Shutterfly 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Use of Proceeds

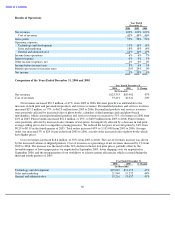

The S-1 relating to our initial public offering was declared effective by the SEC on September 28, 2006

(Registration Statement File No. 333-135426), and the offering commenced the same day. J.P. Morgan Securities

Inc. acted as the sole book-running manager for the offering and Piper Jaffray & Co. and Jefferies & Company, Inc.

acted as co-managers of the offering.

The securities registered were 5,800,000 shares of common stock, plus 870,000 additional shares to cover the

underwriters’ over-allotment option. The underwriters’ over-allotment option expired on October 28, 2006 and was

not exercised by the underwriters. The aggregate public offering price of the offering amount registered, including

shares to cover the underwriters’ over-

allotment option, was $100,050,000. We sold 5,800,000 shares of our common

stock for an aggregate offering price of $87,000,000, and the offering has terminated.

Expenses incurred in connection with the issuance and distribution of the securities registered were as follows:

None of such payments were direct or indirect payments to any of our directors or officers or their associates or

to persons owning 10 percent or more of our common stock or direct or indirect payments to others.

The net offering proceeds to us after deducting underwriters’ discounts and the total expenses described above

was approximately $78.5 million.

Through December 31, 2006, we had not utilized any of the net proceeds from the offering. We intend to use the

net proceeds of the offering for general corporate purposes, including working capital and potential capital

expenditures for manufacturing and website infrastructure equipment and new and existing manufacturing facilities.

We expect our capital expenditures to be between $25 million and $29 million for 2007, which will be funded by a

combination of our cash and cash equivalents, expected cash flows from operations and the net proceeds from the

offering. We expect to spend approximately 40% to 50% of this amount to purchase manufacturing equipment and

on improvements to our new and existing manufacturing facilities, with the remainder to be allocated for the

purchase of website infrastructure equipment. We may also use a portion of the net proceeds for the acquisition of, or

investment in, companies, technologies, products or assets that complement our business.

Our management will retain broad discretion in the allocation and use of the net proceeds of our initial public

offering, and investors will be relying on the judgment of our management regarding the application of the net

proceeds. Pending specific utilization of the net proceeds as described above, we have invested the net proceeds of

the offering in short-term, interest-bearing obligations, investment grade instruments, certificates of deposit or direct

or guaranteed obligations of the United States. The goal with respect to the investment of the net proceeds will be

capital preservation and liquidity so that such funds are readily available to fund our operations.

30

•

Underwriting discounts and commissions

—

$

6,090,000

•

Other expenses

—

$

2,442,000

•

Total expenses

—

$

8,533,000