Texas Instruments 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008

Annual Report

Table of contents

-

Page 1

2008 Annual Report -

Page 2

... India, Eastern Europe and Southeast Asia. We have rapidly expanded our sales teams in these regions and in 2008 opened more than 10 new sales ofï¬ces, including ï¬ve in India, two each in China and Vietnam, and one each in Poland, Russia and Thailand. The pace at which technology transforms lives... -

Page 3

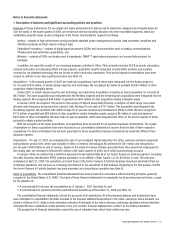

... n n n Description of business and significant accounting policies and practices Restructuring activities Stock-based compensation Profit sharing plans Income taxes Discontinued operations Financial instruments and risk concentration Cash, cash equivalents and short-term investments... -

Page 4

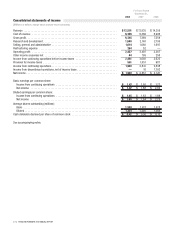

2008 For Years Ended December 31, 2007 2006 Consolidated statements of income [Millions of dollars, except share and per-share amounts] Revenue ...Cost of revenue ...Gross profit ...Research and development ...Selling, general and administrative ...Restructuring expense ...Operating profit ...... -

Page 5

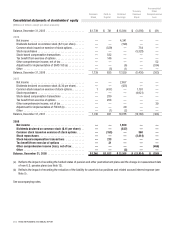

... ($12) ...Prior service cost of defined benefit plans: Annual adjustment, net of tax benefit (expense) of $1 and $2 ...Reclassification of recognized transactions, net of tax benefit (expense) of ($1) and $1 ...Minimum pension liability adjustment: Annual adjustment, net of tax benefit (expense) of... -

Page 6

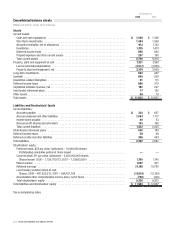

December 31, 2008 2007 Consolidated balance sheets [Millions of dollars, except share amounts] Assets Current assets: Cash and cash equivalents ...Short-term investments ...Accounts receivable, net of allowances ...Inventories ...Deferred income taxes ...Prepaid expenses and other current assets ... -

Page 7

... profit sharing and retirement ...Other ...Net cash provided by operating activities of continuing operations ...Cash flows from investing activities: Additions to property, plant and equipment ...Proceeds from sales of assets ...Purchases of short-term investments ...Sales and maturities of short... -

Page 8

... plans and the change in measurement date of non-U.S. pension plans (see Note 12). (b) Reflects the impact of recording the reduction of the liability for uncertain tax positions and related accrued interest expense (see Note 5). See accompanying notes. [ 6 ] TEXAS INSTRUMENTS 2008 ANNUAL REPORT -

Page 9

..., reduced-instruction set computing (RISC) microprocessors, application-specific integrated circuits (ASIC) products and royalties received for our patented technology that we license to other electronics companies. Prior period segment presentations have been revised to conform to our new reporting... -

Page 10

... of Statement of Financial Accounting Standards (SFAS) No. 123(R), Share-Based Payment. We estimated fair values for non-qualified stock options using the Black-Scholes option-pricing model with the weighted-average assumptions listed in Note 3. Advertising costs: We expense advertising and... -

Page 11

..., plant and equipment and other capitalized costs: Property, plant and equipment are stated at cost and depreciated over their estimated useful lives using the straight-line method. Leasehold improvements are amortized using the straight-line method over the shorter of the remaining lease term or... -

Page 12

..., current liabilities and long-term liabilities are remeasured at exchange rates in effect at the end of each reporting period. Inventories, and property, plant and equipment and depreciation thereon, are remeasured at historic exchange rates. Revenue and expense accounts other than depreciation for... -

Page 13

... SFAS No. 88, Employers' Accounting for Settlements and Curtailments of Defined Benefit Pension Plans and for Termination Benefits. The determination of when we accrue for involuntary severance costs and which standard applies depends on whether the termination benefits are provided under an ongoing... -

