Rite Aid 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

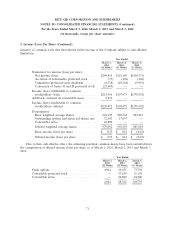

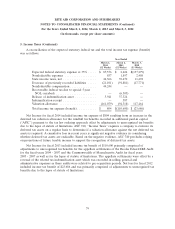

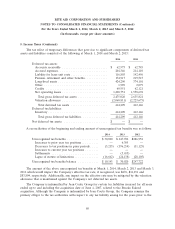

5. Income Taxes (Continued)

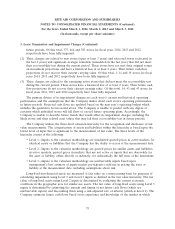

acquisition. Accordingly, as of March 1, 2014, March 2, 2013 and March 3, 2012, the Company had a

corresponding recoverable indemnification asset of $195, $30,710 and $156,797 from Jean Coutu

Group, included in the ‘‘Other Assets’’ line of the Consolidated Balance Sheets, to reflect the

indemnification for such liabilities.

While it is expected that the amount of unrecognized tax benefits will change in the next twelve

months, management does not expect the change to have a significant impact on the results of

operations or the financial position of the company.

The Company recognizes interest and penalties related to tax contingencies as income tax expense.

Prior to the adoption of ASC 740, ‘‘Income Taxes,’’ the Company included interest as income tax

expense and penalties as an operating expense. The Company recognized (benefit) for interest and

penalties in connection with tax matters of ($16,833), ($43,069) and ($2,113) for fiscal years 2014, 2013

and 2012, respectively. As of March 1, 2014 and March 2, 2013 the total amount of accrued income

tax-related interest and penalties was $5,364 and $22,197, respectively.

The Company files U.S. federal income tax returns as well as income tax returns in those states

where it does business. The consolidated federal income tax returns have been subject to examination

by the IRS through fiscal 2008, including the Brooks Eckerd pre-acquisition periods. However, any net

operating losses that were generated in these prior closed years may be subject to examination by the

IRS upon utilization. Tax examinations by various state taxing authorities could generally be conducted

for a period of three to five years after filing of the respective return. However, as a result of filing

amended returns, the Company has statutes open in some states from fiscal year 2005.

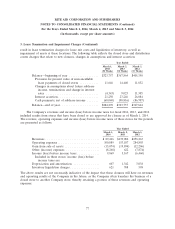

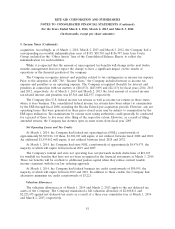

Net Operating Losses and Tax Credits

At March 1, 2014, the Company had federal net operating loss (NOL) carryforwards of

approximately $3,507,186. Of these, $1,906,013 will expire, if not utilized, between fiscal 2020 and 2022.

An additional $1,519,062 will expire, if not utilized, between fiscal 2028 and 2032.

At March 1, 2014, the Company had state NOL carryforwards of approximately $4,476,975, the

majority of which will expire between fiscal 2019 and 2027.

The Company’s federal and state net operating loss carryforwards include deductions of $18,365

for windfall tax benefits that have not yet been recognized in the financial statements at March 1, 2014.

These tax benefits will be credited to additional paid-in capital when they reduce current taxable

income consistent with the tax law ordering approach.

At March 1, 2014, the Company had federal business tax credit carryforwards of $50,595, the

majority of which will expire between 2019 and 2021. In addition to these credits, the Company had

alternative minimum tax credit carryforwards of $3,221.

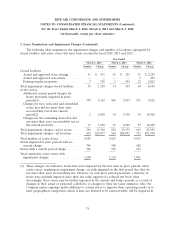

Valuation Allowances

The valuation allowances as of March 1, 2014 and March 2, 2013 apply to the net deferred tax

assets of the Company. The Company maintained a full valuation allowance of $2,060,811 and

$2,223,675 against net deferred tax assets as a result of a three year cumulative loss at March 1, 2014

and March 2, 2013, respectively.

81