Rite Aid 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(6) Represents lease guarantee obligations for 114 former stores related to certain business

dispositions. The respective purchasers assume the obligations and are, therefore, primarily liable

for these obligations.

Obligations for income tax uncertainties pursuant to ASC 740, ‘‘Income Taxes’’ of approximately

$0.9 million are not included in the table above as we are uncertain as to if or when such amounts may

be settled.

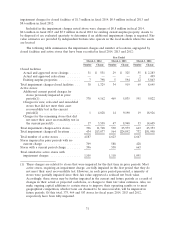

Net Cash Provided By (Used In) Operating, Investing and Financing Activities

Cash flow provided by operating activities was $702.0 million in fiscal 2014. Cash flow was

positively impacted by net income and a decrease in inventory, partially offset by a reduction of

accounts payable resulting from the inventory reduction and the timing of payments, cash used in other

assets and liabilities, net, due primarily to lower vendor deferred income and pension liability and

higher accounts receivable due primarily to increased pharmacy sales and the timing of payments.

Included in cash used by other assets and liabilities, net is the $26.7 million excess tax benefit relating

to stock option exercise and restricted stock vesting windfalls that was recorded as a component of

income tax benefit and an increase of APIC.

Cash flow provided by operating activities was $819.6 million in fiscal 2013. Cash flow was

positively impacted by net income and a reduction of inventory resulting primarily from recent generic

introductions, generic price reductions, management initiatives to reduce inventory levels and fewer

open stores, and a reduction of accounts receivable due to the timing of payments from third party

payors.

Cash flow provided by operating activities was $266.5 million in fiscal 2012. Cash flow was

positively impacted by the reduction in net loss, an increase in accounts payable due to the timing of

purchases partially offset by an increase in inventory resulting primarily from price inflation and

increased store inventory to support sales growth.

Cash used in investing activities was $364.9 million in fiscal 2014. Cash used for the purchase of

property, plant and equipment and prescriptions files was higher than in the prior year due to a higher

investment in Wellness store remodels and prescription file buys, which was partially offset by proceeds

from asset dispositions, sale-leaseback transactions, the sale of lease rights of $8.8 million relating to

one specific store and insurance settlement proceeds of $15.1 million related to buildings and

equipment that were destroyed during hurricane Sandy.

Cash used in investing activities was $346.3 million in fiscal 2013. Cash was used for the purchase

of property, plant and equipment and prescriptions files which was partially offset by proceeds from

asset dispositions and sale-leaseback transactions.

Cash used in investing activities was $221.2 million in fiscal 2012. Cash was used for the purchase

of property, plant and equipment and prescription files which was partially offset by proceeds from

asset dispositions and sale-leaseback transactions.

Cash used in financing activities was $320.2 million in fiscal 2014, which reflects financing fees of

$45.6 million paid for early debt retirement and deferred financing costs of $17.9 million paid in

connection with the issuance of our $500.0 million Tranche 2 Term Loan and $810.0 million of our

6.75% senior notes due 2021 and the corresponding retirement of $500.0 million of our 7.5% senior

secured notes due 2017 and $810.0 million of our 9.5% senior notes due 2017. We also made scheduled

payments of $21.7 million and $8.7 million on our capital lease obligations and our Tranche 6 Term

Loan and we used cash of $21.0 million to repurchase the RALMCO Cumulative Preferred Stock

described above. Also included in cash used in financing activities was a cash inflow of $26.7 million

relating to the excess tax benefit on stock option exercises and restricted stock vesting, which is

completely offset by a cash outflow in cash provided by operating activities.

39