Rite Aid 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

17. Commitments, Contingencies and Guarantees (Continued)

Contingencies

The California Department of Health Care Services (‘‘DHCS’’), the agency responsible for

administering the State of California Medicaid program, implemented retroactive reimbursement rate

reductions effective June 1, 2011, impacting the medical provider community in California, including

pharmacies. Numerous medical providers, including representatives of both chain and independent

pharmacies, filed suits against DHCS in federal district court in California and obtained preliminary

injunctions against the rate cuts, subject to a trial on the merits. DHCS appealed the preliminary

injunctions to the Ninth Circuit Court of Appeals, which Court vacated the injunctions. Based upon the

actions of DHCS and the decision of the appeals court, the Company recorded an appropriate accrual.

In January 2014, the Center for Medicare and Medicaid Services approved a state plan amendment

that excluded certain drugs from the retroactive reimbursement rate reductions effective March 31,

2012. Accordingly, the Company adjusted its accrual to take into account this exclusion at year end. As

pertinent facts and circumstances develop, this accrual may be adjusted further.

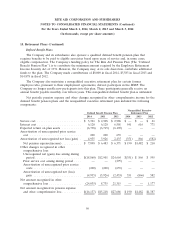

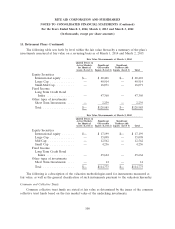

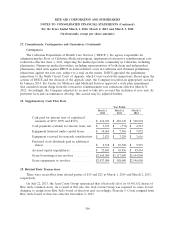

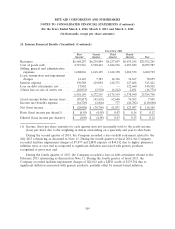

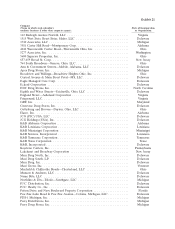

18. Supplementary Cash Flow Data

Year Ended

March 1, March 2, March 3,

2014 2013 2012

Cash paid for interest (net of capitalized

amounts of $197, $399 and $315) ........ $ 414,692 $ 482,145 $ 528,894

Cash payments (refund) for income taxes, net . $ 3,191 $ (776) $ 4,913

Equipment financed under capital leases .... $ 18,065 $ 7,906 $ 7,052

Equipment received for noncash consideration $ 2,825 $ 3,285 $ 3,616

Preferred stock dividends paid in additional

shares ............................ $ 8,318 $ 10,528 $ 9,919

Accrued capital expenditures ............. $ 72,841 $ 45,456 $ 45,454

Gross borrowings from revolver ........... $2,668,000 $1,117,000 $2,654,000

Gross repayments to revolver ............. $2,933,000 $ 588,000 $2,546,000

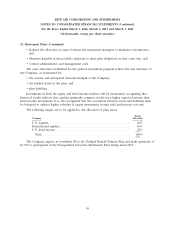

19. Related Party Transactions

There were receivables from related parties of $19 and $23 at March 1, 2014 and March 2, 2013,

respectively.

On July 22, 2013, the Jean Coutu Group announced that it had sold all of its 65,401,162 shares of

Rite Aid’s common stock. As a result of this sale, the Jean Coutu Group was required to cause its last

designee to resign from Rite Aid’s board of directors and, accordingly, Francois J. Coutu resigned from

Rite Aid’s board of directors effective November 8, 2013.

106