Rite Aid 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

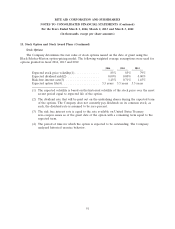

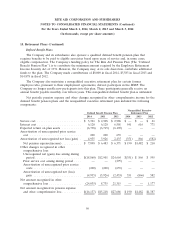

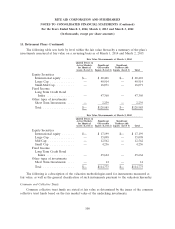

13. Stock Option and Stock Award Plans (Continued)

of restricted stock transactions for the fiscal years ended March 1, 2014, March 2, 2013 and March 3,

2012:

Weighted

Average

Grant Date

Shares Fair Value

Balance at February 26, 2011 .......................... 7,078 $1.12

Granted ........................................ 8,525 1.23

Vested ......................................... (3,366) 1.11

Cancelled ...................................... (731) 1.16

Balance at March 3, 2012 ............................. 11,506 $1.20

Granted ........................................ 5,450 1.31

Vested ......................................... (3,917) 1.18

Cancelled ...................................... (362) 1.26

Balance at March 2, 2013 ............................. 12,677 $1.25

Granted ........................................ 2,743 2.79

Vested ......................................... (4,152) 1.23

Cancelled ...................................... (1,212) 1.48

Balance at March 1, 2014 ............................. 10,056 $1.66

At March 1, 2014, there was $9,155 of total unrecognized pre-tax compensation costs related to

unvested restricted stock grants, net of forfeitures. These costs are expected to be recognized over a

weighted average period of 1.82 years.

The total fair value of restricted stock vested during fiscal years 2014, 2013 and 2012 was $5,098,

$4,623 and $3,724, respectively.

93