Rite Aid 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

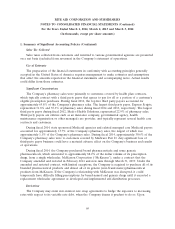

3. Lease Termination and Impairment Charges (Continued)

the store is located. Significant increases or decreases in actual cash flows may result in valuation

changes.

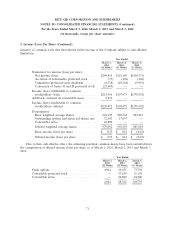

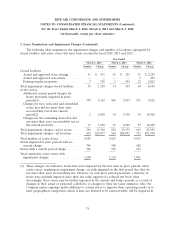

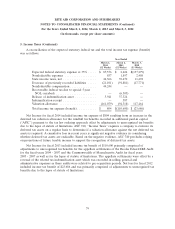

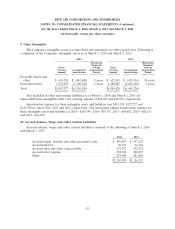

The table below sets forth by level within the fair value hierarchy the long-lived assets as of the

impairment measurement date for which an impairment assessment was performed and total losses as

of March 1, 2014 and March 2, 2013:

Quoted Prices in Significant Fair Values

Active Markets Other Significant as of Total

for Identical Observable Unobservable Impairment Charges

Assets (Level 1) Inputs (Level 2) Inputs (Level 3) Date March 1, 2014

Long-lived assets held and

used ................. $— $ 42 $15,051 $15,093 $(12,279)

Long-lived assets held for

sale ................. — 14,656 — 14,656 (798)

Total .................. $— $14,698 $15,051 $29,749 $(13,077)

Quoted Prices in Significant Fair Values

Active Markets Other Significant as of Total

for Identical Observable Unobservable Impairment Charges

Assets (Level 1) Inputs (Level 2) Inputs (Level 3) Date March 2, 2013

Long-lived assets held and

used ................. $— $1,018 $21,739 $22,757 $(24,298)

Long-lived assets held for

sale ................. — 1,842 — 1,842 (594)

Total .................. $— $2,860 $21,739 $24,599 $(24,892)

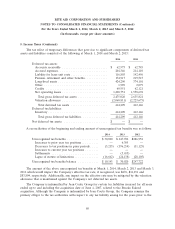

Lease Termination Charges

Charges to close a store, which principally consist of continuing lease obligations, are recorded at

the time the store is closed and all inventory is liquidated, pursuant to the guidance set forth in

ASC 420, ‘‘Exit or Disposal Cost Obligations.’’ The Company calculates the liability for closed stores on

a store-by-store basis. The calculation includes the discounted effect of future minimum lease payments

and related ancillary costs, from the date of closure to the end of the remaining lease term, net of

estimated cost recoveries that may be achieved through subletting or favorable lease terminations. The

Company evaluates these assumptions each quarter and adjusts the liability accordingly.

In fiscal 2014, 2013 and 2012, the Company recorded lease termination charges of $28,227, $45,967

and $48,055, respectively. These charges related to changes in future assumptions, interest accretion

and provisions for 15 stores in fiscal 2014, 14 stores in fiscal 2013, and 23 stores in fiscal 2012. Of the

approximate 40 store closures for fiscal 2015, the Company anticipates that 15 will require a store lease

closing provision.

As part of its ongoing business activities, the Company assesses stores and distribution centers for

potential closure. Decisions to close or relocate stores or distribution centers in future periods would

76