Rite Aid 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 2, 2013, March 3, 2012 and February 26, 2011

(In thousands, except per share amounts)

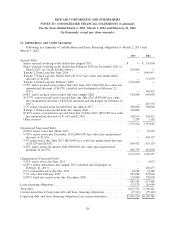

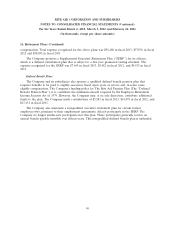

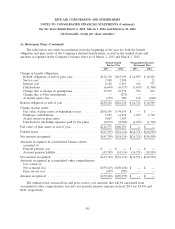

15. Stock Option and Stock Award Plans (Continued)

The weighted average fair value of options granted during fiscal 2013, 2012, and 2011 was $0.91,

$0.82, and $0.71, respectively. Following is a summary of stock option transactions for the fiscal years

ended March 2, 2013, March 3, 2012, and February 26, 2011:

Weighted Weighted

Average Average

Exercise Remaining Aggregate

Price Contractual Intrinsic

Shares Per Share Term Value

Outstanding at February 27, 2010 ...... 76,114 3.08

Granted ....................... 17,443 1.07

Exercised ...................... (244) 0.92

Cancelled ...................... (19,015) 3.66

Outstanding at February 26, 2011 ...... 74,298 2.47

Granted ....................... 23,200 1.19

Exercised ...................... (896) 1.02

Cancelled ...................... (22,804) 4.31

Outstanding at March 3, 2012 ......... 73,798 $1.52

Granted ....................... 12,020 1.32

Exercised ...................... (1,535) 1.06

Cancelled ...................... (3,283) 2.08

Outstanding at March 2, 2013 ......... 81,000 $1.48 6.79 $38,963

Vested or expected to vest at March 2,

2013 .......................... 72,742 $1.51 6.66 $35,262

Exercisable at March 2, 2013 .......... 42,893 $1.71 5.75 $21,534

As of March 2, 2013, there was $18,202 of total unrecognized pre-tax compensation costs related

to unvested stock options, net of forfeitures. These costs are expected to be recognized over a weighted

average period of 2.35 years.

Cash received from stock option exercises for fiscal 2013, 2012, and 2011 was $1,646, $914, and

$226 respectively. There was no income tax benefit from stock options for fiscal 2013, 2012 and 2011.

The total intrinsic value of stock options exercised for fiscal 2013, 2012, and 2011 was $714, $255, and

$81, respectively.

Typically, stock options granted vest, and are subsequently exercisable in equal annual installments

over a four-year period for employees. During fiscal 2012, certain employee stock options and awards

were issued that vest 50% in year 3 and 50% in year four. Non-employee director options granted vest,

and are subsequently exercisable in equal annual installments over a three-year period.

97