Page 14

... under our employee stock purchase plan. We issue awards of non-qualified stock options generally with graded vesting provisions (e.g., 25 percent per year for four years). In such cases, we recognize the related compensation cost on a straight-line basis over the minimum service period required for... -

Page 15

...grant. The TI Employees 2005 Stock Purchase Plan is a discount-purchase plan and consequently, the Black-Scholes option pricing model is not used to determine the fair value per share of these awards. The fair value per share under this plan equals the amount of the discount. Long-term incentive and... -

Page 16

... stock options outstanding under the various long-term plans mentioned above at December 31, 2008, is as follows: Range of Exercise Share Prices Stock Options Outstanding Number Weighted Average Outstanding Remaining Contractual Life (shares) (years) Weighted Average Exercise Price per Share Options... -

Page 17

...million) in 2008, 2007 and 2006. 4. Profit sharing plans Profit sharing benefits are generally formulaic and determined by one or more subsidiary or company-wide financial metrics. We pay profit sharing benefits primarily under the company-wide TI Employee Profit Sharing Plan. This plan provides for... -

Page 18

... retirement costs (defined benefit and retiree health care) ...Other ...Net deferred income tax asset... $ 441 431 294 366 207 53 98 1,890 (2) 1,888 $ 185 369 245 363 159 35 86 1,442 (5) 1,437 (91) (16) (140) (15) (262) $ 1,626 (122) (25) (68) (107) (322) $ 1,115 [ 16 ] TEXAS INSTRUMENTS 2008... -

Page 19

... may occur within the next 12 months resulting from the eventual outcome of the years currently under audit or appeal. However, we do not anticipate any such outcome will result in a significant change to our financial condition or results of operations. TEXAS INSTRUMENTS 2008 ANNUAL REPORT [ 17 ] -

Page 20

... as follows: Accounts Receivable Allowances Balance at Beginning of Year Additions Charged to Operating Results Recoveries and Write-offs, Net Balance at End of Year 2008 ...2007 ...2006 ... $ 26 $ 26 $ 34 $ 7 $ - $ 2 $ (3) $ - $ (10) $ 30 $ 26 $ 26 [ 18 ] TEXAS INSTRUMENTS 2008 ANNUAL REPORT -

Page 21

... gains on cash equivalents and short-term investments for the years ending December 31, 2007 and 2006. Gross unrealized losses were $19 million, $14 million and $23 million, respectively, for these time periods. Unrealized losses for the years ending December 31, 2008 and 2007 were primarily... -

Page 22

...to liquidate our auction-rate investments is likely to be limited for some period of time, we do not believe this will materially impact our ability to fund our working capital needs, capital expenditures, dividend payments or other business requirements. [ 20 ] TEXAS INSTRUMENTS 2008 ANNUAL REPORT -

Page 23

...by level, our financial assets and liabilities that were accounted for at fair value as of December 31, 2008. The table does not include either cash on hand or assets and liabilities that are measured at historical cost or any basis other than fair value. TEXAS INSTRUMENTS 2008 ANNUAL REPORT [ 21 ] -

Page 24

... technology, to be amortized over three to five years. There were no significant in-process R&D charges associated with 2008 or 2007 acquisitions. In 2006 we recorded a $5 million charge for in-process R&D as a result of the acquisition of Chipcon. [ 22 ] TEXAS INSTRUMENTS 2008 ANNUAL REPORT -

Page 25

... these shares for 2008 and 2007 totaled $14 million and $11 million. Our aggregate expense for employees under the U.S. defined contribution plans was $56 million in each of 2008, 2007 and 2006. Benefits under the qualified defined benefit pension plan are determined using a formula based upon years... -

Page 26

... non-qualified plans of $12 million in 2008 and $3 million in 2007. U.S. retiree health care benefit plan: We offer most of our U.S. employees access to group medical coverage during their retirement. We make a contribution toward the cost of those retiree medical benefits for certain retirees and... -

