equivalents. We consider investments in liquid debt securities with maturities beyond three months from the date of our

investment as being available for use in current operations, and include these investments in short-term investments.

Investments in debt securities are classified as available for sale and are stated at fair value, which is generally based on market

prices or broker quotes (see Note 10). Changes in fair value of these investments are recorded as an increase or decrease, net of taxes,

in accumulated other comprehensive income (AOCI), except where losses are considered to be other-than-temporary, in which case the

losses are recorded in other income (expense) net (OI&E).

Inventories: Inventories are stated at the lower of cost or estimated net realizable value. Cost is generally computed on a currently

adjusted standard cost basis, which approximates costs on a first-in first-out basis. Standard costs are based on the normal utilization

of installed factory capacity. Costs associated with underutilization of capacity are expensed as incurred.

We review inventory quarterly for salability and obsolescence. A specific allowance is provided for inventory considered unlikely to

be sold. Remaining inventory includes a salability and obsolescence allowance based on an analysis of historical disposal activity. We

write-off inventory in the period in which disposal occurs.

Property, plant and equipment and other capitalized costs: Property, plant and equipment are stated at cost and depreciated over their

estimated useful lives using the straight-line method. Leasehold improvements are amortized using the straight-line method over the

shorter of the remaining lease term or the estimated useful lives of the improvements. Acquisition-related intangibles are amortized

on a straight-line basis over the estimated economic life of the assets. Capitalized software licenses generally are amortized on a

straight-line basis over the term of the license. Fully depreciated or amortized assets are written off against accumulated depreciation

or amortization.

Impairments of long-lived assets: We regularly review whether facts or circumstances exist that indicate the carrying values of property,

plant and equipment or intangible assets are impaired. We assess the recoverability of assets by comparing the projected undiscounted

net cash flows associated with those assets to their respective carrying amounts. An impairment charge, if any, is based on the excess

of the carrying amount over the fair value of those assets. Fair value is determined by available market valuations, if applicable, or by

discounted cash flows (DCF).

Long-term investments: Long-term investments consist of non-marketable equity securities, venture capital funds, mutual funds and,

beginning in the first quarter of 2008, auction-rate securities (debt instruments with variable interest rates). We determine cost or

amortized cost, as appropriate, on a specific identification basis.

Investments in marketable equity securities and auction-rate securities are classified as available-for-sale and are stated at fair

value (see Note 10). Changes in the fair value of these investments are recorded as an increase or decrease, net of taxes, in AOCI except

where losses are considered to be other-than-temporary, in which case losses are recorded in OI&E. We generally consider marketable

equity securities to be other-than-temporarily impaired if they have traded below their cost basis for more than six months. Auction-rate

securities are considered to be other-than-temporarily impaired if the fair value is below par value and full recovery of the value is not

anticipated during the period we expect to hold the investment.

Investments in non-marketable equity securities consist of investments in early stage development companies, are stated at

historical cost and are subject to a periodic impairment review. We record any impairment considered other-than-temporary in OI&E.