Shutterfly 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

incur additional legal and accounting costs in order to comply with regulatory reporting requirements and the

Sarbanes-Oxley Act of 2002, as well as additional costs such as investor relations and higher insurance premiums.

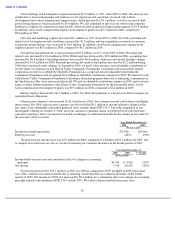

Interest Expense. Interest expense consists of interest costs recognized under our capital lease obligations and

for borrowed money.

Other Income (Expense), Net.

Other income (expense), net consists primarily of the interest income on our cash

accounts and the net income (expense) related to changes in the fair value of our convertible preferred stock warrants

under FASB Staff Position, or FSP 150-5, “Issuer’s Accounting under FASB Statement No. 150 for Freestanding

Warrants and Other Similar Instruments on Shares That Are Redeemable” adopted in July 2005. Under FSP

150-5, the warrants were subject to re-measurement at each balance sheet date, and changes in fair value were

recognized as a component of other income (expense), net. Subsequent to the completion of our initial public

offering on October 4, 2006, all of our warrants to purchase shares of preferred stock converted into warrants to

purchase shares of common stock. Accordingly, the liability for the convertible preferred stock warrants was

reclassified as common stock and additional paid-in capital and the warrants are no longer subject to re-

measurement.

Income Taxes. Provision for income taxes depends on the statutory rate in the countries where we sell our

products. Historically, we have only been subject to taxation in the United States because we have sold almost all of

our products to customers in the United States. If we continue to sell our products primarily to customers located

within the United States, we anticipate that our long-term future effective tax rate will be between 38% and 45%,

without taking into account the use of any of our net operating loss carryforwards. However, we anticipate that in the

future we may further expand our sale of products to customers located outside of the United States, in which case

we would become subject to taxation based on the foreign statutory rates in the countries where these sales took

place and our effective tax rate could fluctuate accordingly.

Our fiscal year end for federal and state tax purposes is September 30. As our fiscal year for financial reporting

purposes is December 31, we plan on changing our fiscal year end for federal and state tax purposes to December 31

by filing short-period income tax returns for federal and state purposes covering October 1, 2006 through

December 31, 2006. We do not expect this will have a material impact on our income tax provision. As of

December 31, 2006, for federal and state tax purposes, we had approximately $43 million of federal and $41 million

of state net operating loss carryforwards available to reduce future taxable income. These net operating loss

carryforwards begin to expire in 2020 and 2008 for federal and state tax purposes, respectively.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with accounting principles generally accepted

in the United States, or GAAP. The preparation of these consolidated financial statements requires us to make

estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, costs and expenses and

related disclosures. We base our estimates on historical experience and on various other assumptions that we believe

to be reasonable under the circumstances. In many instances, we could have reasonably used different accounting

estimates, and in other instances, changes in the accounting estimates are reasonably likely to occur from period to

period. Accordingly, actual results could differ significantly from the estimates made by our management. To the

extent that there are material differences between these estimates and actual results, our future financial statement

presentation of our financial condition or results of operations will be affected.

In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP and does

not require management’s judgment in its application, while in other cases, management’s judgment is required in

selecting among available alternative accounting standards that allow different accounting treatment for similar

transactions. We believe that the accounting policies discussed below are the most critical to understanding our

historical and future performance, as these policies relate to the more significant areas involving management’s

judgments and estimates.

Revenue Recognition. We generate revenues primarily from the printing and shipping of prints, photo-based

products, such as photo books, cards and calendars, photo-based merchandise, such as mugs, mouse pads and

magnets, and ancillary products such as frames, photo albums and scrapbooking accessories. We generally

36