Page 27

... Care Non-U.S. Defined Benefit Total Overfunded retirement plans ...Accrued profit sharing and retirement ...Underfunded retirement plans ...Funded status (FVPA - BO) at end of year ... $ 19 (6) (35) $ (22) $ $ - - (71) (71) $ $ 86 (5) (78) 3 $ 105 (11) (184) $ (90) TEXAS INSTRUMENTS 2008... -

Page 28

... in AOCI as of December 31, 2008, that are expected to be amortized into net periodic benefit cost over the next fiscal year are: $1 million and $17 million for the U.S. defined benefit plans; $2 million and $8 million for the U.S. retiree health care plan; and ($4) million and $43 million for... -

Page 29

... pension assets. The majority of the assets in the retiree health care benefit plan are invested in a series of Voluntary Employee Benefit Association (VEBA) trusts. Weighted average asset allocations at December 31, are as follows: U.S. Defined Benefit 2008 2007 U.S. Retiree Health Care 2008 2007... -

Page 30

...account of participants, as of December 31, 2008, we have a forward purchase contract with a commercial bank to acquire 430,000 shares of TI common stock at a fixed price of $18.85 per share at the end of the contract term or, at our option, to settle in cash with the bank. We can unwind all or part... -

Page 31

...accounted for as operating leases. Lease agreements frequently include purchase and renewal provisions and require us to pay taxes, insurance and maintenance costs. Rental and lease expense incurred was $124 million, $123 million and $125 million in 2008, 2007 and 2006. Capitalized software licenses... -

Page 32

...$ Authorizations for property, plant and equipment expenditures in future years were $136 million at December 31, 2008. Accrued expenses and other liabilities December 31, 2008 2007 Accrued salaries, wages and vacation pay ...Restructuring ...Customer incentive programs and allowances ...Property... -

Page 33

... and movie projectors); RISC microprocessors (designed to provide very fast computing and are often implemented in servers); and, custom semiconductors known as ASICs. Other also includes handheld graphing and scientific calculators and royalties received for our patented technology that we license... -

Page 34

... revenue in 2006; if indirect sales such as to contract manufacturers are included, Nokia accounted for 20 percent, 19 percent and 15 percent of our 2008, 2007 and 2006 revenue. Revenue from sales to Nokia is reflected primarily in our Wireless segment. [ 32 ] TEXAS INSTRUMENTS 2008 ANNUAL REPORT -

Page 35

... financial position of Texas Instruments Incorporated and subsidiaries at December 31, 2008 and 2007, and the consolidated results of their operations and their cash flows for each of the three years in the period ended December 31, 2008, in conformity with U.S. generally accepted accounting... -

Page 36

... reporting is effective based on the COSO criteria. TI's independent registered public accounting firm, Ernst & Young LLP, has issued an audit report on the effectiveness of our internal control over financial reporting, which immediately follows this report. [ 34 ] TEXAS INSTRUMENTS 2008 ANNUAL... -

Page 37

... statements of income, comprehensive income, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2008 and our report dated February 20, 2009 expressed an unqualified opinion thereon. Dallas, Texas February 20, 2009 TEXAS INSTRUMENTS 2008 ANNUAL REPORT... -

Page 38

...... $ 3,330 763 537 2,122 $ 4,407 686 425 4,886 $ 2,456 1,272 199 5,302 $ 3,614 1,288 173 4,151 $ 2,973 1,260 154 753 See Notes to Financial Statements and Management's Discussion and Analysis of Financial Condition and Results of Operations. [ 36 ] TEXAS INSTRUMENTS 2008 ANNUAL REPORT -

Page 39

...are designed to control a set of specific tasks for electronic equipment. Sales of Embedded Processing products accounted for about 15 percent of our revenue in 2008. The worldwide market for embedded processors was about $17 billion in 2008. According to TEXAS INSTRUMENTS 2008 ANNUAL REPORT [ 37 ] -

Page 40

... and operate semiconductor manufacturing sites in North America, Asia and Europe. These facilities include high-volume wafer fabrication plants and assembly/test sites. Our facilities require substantial investment to construct and are largely fixed-cost [ 38 ] TEXAS INSTRUMENTS 2008 ANNUAL REPORT -

