Shutterfly 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

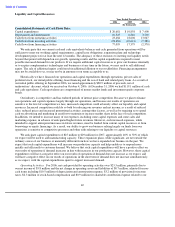

Liquidity and Capital Resources

We anticipate that our current cash and cash equivalents balances and cash generated from operations will be

sufficient to meet our working capital requirements, capital lease obligations, expansion plans and technology

development projects for at least the next 12 months. The adequacy of these resources to meeting our liquidity needs

beyond that period will depend on our growth, operating results and the capital expenditures required to meet

possible increased demand for our products. If we require additional capital resources to grow our business internally

or to acquire complementary technologies and businesses at any time in the future, we may seek to sell additional

equity. The sale of additional equity could result in additional dilution to our stockholders. Financing arrangements

may not be available to us, or may not be in amounts or on terms acceptable to us.

Historically we have financed our operations and capital expenditures through operations, private sales of

preferred stock, our initial public offering, lease financing and the use of bank and related-party loans. As a result of

our initial public offering in September 2006, we raised approximately $80.9 million of proceeds, net of

underwriters’

discount, which we received on October 4, 2006. At December 31, 2006 we had $119.1 million of cash

and cash equivalents. Cash equivalents are compromised of money market funds and investment-grade corporate

bonds.

Our industry is competitive and has endured periods of intense price competition. Because we plan to finance

our operations and capital expenses largely through our operations, and because our results of operations are

sensitive to the level of competition we face, increased competition could adversely affect our liquidity and capital

resources. Increased competition could do so both by reducing our revenues and net income, as a result of reduced

sales, reduced prices and increased promotional activities, among other factors, as well as by requiring us to spend

cash on advertising and marketing in an effort to maintain or increase market share in the face of such competition.

In addition, we intend to increase many of our expenses, including some capital expenses and some sales and

marketing expense, in advance of anticipated higher future revenues. However, such increased expenses, while

intended to support anticipated increases in future revenues, must be funded from current capital resources or from

borrowings or equity financings. As a result, our ability to grow our business relying largely on funds from our

operations is sensitive to competitive pressures and other risks relating to our liquidity or capital resources.

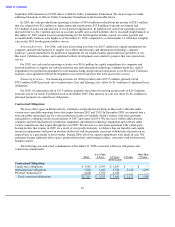

We anticipate capital expenditures of $25 million to $29 million for 2007, approximately 40% to 50% of which

we expect will be used to add manufacturing capacity. These expansion plans, while significant, are not outside the

ordinary course of our business or materially different from how we have expanded our business in the past. We

expect that such capital expenditures will increase our production capacity and help enable us to respond more

quickly and efficiently to customer demand. We believe that such capital expenditures will have a positive effect on

our results of operations if demand increases in line with increases in our production capacity. However, these capital

expenditures will have a negative effect on our results of operations if demand does not increase as we expect, and

will have a negative effect on our results of operations in the short term if demand does not increase simultaneously,

as we expect, with the capital expenditures spent to support increased demand.

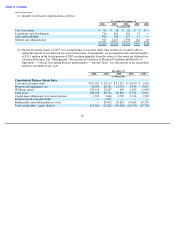

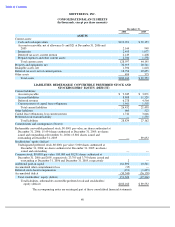

Operating Activities. For 2006, net cash provided by operating activities was $23.5 million, primarily due to

our net income of $5.8 million and the net change in operating assets and liabilities of $0.7 million, adjusted for non-

cash items including $10.5 million of depreciation and amortization expense, $3.2 million of provision for income

taxes, $2.3 million of stock-based compensation and $0.9 million for charitable contribution expense related to our

42

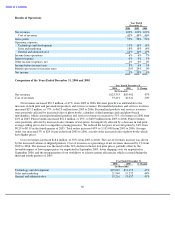

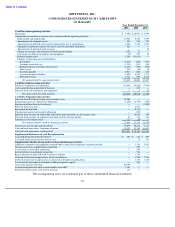

Year Ended December 31,

2006

2005

2004

(In thousands)

Consolidated Statements of Cash Flows Data:

Capital expenditures

$

20,681

$

10,858

$

7,400

Depreciation and amortization

10,525

6,246

3,769

Cash flows from operating activities

23,484

18,606

13,067

Cash flows from investing activities

(20,681

)

(10,613

)

(7,386

)

Cash flows from financing activities

77,095

17,379

(2,570

)