Rite Aid 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

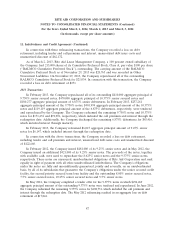

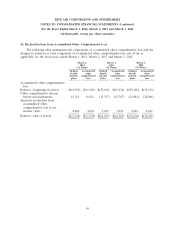

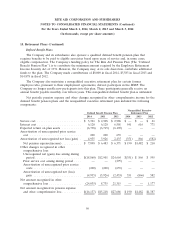

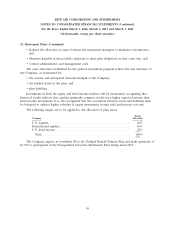

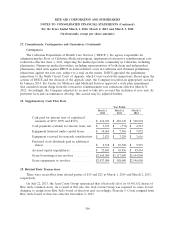

15. Retirement Plans (Continued)

The table below sets forth reconciliation from the beginning of the year for both the benefit

obligation and plan assets of the Company’s defined benefit plans, as well as the funded status and

amounts recognized in the Company’s balance sheet as of March 1, 2014 and March 2, 2013:

Defined Benefit Nonqualified Executive

Pension Plan Retirement Plan

2014 2013 2014 2013

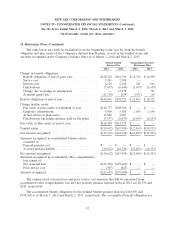

Change in benefit obligations:

Benefit obligation at end of prior year .............. $158,522 $142,310 $ 14,332 $ 14,509

Service cost ................................. 3,341 2,908 — —

Interest cost ................................. 6,120 6,128 541 616

Distributions ................................ (7,677) (6,644) (1,657) (1,659)

Change due to change in assumptions .............. — 13,979 — 756

Actuarial (gain) loss ........................... (11,710) (159) (351) 110

Benefit obligation at end of year ................... $148,596 $158,522 $ 12,865 $ 14,332

Change in plan assets:

Fair value of plan assets at beginning of year ......... $114,773 $108,196 $ — $ —

Employer contributions ........................ 8,000 5,583 1,655 1,659

Actual return on plan assets ..................... 13,888 9,067 — —

Distributions (including expenses paid by the plan) .... (7,677) (8,073) (1,655) (1,659)

Fair value of plan assets at end of year ............... $128,984 $114,773 $ — $ —

Funded status ................................. $(19,612) $(43,749) $(12,865) $(14,331)

Net amount recognized .......................... $(19,612) $(43,749) $(12,865) $(14,331)

Amounts recognized in consolidated balance sheets

consisted of:

Prepaid pension cost .......................... $ — $ — $ — $ —

Accrued pension liability ........................ (19,612) (43,749) (12,865) (14,331)

Net amount recognized .......................... $(19,612) $(43,749) $(12,865) $(14,331)

Amounts recognized in accumulated other comprehensive

loss consist of:

Net actuarial loss ............................. $(35,348) $ (59,143) $ — $ —

Prior service cost ............................. (307) (547) — —

Amount recognized ............................. $(35,655) $(59,690) $ — $ —

The estimated net actuarial loss and prior service cost amounts that will be amortized from

accumulated other comprehensive loss into net periodic pension expense in fiscal 2015 are $2,399 and

$240, respectively.

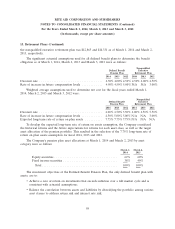

The accumulated benefit obligation for the defined benefit pension plan was $148,596 and

$158,368 as of March 1, 2014 and March 2, 2013, respectively. The accumulated benefit obligation for

97