Rite Aid 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

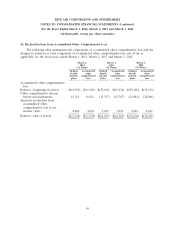

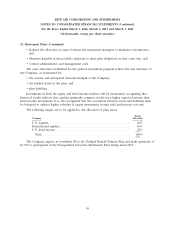

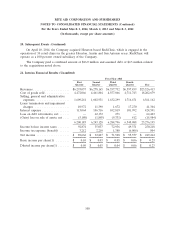

16. Multiemployer Plans that Provide Pension Benefits (Continued)

collective-bargaining agreement(s) to which the plans are subject and any minimum funding

requirements. There have been no significant changes that affect the comparability of total employer

contributions of fiscal years 2014, 2013, and 2012.

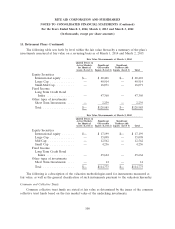

Expiration

FIP/ RP Date of

Pension Protection Act Contributions of

EIN/Pension Status Collective- Minimum

Zone Status the Company

Plan Pending/ Surcharge Bargaining Funding

Pension Number 2014 2013 Implemented 2014 2013 2012 Imposed Agreement Requirements

1199 SEIU Health Care

Employees Pension Fund . 13-3604862-001 Green— Green— No $14,093 $ 9,830 $ 9,156 No 4/18/2015 Contribution rate of 15.8%

12/31/2012 12/31/2011 of gross wages earned per

associate.

Southern California United

Food and Commercial

Workers Unions and Drug

Employers Pension Fund . 51-6029925-001 Red— Red— Implemented 6,476 3,416 459 No 7/12/2015 Contributions of $1.242 per

12/31/2013 12/31/2012 hour worked for pharmacists

and $0.563 per hour worked

for non pharmacists.

Northern California

Pharmacists, Clerks and

Drug Employers Pension

Plan . . . . . . . . . . . . 94-2518312-001 Green— Green— No 2,900 2,858 2,937 No 7/13/2013 Contributions of $0.57 per

12/31/2013 12/31/2012 hour worked for associates.

United Food and

Commercial Workers

Union-Employer Pension

Fund ........... 34-6665155-001 Red— Red— Implemented 629 559 529 No 12/31/2014 Contribution rate of $1.49

9/30/2013 9/30/2012 per hour worked.

United Food and

Commercial Workers

Union Local 880—

Mercantile Employers

Joint Pension Fund .... 51-6031766-001 Yellow— Yellow— Implemented 441 399 322 No 12/31/2014 Contribution rate of $1.52

9/30/2013 9/30/2012 per hour worked.

Other Funds . . . . . . . . . 2,078 2,725 1,191

$26,617 $19,787 $14,594

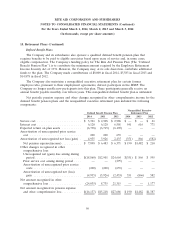

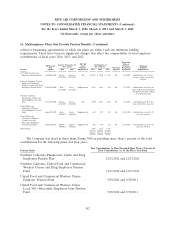

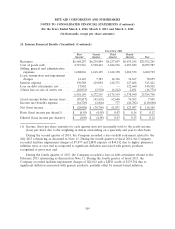

The Company was listed in these plans Forms 5500 as providing more than 5 percent of the total

contributions for the following plans and plan years:

Year Contributions to Plan Exceeded More Than 5 Percent of

Pension Fund Total Contributions (as of the Plan’s Year-End)

Northern California Pharmacists, Clerks and Drug

Employers Pension Plan .................. 12/31/2012 and 12/31/2011

Southern California United Food and Commercial

Workers Unions and Drug Employers Pension

Fund ................................ 12/31/2012 and 12/31/2011

United Food and Commercial Workers Union-

Employer Pension Fund .................. 9/30/2012 and 9/30/2011

United Food and Commercial Workers Union

Local 880—Mercantile Employers Joint Pension

Fund ................................ 9/30/2012 and 9/30/2011

102