Rite Aid 2014 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• pay dividends;

• make redemptions and repurchases of capital stock;

• make loans and investments;

• prepay, redeem or repurchase debt;

• engage in acquisitions, consolidations, asset dispositions, sale-leaseback transactions and affiliate

transactions;

• change our business;

• amend some of our debt and other material agreements;

• issue and sell capital stock of subsidiaries;

• restrict distributions from subsidiaries; and

• grant negative pledges to other creditors.

The senior secured credit facility contains covenants which place restrictions on the incurrence of

debt beyond the restrictions described above, the payment of dividends, sale of assets, mergers and

acquisitions and the granting of liens. Our senior secured credit facility has a financial covenant which

requires us to maintain a minimum fixed charge coverage ratio. The covenant requires that, if

availability on the revolving credit facility is less than $150.0 million, we maintain a minimum fixed

charge coverage ratio of 1.00 to 1.00. As of March 1, 2014, we had availability under our revolving

credit facility of approximately $1,315.1 million, our fixed charge coverage ratio was greater than 1.00

to 1.00, and were in compliance with the senior secured credit facility’s financial covenant.

Our stockholders will experience dilution if we issue additional common stock.

We are generally not restricted from issuing additional shares of our common shares or preferred

stock, including, subject to the terms of our outstanding debt instruments, any securities that are

convertible into or exchangeable for, or that represent the right to receive, common shares or preferred

stock or any substantially similar securities, whether for cash, as part of incentive compensation or in

refinancing transactions. Any additional future issuances of common stock will reduce the percentage of

our common stock owned by investors who do not participate in such issuances. In most circumstances,

stockholders will not be entitled to vote on whether or not we issue additional shares of common stock.

The market price of our common stock could decline as a result of issuances of a large number of

shares of our common stock or the perception that such issuances could occur.

Risks Related to our Operations

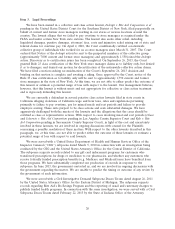

We need to improve our operations in order to improve our financial condition, but our operations will not

improve if we cannot effectively implement our business strategy or if our strategy is negatively affected by

worsening economic conditions.

We have not yet achieved the sales productivity level of our major competitors. We believe that

improving the sales of existing stores is important to improving profitability and operating cash flow. If

we are not successful in implementing our strategies, including our efforts to increase sales and further

reduce costs, or if our strategies are not effective, we may not be able to improve our operations. In

addition, any further adverse change or continued weakness in general economic conditions or major

industries can adversely affect drug benefit plans and reduce our pharmacy sales. Adverse changes in

general economic conditions could affect consumer buying practices and consequently reduce our sales

of front end products, and cause a decrease in our profitability. Failure to improve operations or a

continued weakness in major industries or general economic conditions would adversely affect our

13