Rite Aid 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities.

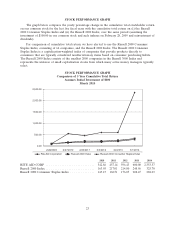

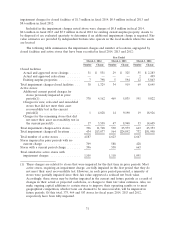

Our common stock is listed on the NYSE under the symbol ‘‘RAD.’’ On April 11, 2014, we had

approximately 22,200 stockholders of record. Quarterly high and low closing stock prices, based on the

composite transactions, are shown below.

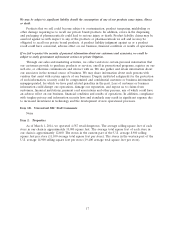

Fiscal Year Quarter High Low

2015 (through April 11, 2014) ...................... First $7.04 $6.05

2014 ........................................ First 2.97 1.65

Second 3.52 2.74

Third 5.92 3.46

Fourth 6.74 4.99

2013 ........................................ First 2.05 1.18

Second 1.45 1.12

Third 1.33 1.00

Fourth 1.70 0.97

We have not declared or paid any cash dividends on our common stock since the third quarter of

fiscal 2000 and we do not anticipate paying cash dividends on our common stock in the foreseeable

future. Our senior secured credit facility, second priority secured term loan facilities and some of the

indentures that govern our other outstanding indebtedness restrict our ability to pay dividends.

We have not sold any unregistered equity securities during the period covered by this report, nor

have we repurchased any of our common stock, during the period covered by this report.

Rite Aid Lease Management Company, a subsidiary of the Company, had 213,000 shares of its

Cumulative Preferred Stock, Class A, par value $100 per share (‘‘RALMCO Cumulative Preferred

Stock’’), outstanding. On November 29, 2013, we repurchased all of the outstanding RALMCO

Cumulative Preferred Stock for $21,034.

On September 26, 2013, we agreed to exchange eight shares of our 7% Series G Convertible

Preferred Stock (the ‘‘Series G preferred stock’’) and 1,876,013 shares of our 6% Series H Convertible

Preferred Stock (the ‘‘Series H preferred stock’’, collectively the ‘‘Preferred Stock’’), held by Green

Equity Investors III, L.P. (‘‘LGP’’) for 40,000,000 shares of our common stock, par value $1.00 per

share (the ‘‘Exchange’’), with a market value of $190,400 at the $4.76 per share closing price on the

Settlement Date (as hereinafter defined), pursuant to an individually negotiated exchange transaction.

The Exchange settled on September 30, 2013 (the ‘‘Settlement Date’’). Following the Settlement Date,

no shares of the Series G preferred stock or Series H preferred stock remained outstanding and our

restated certificate of incorporation was amended to eliminate all references to the Series G preferred

stock and Series H preferred stock.

22