Shutterfly 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

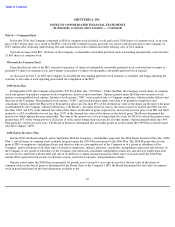

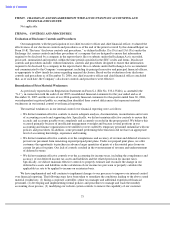

Rent expense is recorded on a straight-line basis over the lease term. When a lease provides for fixed escalations of the minimum rental

payments, the difference between the straight-line rent charged to expense, and the amount payable under the lease is recognized as deferred

rent.

The Company leases certain equipment, software and colocation services under non-cancelable capital leases, operating leases or long-

term

agreements that expire at various dates through the year 2010. The leased equipment is subject to a security interest. The total outstanding

obligation under capital leases at December 31, 2006 and 2005 was $3,703 and $5,149, respectively.

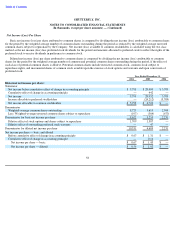

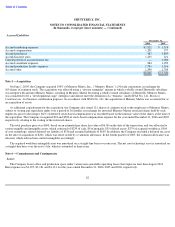

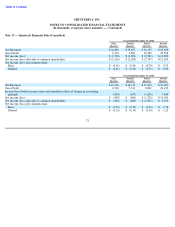

At December 31, 2006, the total future minimum payments under non-cancelable scheduled rentals are as follows:

Purchase obligations consist of non-cancelable marketing agreements and colocation services. As of December 31, 2006, the Company’s

purchase obligations totaled $4,006.

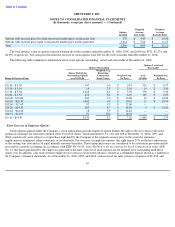

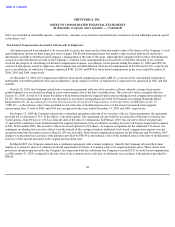

Indemnifications

In the normal course of business, the Company enters into contracts and agreements that contain a variety of representation and warranties

and provide for general indemnifications. The Company’s exposure under these agreements is unknown because it involves future claims that

may be made against the Company, but have not yet been made. To date, the Company has not paid any claims or been required to defend any

action related to its indemnification obligations. However, the Company may record charges in the future as a result of these indemnification

obligations.

In accordance with its bylaws, the Company has indemnification obligations to its officers and directors for certain events or occurrences,

subject to certain limits, while they are serving at the Company’s request in such a capacity. There have been no claims to date and the

Company has a director and officer insurance policy that enables it to recover a portion of any amounts paid for future claims.

Contingencies

From time to time, the Company may have certain contingent liabilities that arise in the ordinary course of its business activities. The

Company accrues contingent liabilities when it is probable that future expenditures will be made and such expenditures can be reasonably

estimated.

63

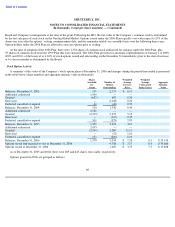

Operating

Capital

Leases

Leases

Year Ending:

2007

$

1,462

$

2,095

2008

1,704

1,364

2009

2,080

483

2010

1,397

—

2011 and thereafter

2,620

—

Total minimum lease payments

$

9,263

3,942

Less: amount representing interest

(239

)

Present value of future minimum lease payments

3,703

Less: current portion

(1,961

)

Non

-

current portion of capital lease obligations

$

1,742