Shutterfly 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

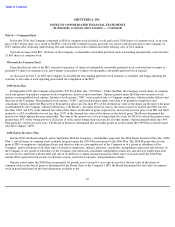

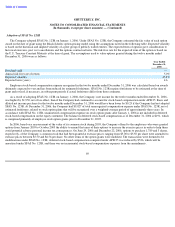

Note 8 — Common Stock

In October 2006, the Company completed its IPO of common stock in which it sold and issued 5,800 shares of common stock, at an issue

price of $15.00 per share. As a result of the IPO, a total of $87.0 million in gross proceeds was raised, with net proceeds to the Company of

$78.5 million after deducting underwriting fees and commissions of $6.1 million and other offering costs of $2.4 million.

Upon the closing of the IPO, all shares of the Company’s redeemable convertible preferred stock outstanding automatically converted into

13,863 shares of common stock.

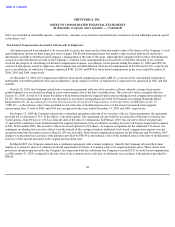

Warrants for Common Stock

Upon the effective date of the IPO, warrants to purchase 41 shares of redeemable convertible preferred stock converted into warrants to

purchase 41 shares of common stock, and warrants to purchase 41 shares of redeemable convertible preferred stock expired.

As discussed in Note 3, in 2005 the Company reclassified the freestanding preferred stock warrants as a liability and began adjusting the

warrants to fair value at each reporting period until the completion of the IPO.

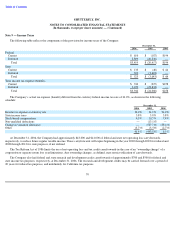

1999 Stock Plan

In September 1999, the Company adopted the 1999 Stock Plan (the “1999 Plan”). Under the Plan, the Company issued shares of common

stock and options to purchase common stock to employees, directors and consultants. Options granted under the Plan were incentive stock

options or non-qualified stock options. Incentive stock options (“ISO”) were granted only to Company employees, which includes officers and

directors of the Company. Non-qualified stock options (“NSO”) and stock purchase rights were able to be granted to employees and

consultants. Options under the Plan were to be granted at prices not less than 85% of the deemed fair value of the shares on the date of the grant

as determined by the Company’s Board of Directors (“the Board”), provided, however, that (i) the exercise price of an ISO and NSO was not

less than 100% and 85% of the deemed fair value of the shares on the date of grant, respectively, and (ii) the exercise price of an ISO and NSO

granted to a 10% stockholder was not less than 110% of the deemed fair value of the shares on the date of grant. The Board determined the

period over which options become exercisable. The term of the options was to be no longer than five years for ISOs for which the grantee owns

greater than 10% of the voting power of all classes of stock and no longer than ten years for all other options. Options granted under the 1999

Plan generally vested over four years. The Board of Directors determined that no further grants of awards under the 1999 Plan would be made

after the Company’s IPO.

2006 Equity Incentive Plan

In June 2006, the Board adopted, and in September 2006 the Company’s stockholders approved, the 2006 Equity Incentive Plan (the “

2006

Plan”), and all shares of common stock available for grant under the 1999 Plan transferred to the 2006 Plan. The 2006 Plan provides for the

grant of ISOs to employees (including officers and directors who are also employees) of the Company or of a parent or subsidiary of the

Company, and for the grant of all other types of awards to employees, officers, directors, consultants, independent contractors and advisors of

the Company or any parent or subsidiary of the Company, provided such consultants, independent contractors and advisors render bona-fide

services not in connection with the offer and sale of securities in a capital-raising transaction. Other types of awards under the 2006 Plan

include NSO restricted stock awards, stock bonus awards, restricted stock units, and performance shares.

Options issued under the 2006 Plan are generally for periods not to exceed 10 years and are issued at the fair value of the shares of

common stock on the date of grant as determined by the Board. Prior to the Company’s IPO, the Board determined the fair value of common

stock in good faith based on the best information available to the

65