Rite Aid 2014 Annual Report Download - page 30

Download and view the complete annual report

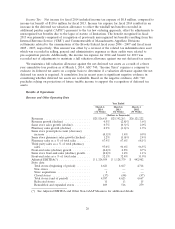

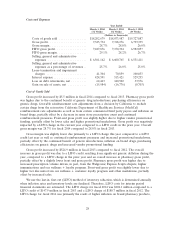

Please find page 30 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.partially offset by deflation on generic pharmacy products, which contributed to overall inflation in

fiscal 2014. The inflation in fiscal 2014 compares to overall deflation in fiscal 2013, which was due to

significant generic pharmacy product deflation, partially offset by brand pharmacy product inflation.

During fiscal 2013, we experienced significant price decreases on high volume generic

introductions. During the first few months after new generic drugs are introduced, supplier prices tend

to decrease as multiple suppliers enter the market place. This resulted in significant deflation on

generic pharmacy products which more than offset brand pharmacy product inflation, causing overall

deflation in fiscal 2013, and consequently, resulted in a LIFO credit of $147.9 million.

During fiscal 2012, we experienced significant brand pharmacy product inflation, partially offset by

generic pharmacy product deflation, which contributed to overall inflation during fiscal 2012. The

overall inflation in fiscal 2012 resulted in a LIFO charge of $188.7 million.

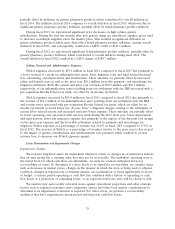

Selling, General and Administrative Expenses

SG&A expenses decreased by $39.6 million in fiscal 2014 compared to fiscal 2013 due primarily to

a lower reversal of certain tax indemnification assets, lower litigation costs and legal and professional

fees, advertising, and depreciation and amortization. These amounts are partially offset by increased

salary and benefit costs as well as the prior year $18.1 million favorable payment card interchange fee

litigation settlement. Both the current and prior year reversals of $30.5 million and $91.3 million,

respectively, of tax indemnification assets resulting from our settlement with the IRS associated with a

pre-acquisition Brooks Eckerd tax audit, are offset by an income tax benefit.

SG&A expenses increased by $69.4 million in fiscal 2013 compared to fiscal 2012 due primarily to

the reversal of $91.3 million of tax indemnification asset resulting from our settlement with the IRS

and certain states associated with pre-acquisition Brooks Eckerd tax issues, which are offset by an

income tax benefit as noted below (in ‘‘Income Taxes’’), litigation charges relating to the settlement of

certain labor related actions and increased associate bonus expense. These amounts are partially offset

by lower operating costs associated with one less week during the 2013 fiscal year, lower depreciation

and amortization, lower self insurance expense due primarily to the impact of the discount rate change

on the prior year expense and the favorable settlement related to payment card interchange fee

litigation. SG&A expenses as a percentage of revenue was 26.0% in fiscal 2013 compared to 25.0% in

fiscal 2012. The increase in SG&A as a percentage of revenues relative to the prior year is due in part

to the impact of generic introductions and reimbursement rate pressures which resulted in a lower

revenue base to measure our SG&A expenses against.

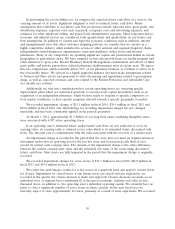

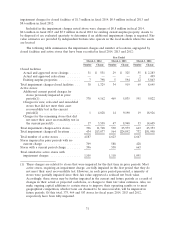

Lease Termination and Impairment Charges

Impairment Charges:

We evaluate long-lived assets for impairment whenever events or changes in circumstances indicate

that an asset group has a carrying value that may not be recoverable. The individual operating store is

the lowest level for which cash flows are identifiable. As such, we evaluate individual stores for

recoverability of assets. To determine if a store needs to be tested for recoverability, we consider items

such as decreases in market prices, changes in the manner in which the store is being used or physical

condition, changes in legal factors or business climate, an accumulation of losses significantly in excess

of budget, a current period operating or cash flow loss combined with a history of operating or cash

flow losses or a projection of continuing losses, or an expectation that the store will be closed or sold.

We monitor new and recently relocated stores against operational projections and other strategic

factors such as regional economics, new competitive entries and other local market considerations to

determine if an impairment evaluation is required. For other stores, we perform a recoverability

analysis if they have experienced current-period and historical cash flow losses.

29