Page 41

... jurisdictions and their taxing authorities. As a result, during any particular reporting period, we might reflect in our financial statements one or more tax refunds or assessments, or changes to tax liabilities, involving one or more taxing authorities. TEXAS INSTRUMENTS 2008 ANNUAL REPORT [ 39 ] -

Page 42

... resulting from our efforts to reduce inventory. The decline affected all segments. Last year's gross profit included a $39 million pre-tax gain on the sale of our broadband digital subscriber line (DSL) customer-premises equipment product line. [ 40 ] TEXAS INSTRUMENTS 2008 ANNUAL REPORT -

Page 43

... each segment's results, bear in mind that restructuring charges negatively impacted each segment's operating profit as follows: 2008 2007 Analog...Embedded Processing ...Wireless ...Other ...Total restructuring ... $ 60 24 130 40 $254 $ 18 4 20 10 $ 52 TEXAS INSTRUMENTS 2008 ANNUAL REPORT [ 41 ] -

Page 44

... that we believe we will accomplish by retaining this operation and reducing the investment levels to the minimum required to support our existing customer engagements. See Note 2 to the Financial Statements regarding the associated costs and savings. [ 42 ] TEXAS INSTRUMENTS 2008 ANNUAL REPORT -

Page 45

... of the sale of our DSL customer-premises equipment product line in 2007 and lower royalties. Operating profit for 2008 from Other was $772 million, or 29.3 percent of revenue. This was a decrease of $124 million compared with 2007 due to lower revenue. Prior results of operations 2007 compared with... -

Page 46

... DSL customer premises equipment product line in the third quarter of 2007. Operating profit was $896 million, or 28.7 percent of revenue. This was a decrease of $128 million from 2006 due to lower revenue. Financial condition At the end of 2008, total cash (cash and cash equivalents plus short-term... -

Page 47

... financial condition and that require the most subjective judgment. If actual results differ significantly from management's estimates and projections, there could be a significant effect on our financial statements. Revenue recognition Revenue from sales of our products is recognized upon shipment... -

Page 48

... licensee sales, we recognize royalty revenue upon the sale by the licensee of royaltybearing products, as estimated by us, based on historical experience and analysis of annual sales results of licensees. Estimates are periodically adjusted as a result of reviews of reported results of licensees... -

Page 49

... auction; forward projections of the interest rate benchmarks specified in such formulas; the likely timing of principal repayments; the probability of full repayment considering the guarantees by the U.S. Department of Education of the underlying student loans, guarantees by other third parties... -

Page 50

... results. See Note 9 to the Financial Statements for details of equity and other long-term investments. Quarterly financial data (Millions of dollars, except per-share amounts) Quarter 2008 1st 2nd 3rd 4th Revenue ...Gross profit ...Operating profit ...Net income ...Earnings per common share... -

Page 51

... the high and low closing prices of TI common stock as reported by Bloomberg L.P. and the dividends paid per common share for each quarter during the past two years. Quarter 1st 2nd 3rd 4th Stock prices: 2008 High ...Low...2007 High...Low ...Dividends paid: 2008 ...2007 ... $33.24 27.51 $32.59 28... -

Page 52

... or recalls by TI customers for a product containing a TI part; • TI's ability to recruit and retain skilled personnel; and • Timely implementation of new manufacturing technologies, installation of manufacturing equipment and the ability to obtain needed third-party foundry and assembly/test... -

Page 53

... year ended December 31, 2008. As required by the New York Stock Exchange listing standards, an unqualiï¬ed annual certiï¬cation indicating compliance with the listing standards was signed by TI's Chief Executive Ofï¬cer and submitted on April 29, 2008. OMAP is a trademark of Texas Instruments... -

Page 54

Texas Instruments Incorporated P.O. Box 660199 Dallas, TX 75266-0199 www.ti.com 10% Cert no. An equal opportunity employer © 2009 Texas Instruments Incorporated TI-30001J