Texas Instruments 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[ 8 ] TEXAS INSTRUMENTS 2008 ANNUAL REPORT

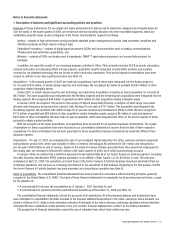

Revenue recognition: We recognize revenue from sales of our products, including shipping fees, when title passes to the customer,

which usually occurs upon shipment or delivery, depending upon the terms of the sales order and when collectibility is reasonably

assured. Estimates of product returns for quality reasons and of price allowances (based on historical experience, product shipment

analysis and customer contractual arrangements) are recorded when revenue is recognized. Allowances include discounts for prompt

payment, as well as volume-based incentives and special pricing arrangements. In addition, we record allowances for doubtful accounts

for amounts of accounts receivable that we estimate may not be collected.

We recognize revenue from sales of our products to distributors, net of allowances, consistent with the principles discussed above.

Title transfers to the distributors at delivery and payment is due on our standard commercial terms; payment terms are not contingent

upon resale of the products. We calculate credit allowances based on historical data, current economic conditions and contractual

terms. For instance, we sell to distributors at standard published prices, but we may grant them price adjustment credits in response

to individual competitive opportunities they may have. To estimate allowances for this type of credit, we use statistical percentages of

revenue, determined quarterly, based upon recent historical adjustment trends.

We also provide distributors an allowance to scrap certain slow-moving or obsolete products in their inventory, estimated as a

negotiated fixed percentage of each distributor’s purchases from us. In addition, if we publish a new price for a product that is lower

than that paid by distributors for the same product still remaining in each distributor’s on-hand inventory, we may credit them for the

difference between those prices. The allowance for this type of credit is based on the identified product price difference applied to our

estimate of each distributor’s on-hand inventory of that product. We believe we can reasonably and reliably estimate allowances for

credits to distributors in a timely manner.

Our contractual agreements with intellectual property licensees determine the amount and timing of royalty revenue. We recognize

royalty revenue when earned under the terms of the agreements and when we consider realization of payment to be probable. Where

royalties are based on a percentage of licensee sales of royalty-bearing products, we recognize royalty revenue by applying this

percentage to our estimate of applicable licensee sales. We base this estimate on historical experience and an analysis of licensees’

sales results. Where royalties are based on fixed payment amounts, we recognize royalty revenue ratably over the term of the royalty

agreement. Where warranted, revenue from licensees may be recognized on a cash basis.

We include shipping and handling costs in cost of revenue.

Stock-based compensation: We have several stock-based employee compensation plans, which are more fully described in Note 3.

We account for awards granted under those plans using the fair-value recognition provisions of Statement of Financial Accounting

Standards (SFAS) No. 123(R), Share-Based Payment. We estimated fair values for non-qualified stock options using the Black-Scholes

option-pricing model with the weighted-average assumptions listed in Note 3.

Advertising costs: We expense advertising and other promotional costs as incurred. This expense was $123 million in 2008, $194 million

in 2007 and $216 million in 2006.

Income taxes: We account for income taxes using an asset and liability approach. We record the amount of taxes payable or refundable

for the current year and the deferred tax assets and liabilities for future tax consequences of events that have been recognized in the

financial statements or tax returns. We record a valuation allowance when it is more likely than not that some portion or all of the

deferred tax assets will not be realized.

In July 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation (FIN) No. 48, Accounting for Uncertainty in

Income Taxes - an Interpretation of FASB Statement No. 109. We adopted the provisions of FIN 48 effective January 1, 2007 (see Note 5).

Other assessed taxes: Some transactions require us to collect taxes such as sales, value-added and excise taxes from our customers.

These transactions are presented in our statements of income on a net (excluded from revenue) basis.