Shutterfly 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

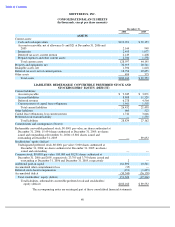

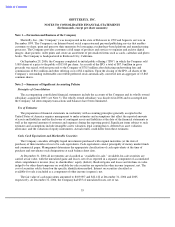

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

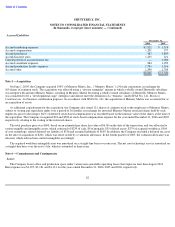

respectively. Capitalized costs are amortized over the useful life, which is generally three years. Amortization of

capitalized costs totaled approximately $993, $404 and $204 for the years ended December 31, 2006, 2005 and 2004,

respectively. Costs associated with minor enhancements and maintenance for the Company’

s website are expensed as

incurred.

Long-Lived Assets

The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate

that the carrying amount of an asset may not be recoverable in accordance with Statement of Financial Accounting

Standards No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets (“SFAS No. 144”).

Recoverability is measured by comparison of the carrying amount to the future net cash flows which the assets are

expected to generate. If such assets are considered to be impaired, the impairment to be recognized is measured by

the amount by which the carrying amount of the assets exceeds the projected discounted future cash flows arising

from the asset using a discount rate determined by management to be commensurate with the risk inherent to the

Company’s current business model.

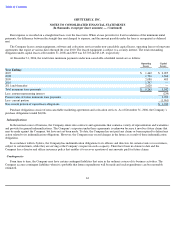

Intangible Assets

The Company accounts for intangible assets in accordance with Statement of Financial Accounting Standards

No. 142,

Goodwill and Other Intangible Assets (“SFAS No. 142”). Goodwill and intangible assets with indefinite

lives are not amortized but are tested for impairment on an annual basis or whenever events or changes in

circumstances indicate that the carrying amount of these assets may not be recoverable. Intangible assets with finite

useful lives are amortized using the straight-line method over their useful lives and are reviewed for impairment in

accordance with SFAS No. 144.

In May 2005, the Company entered into a settlement and license agreement (the “Agreement”) to resolve

litigation brought by a third party with respect to alleged infringement of certain processes under U.S. patents. Under

the terms of the Agreement, the Company agreed to pay a total of $2,000, $1,000 of which was paid in 2005, and the

remaining $1,000 was paid in January 2006. The Agreement provides the Company with a license to the third party’

s

patents, including a non- exclusive, fully paid-up, royalty-free, worldwide license to the patents underlying the

litigation. In conjunction with the agreement, the third party and the Company agreed to a mutual release of claims,

the Company agreed to pay $2,000, of which $379 was recorded as a settlement expense in 2004 for the alleged

patent infringement that occurred during 2002 through 2004 and the remaining $1,621 was recorded as an intangible

asset. The intangible asset is amortized ratably over its estimated life through 2017, the expiration dates of the

patents-in-suit. The Company recorded amortization expense of $126 and $126, in 2006 and 2005, respectively.

Intangible assets related to acquired workforce were amortized on a straight-line basis over the estimated useful

life of one year (Note 5).

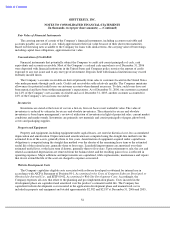

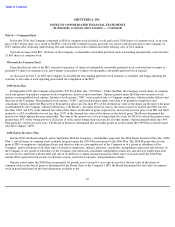

Freestanding Preferred Stock Warrants

Freestanding warrants and other similar instruments related to shares that are redeemable are accounted for in

accordance with Statement of Financial Accounting Standards No. 150, Accounting for Certain Financial

Instruments with Characteristics of Both Liabilities and Equity

(“SFAS No. 150”). Under SFAS No. 150, the

freestanding warrants that were related to the Company’s redeemable convertible preferred stock were recorded as

liabilities on the consolidated balance sheet. The warrants were subject to re-measurement at each balance sheet date

and any change in fair value was recognized as a component of other income (expense), net. Subsequent to the

Company’s IPO and the associated conversion of the Company’s outstanding redeemable convertible preferred stock

to common stock, the warrants to exercise the redeemable convertible preferred stock converted into common stock

warrants; accordingly, the liability related to the redeemable convertible preferred stock warrants was

55