Shutterfly 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

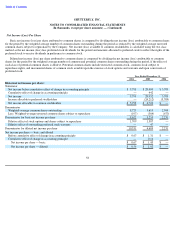

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

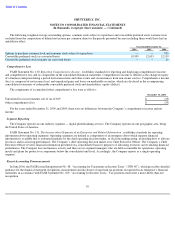

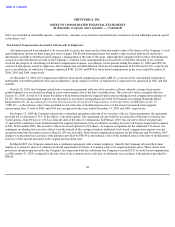

Legal Matters

On August 29, 2006, the Company’s former chief financial officer, Virender Ahluwalia, sued the Company in San Mateo County Superior

Court alleging causes of action for reformation of contract, breach of contract and breach of fiduciary duty. The plaintiff claims that he is

entitled to exercise stock options for 16 shares of the Company’s common stock because his vesting schedule should be deemed to have started

one year earlier than contractually agreed. In addition, plaintiff claims that withholding taxes were not due at the time of exercise of his

nonqualified stock options to purchase 277 shares of the Company’s common stock in 2005. Plaintiff claims that, because the Company

required that he make provision for the applicable withholding taxes at the time of exercise of such options, he was damaged by having to

immediately sell a portion of those shares upon his exercise in order to raise the funds necessary to pay applicable withholding taxes. The

plaintiff is seeking compensatory and punitive damages. The Company disputes the plaintiff’s claims, believes that it has meritorious defenses

and intends to vigorously defend this action. At this time, the Company does not believe that the amount of potential loss is reasonably

estimable.

From time to time, the Company may be involved in various legal proceedings arising in the ordinary course of business. At December 31,

2006, in the opinion of management, there are no other matters that are expected to have a material adverse effect on the Company’s financial

position, results of operations or cash flows.

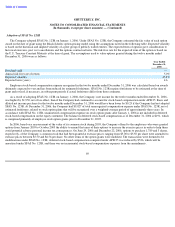

Note 7 — Loan Payable

In February 2003, the Company received a $2,500 loan from a stockholder to finance working capital. The loan was repayable

commencing March 2004, based on a 36-month repayment schedule. Any remaining outstanding balance was due and immediately payable at

the end of February 2006. The loan bore an annual interest rate of 5% above the Prime Rate, as published in the Wall Street Journal, and not to

exceed 12%. The Prime Rate was adjusted on a monthly basis. The Company granted the lender a continuing security interest in all of its

assets. The loan agreement provided for certain financial and non-

financial covenants, the breach of which could have resulted in an increase in

the interest rate or the loan being immediately callable.

In connection with this loan, the Company issued warrants to purchase 138 and 113 shares of Series D and E convertible preferred stock,

respectively. The warrants each had an exercise price of $0.615 per share. The fair value of the warrants was estimated at an aggregate of $115

using the Black-Scholes valuation model with the following assumptions: expected volatility of 70%, risk free interest rate of 4.24%, expected

life of 10 years and no dividends. The fair value of the warrants was recorded as a discount to the loan and was amortized to interest expense

using the effective interest rate method over the loan term. The Company repaid the entire amount of the loan during 2004. A total of $83 was

recognized as interest expense during the period ended December 31, 2004. The warrants were fully exercised in 2004.

In August 2005, the Company entered into a $7,000 term loan agreement with Silicon Valley Bank to finance equipment purchases. The

loan was repayable commencing September 2005, based on a 36-month repayment schedule. Any remaining outstanding balance would have

been due and immediately payable at the beginning of August 2008. The loan bore an annual interest rate on the outstanding principal amount

from the date when made until paid in full at a rate per annum equal to the Prime Rate plus the Applicable Term Margin. The Applicable Term

Margin was based on the Cash Flow Leverage Ratio, and ranged from 0.50% to 1.0%. The loan agreement provided for certain financial and

non-financial covenants, the breach of which could have resulted in an increased interest rate or the loan being immediately callable.

The Company borrowed $2,571 on this loan in August 2005, and repaid the full balance in November 2005. A total of $125 was

recognized as interest expense during the year ended December 31, 2005.

64