Shutterfly 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

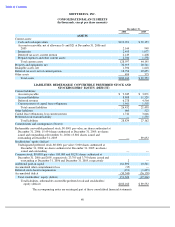

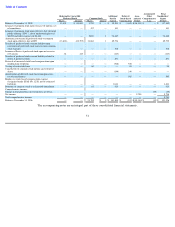

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

transferred to common stock and additional paid-in-capital and the common stock warrants are no longer subject to

re-measurement.

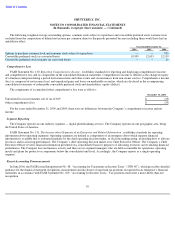

Revenue Recognition

The Company generally recognizes revenue from product sales upon shipment when persuasive evidence of an

arrangement exists, the selling price is fixed or determinable and collection of resulting receivables is reasonably

assured. Revenues from amounts billed to customers, including prepaid orders, are deferred until shipment of

fulfilled orders.

The Company provides its customers with a 100% satisfaction guarantee whereby products can be returned

within a 30-day period for a reprint or refund. The Company maintains an allowance for estimated future returns

based on historical data. The provision for estimated returns is included in accrued liabilities. During the years ended

December 31, 2006, 2005 and 2004, returns totaled less than 1% of net revenues and have been within management’

s

expectations.

The Company periodically provides incentive offers to its customers in exchange for setting up an account and

to encourage purchases. Such offers include free products and percentage discounts on current purchases. Discounts,

when accepted by customers, are treated as a reduction to the purchase price of the related transaction and are

presented in net revenues. Production costs related to free products are included in cost of revenues upon redemption.

Shipping charged to customers is recognized as revenue.

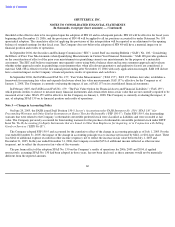

Cost of Revenues

Cost of revenues consist primarily of direct materials, the majority of which consists of paper, payroll and

related expenses for direct labor, shipping charges, packaging supplies, distribution and fulfillment activities, rent for

production facilities, depreciation of production equipment and third-party costs for photo-based merchandise. Cost

of revenues also includes payroll and related expenses for personnel engaged in customer service. In addition, cost of

revenues includes any third-party software or patents licensed, as well as the amortization of capitalized website

development costs.

Technology and Development Expense

Technology and development expense consists primarily of payroll and related expenses for the development

and ongoing maintenance of the Company’s website, infrastructure and software. These expenses include

depreciation of the computer and network hardware used to run the Company’s website and store the customer data

that the Company maintains, as well as amortization of purchased software. Technology and development expense

also includes colocation and bandwidth costs. Technology and development costs are charged to operations as

incurred.

Sales and Marketing Expense

Sales and marketing expense consists of costs incurred for marketing programs and personnel and related

expenses for customer acquisition, product marketing, business development and public relations activities. The

Company’s marketing efforts consist of various online and offline media programs, such as e-mail and direct mail

promotions, the purchase of keyword search terms and various strategic alliances. Fees paid to third parties who

drive new customers to our website are charged to expense as incurred.

56