Shutterfly 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

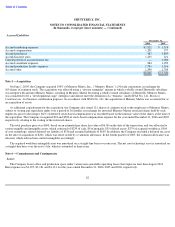

Board and Company’s management at the time of the grant. Following the IPO, the fair value of the Company’s common stock is determined

by the last sale price of such stock on the Nasdaq Global Market. Options issued under the 2006 Plan typically vest with respect to 25% of the

shares one year after the options’ vesting commencement date, and the remainder ratably on a monthly basis over the following three years.

Option holders under the 2006 Plan are allowed to exercise options prior to vesting.

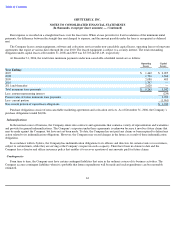

At the time of adoption of the 2006 Plan, there were 1,358 shares of common stock authorized for issuance under the 2006 Plan, plus

93 shares of common stock from the 1999 Plan that were unissued. The 2006 Plan provides for automatic replenishments on January 1 of 2008,

2009, and 2010, of the lesser of a) 4.62% of stock options issued and outstanding on the December 31 immediately prior to the date of increase

or b) a lesser number as determined by the Board.

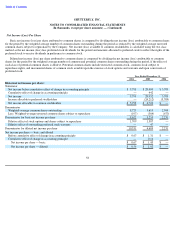

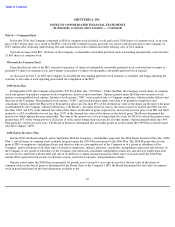

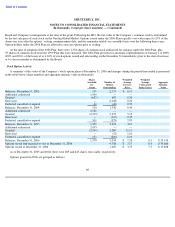

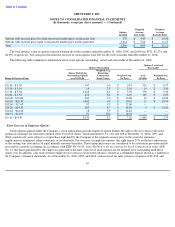

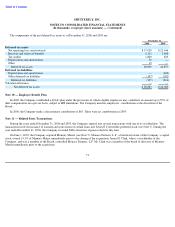

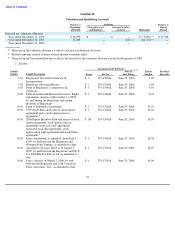

Stock Option Activity

A summary of the status of the Company’

s stock option plans at December 31, 2006 and changes during the period then ended is presented

in the table below (share numbers and aggregate intrinsic value in thousands):

As of December 31, 2005 and 2004, there were 489 and 645 shares exercisable, respectively.

Options granted in 2006 are grouped as follows:

66

Shares

Weighted

Weighted

Available

Number of

Average

Average

Aggregate

for

Options

Exercise

Contractual

Intrinsic

Grant

Outstanding

Price

Term (Years)

Value

Balances, December 31, 2003

155

2,137

$

0.31

Additional authorized

1,000

—

—

Granted

(687

)

687

0.30

Exercised

—

(

1,448

)

0.22

Forfeited, cancelled or expired

42

(40

)

0.50

Balances, December 31, 2004

510

1,336

0.40

Additional authorized

2,720

—

—

Granted

(2,372

)

2,372

5.12

Exercised

—

(

315

)

0.35

Forfeited, cancelled or expired

501

(375

)

2.89

Balances, December 31, 2005

1,359

3,018

3.91

Additional authorized

2,055

—

—

Granted

(2,269

)

2,269

11.11

Exercised

—

(

52

)

1.61

Forfeited, cancelled or expired

233

(201

)

6.10

Balances, December 31, 2006

1,378

5,034

$

7.28

8.5

$

35,914

Options vested and expected to vest at December 31, 2006

4,788

$

7.17

8.4

$

34,666

Options vested at December 31, 2006

1,485

$

3.75

7.3

$

15,808